Question

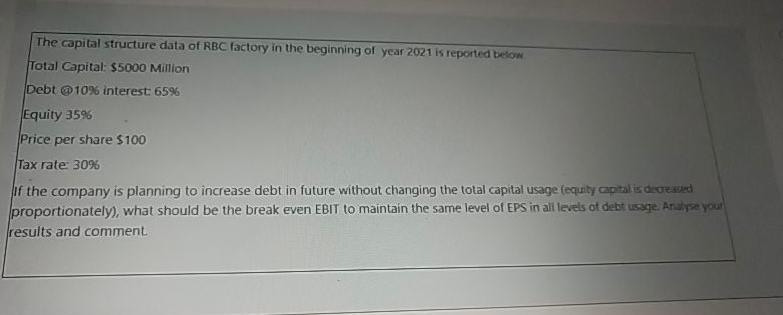

The capital structure data of RBC factory in the beginning of year 2021 is reported below Total Capital: $5000 Million Debt @10% interest: 65%

The capital structure data of RBC factory in the beginning of year 2021 is reported below Total Capital: $5000 Million Debt @10% interest: 65% Equity 35% Price per share $100 Tax rate: 30% If the company is planning to increase debt in future without changing the total capital usage (equity capital is decreased proportionately), what should be the break even EBIT to maintain the same level of EPS in all levels of debt usage. Analyse your results and comment.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Calculate the current equity capital Equity capital Total Capital Debt Equity capital 55000 Millio...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Income Tax Fundamentals 2013

Authors: Gerald E. Whittenburg, Martha Altus Buller, Steven L Gill

31st Edition

1111972516, 978-1285586618, 1285586611, 978-1285613109, 978-1111972516

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App