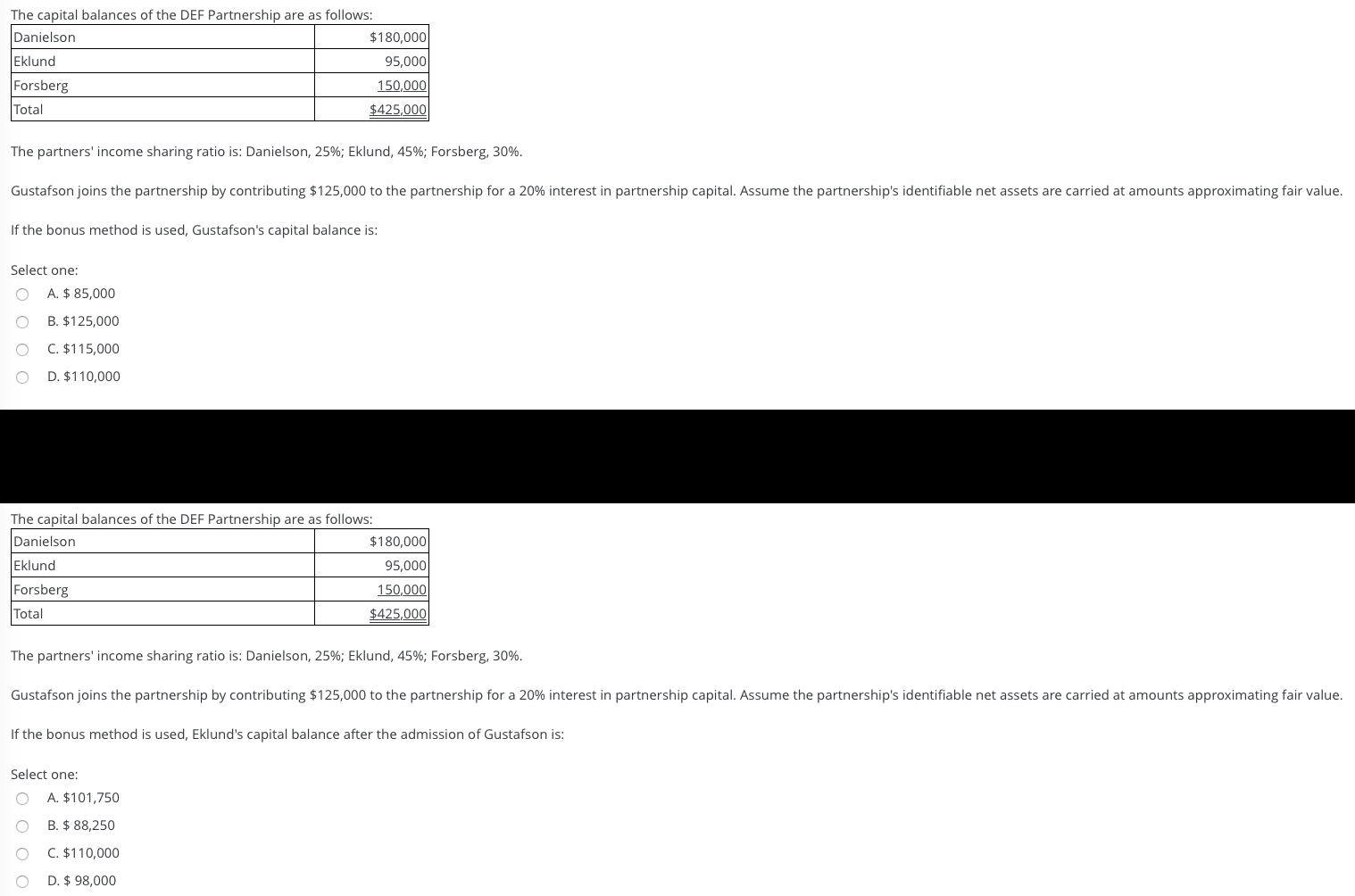

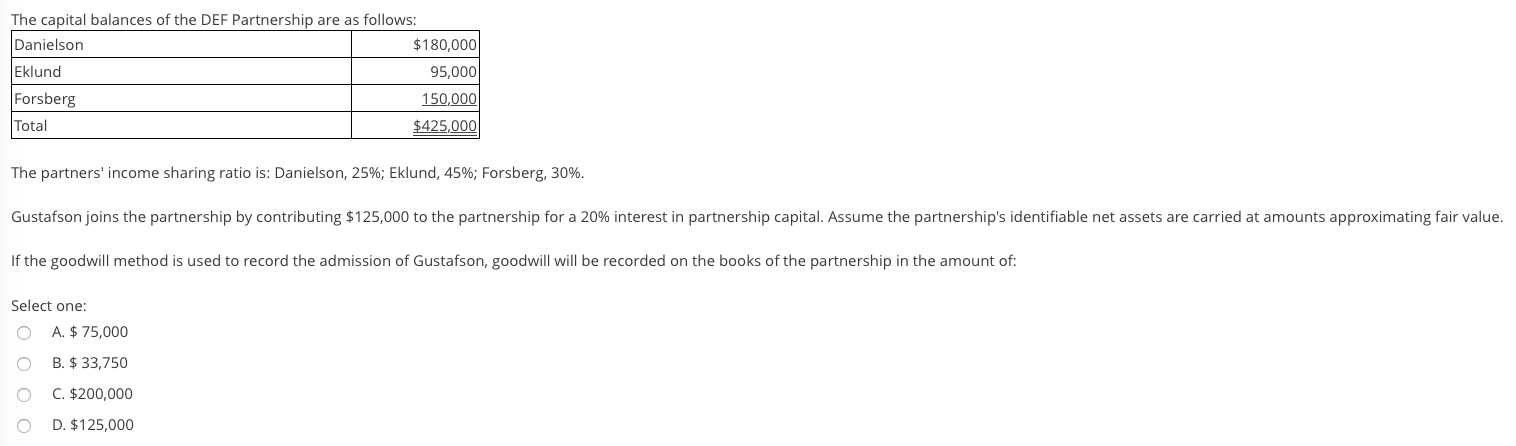

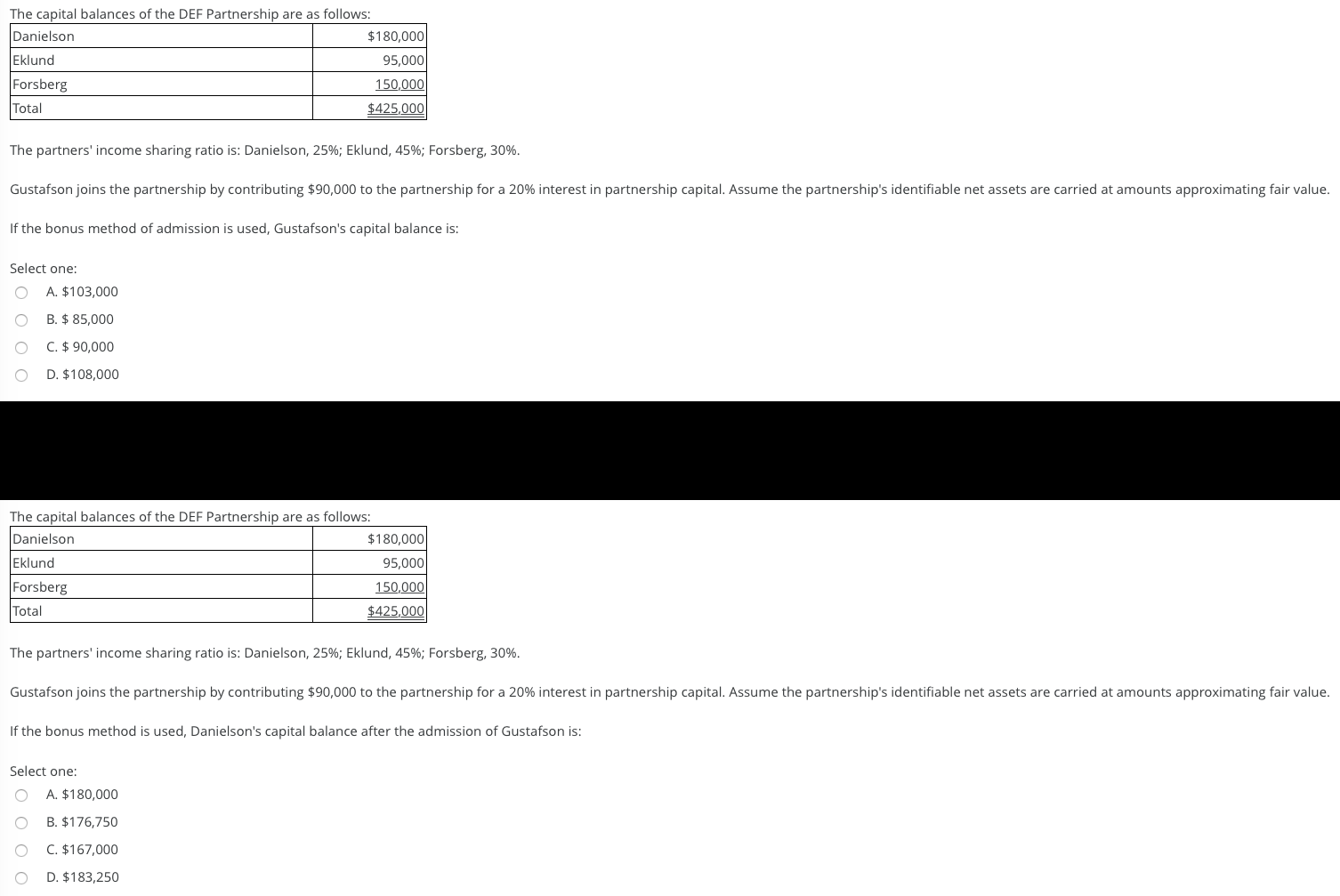

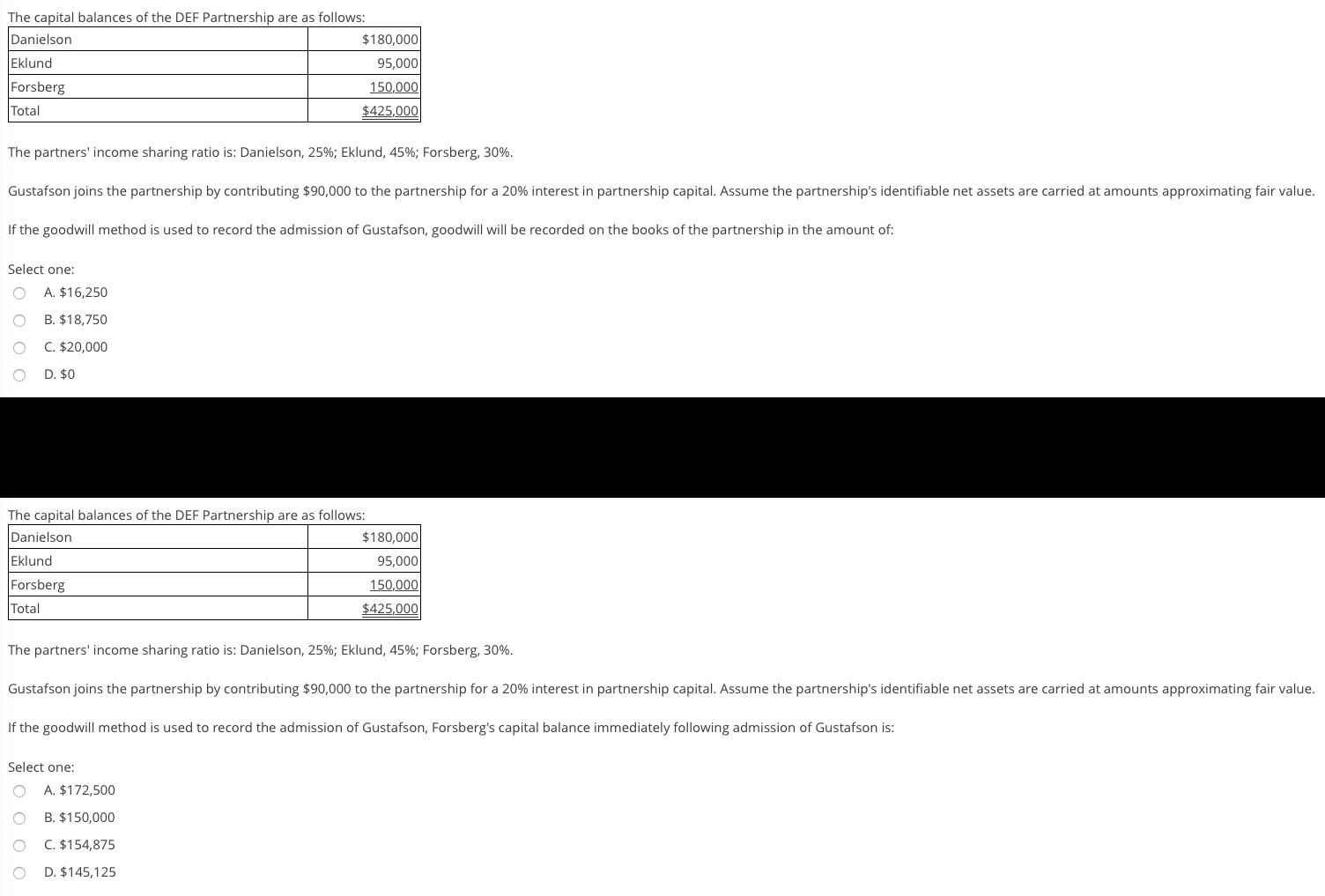

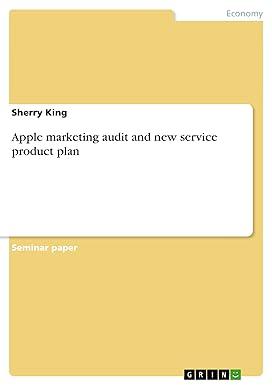

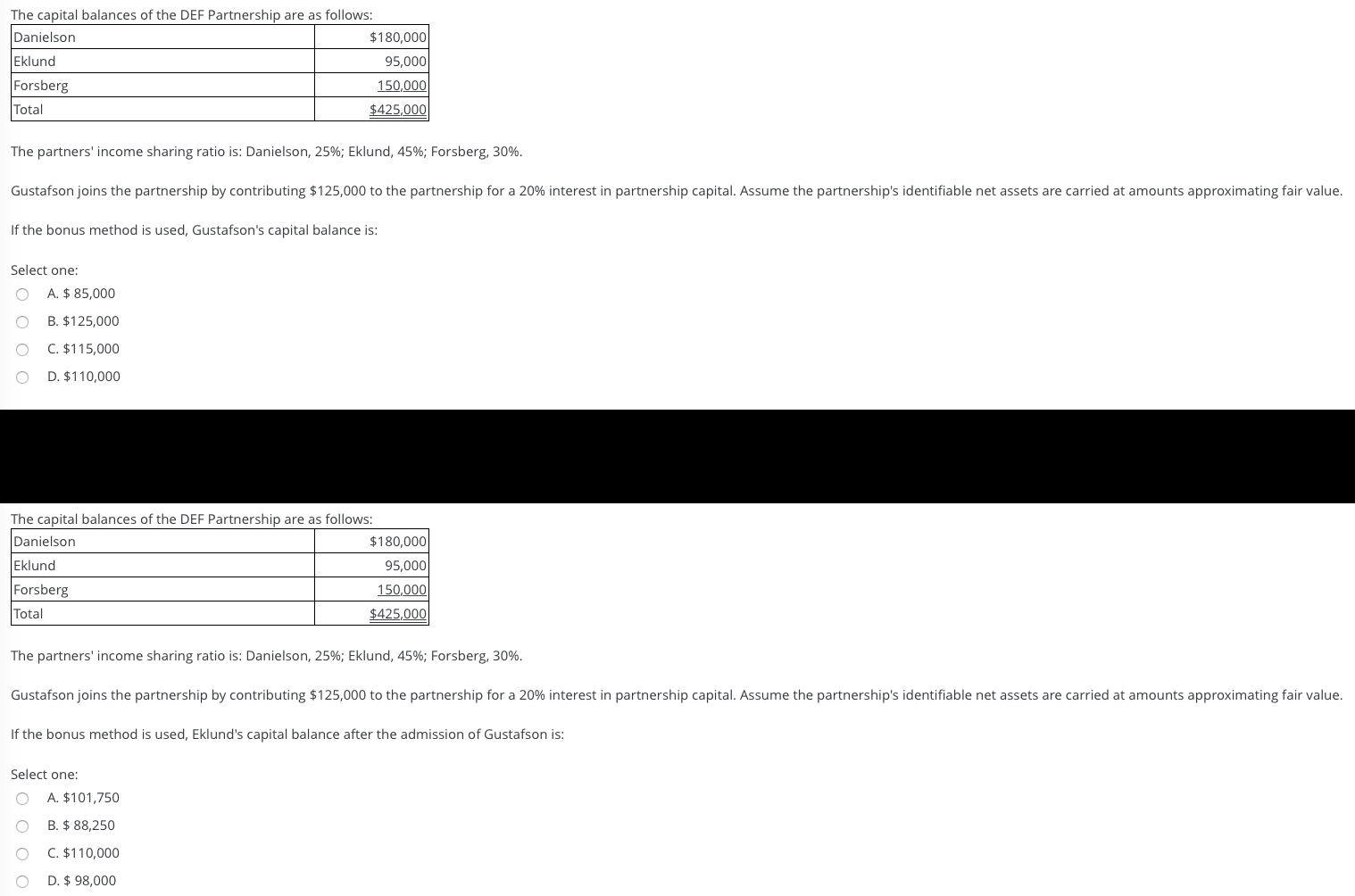

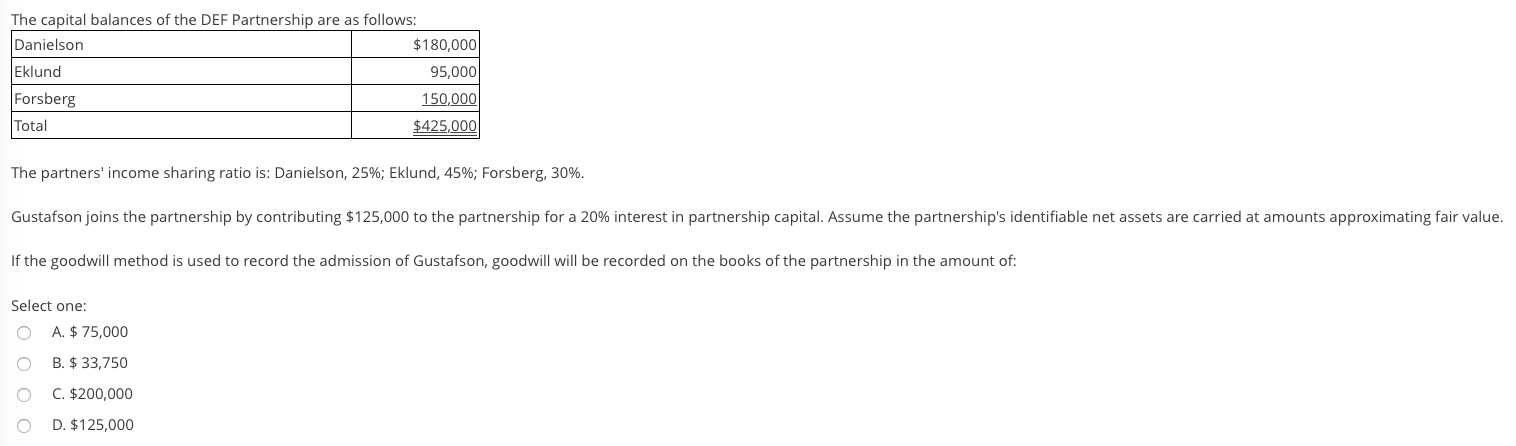

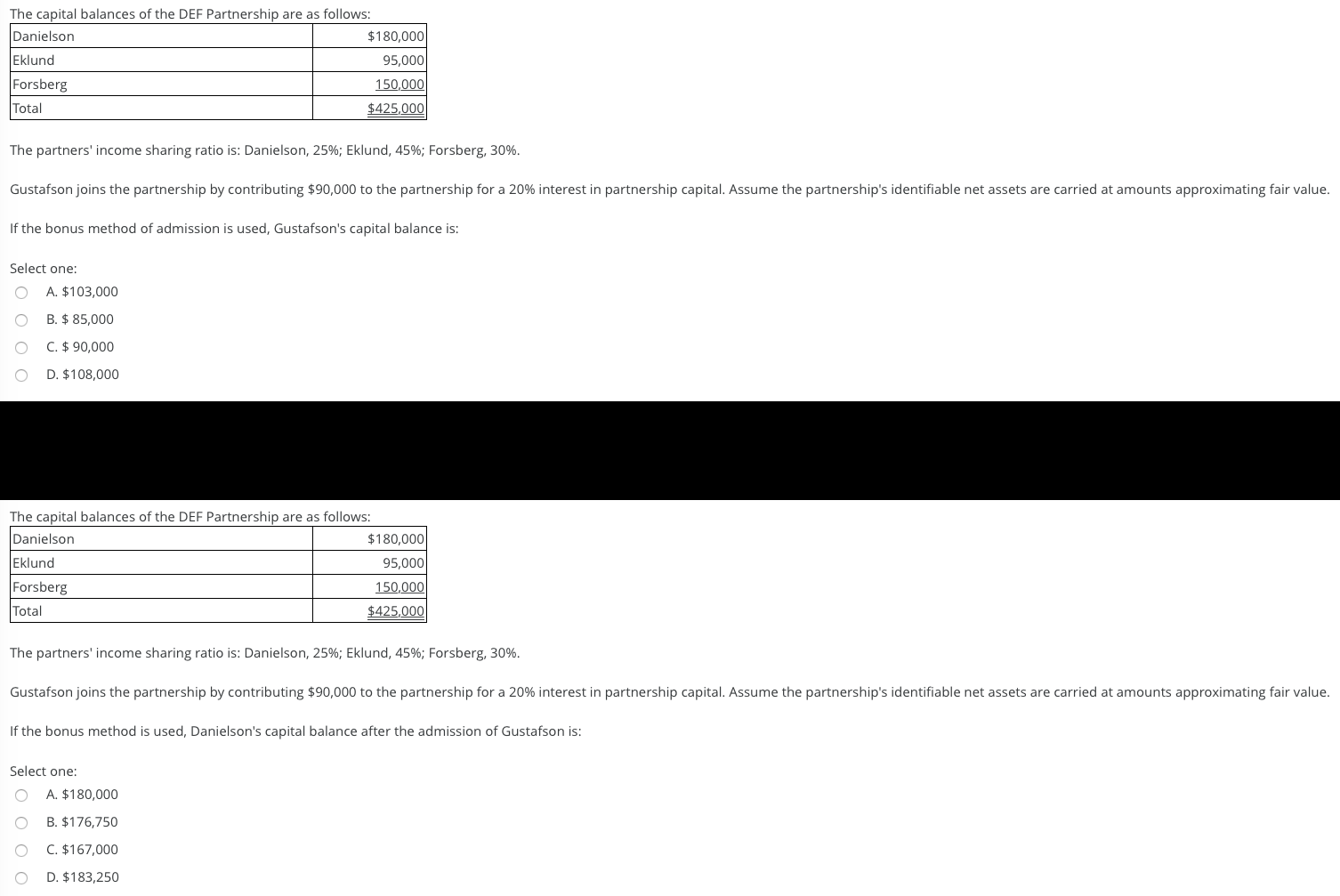

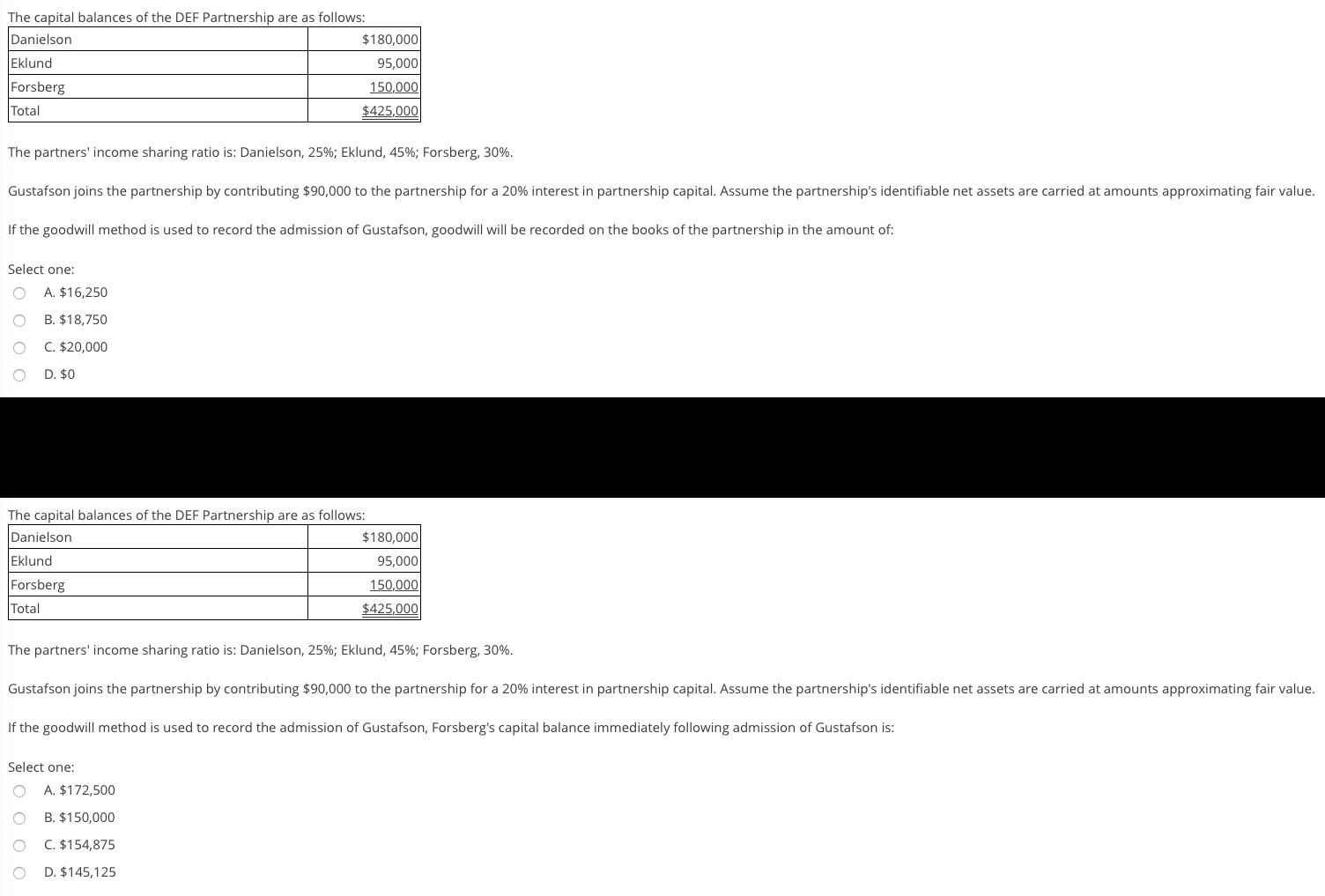

The capital balances of the DEF Partnership are as follows: Danielson $180,000 Eklund 95,000 Forsberg 150,000 Total $425,000 The partners' income sharing ratio is: Danielson, 25%; Eklund, 45%; Forsberg, 30%. Gustafson joins the partnership by contributing $125,000 to the partnership for a 20% interest in partnership capital. Assume the partnership's identifiable net assets are carried at amounts approximating fair value. If the bonus method is used, Gustafson's capital balance is: Select one: A. $ 85,000 B. $125,000 C. $115,000 D. $110,000 The capital balances of the DEF Partnership are as follows: Danielson $180,000 Eklund 95,000 Forsberg 150,000 Total $425,000 The partners' income sharing ratio is: Danielson, 25%; Eklund, 45%; Forsberg, 30%. Gustafson joins the partnership by contributing $125,000 to the partnership for a 20% interest in partnership capital. Assume the partnership's identifiable net assets are carried at amounts approximating fair value. If the bonus method is used, Eklund's capital balance after the admission of Gustafson is: Select one: A. $101,750 B. $ 88,250 C. $110,000 D. $ 98,000 The capital balances of the DEF Partnership are as follows: Danielson $180,000 Eklund 95,000 Forsberg 150,000 Total $425,000 The partners' income sharing ratio is: Danielson, 25%; Eklund, 45%; Forsberg, 30%. Gustafson joins the partnership by contributing $125,000 to the partnership for a 20% interest in partnership capital. Assume the partnership's identifiable net assets are carried at amounts approximating fair value. If the goodwill method is used to record the admission of Gustafson, goodwill will be recorded on the books of the partnership in the amount of: Select one: A. $ 75,000 B. $ 33,750 C. $200,000 D. $125,000 The capital balances of the DEF Partnership are as follows: Danielson $180,000 Eklund 95,000 Forsberg 150,000 Total $425,000 The partners' income sharing ratio is: Danielson, 25%; Eklund, 45%; Forsberg, 30%. Gustafson joins the partnership by contributing $90,000 to the partnership for a 20% interest in partnership capital. Assume the partnership's identifiable net assets are carried at amounts approximating fair value. If the bonus method of admission is used, Gustafson's capital balance is: Select one: A. $103,000 B. $ 85,000 C. $ 90,000 D. $108,000 The capital balances of the DEF Partnership are as follows: Danielson $180,000 Eklund 95,000 Forsberg 150,000 Total $425,000 The partners' income sharing ratio is: Danielson, 25%; Eklund, 45%; Forsberg, 30%. Gustafson joins the partnership by contributing $90,000 to the partnership for a 20% interest in partnership capital. Assume the partnership's identifiable net assets are carried at amounts approximating fair value. If the bonus method is used, Danielson's capital balance after the admission of Gustafson is: Select one: A. $180,000 B. $176,750 C. $167,000 D. $183,250 The capital balances of the DEF Partnership are as follows: Danielson $180,000 Eklund 95,000 Forsberg 150,000 Total $425,000 The partners' income sharing ratio is: Danielson, 25%; Eklund, 45%; Forsberg, 30%. Gustafson joins the partnership by contributing $90,000 to the partnership for a 20% interest in partnership capital. Assume the partnership's identifiable net assets are carried at amounts approximating fair value. If the goodwill method is used to record the admission of Gustafson, goodwill will be recorded on the books of the partnership in the amount of: Select one: A. $16,250 B. $18,750 C. $20,000 D. $0 The capital balances of the DEF Partnership are as follows: Danielson $180,000 Eklund 95,000 Forsberg 150,000 Total $425,000 The partners' income sharing ratio is: Danielson, 25%; Eklund, 45%; Forsberg, 30%. Gustafson joins the partnership by contributing $90,000 to the partnership for a 20% interest in partnership capital. Assume the partnership's identifiable net assets are carried at amounts approximating fair value. If the goodwill method is used to record the admission of Gustafson, Forsberg's capital balance immediately following admission of Gustafson is: Select one: A. $172,500 B. $150,000 C. $154,875 D. $145,125