Question: 1. The capital structure for Mills Corporation is shown below. Currently, flotation costs are 13% of market value for a new bond issue and

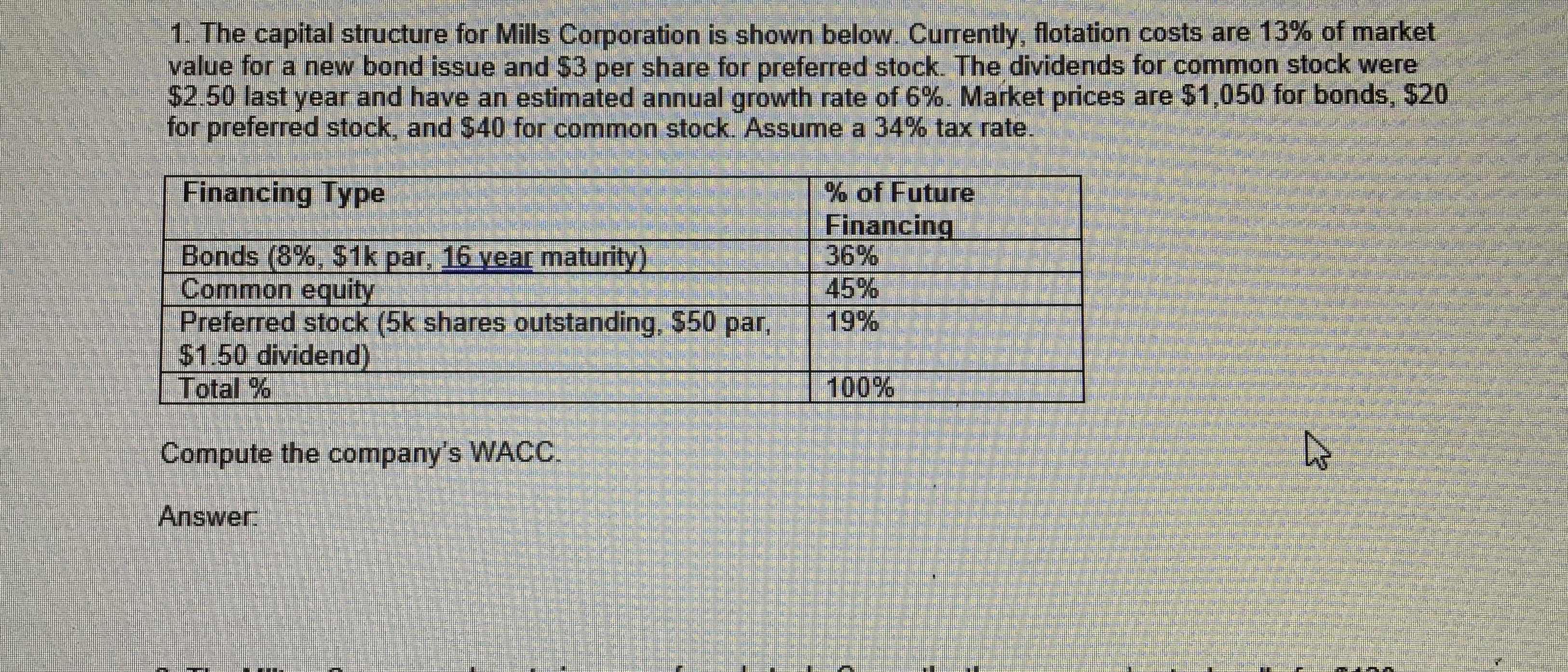

1. The capital structure for Mills Corporation is shown below. Currently, flotation costs are 13% of market value for a new bond issue and $3 per share for preferred stock. The dividends for common stock were $2.50 last year and have an estimated annual growth rate of 6%. Market prices are 51,050 for bonds, $20 for preferred stock, and $40 for common stock. Assume a 34% tax rate. Financing Type Bonds (8%, $1k par, 16 year maturity) Common equity Preferred stock (5k shares outstanding, $50 par, $1.50 dividend) Total % % of Future Financing 36% 45% 19% 100% Compute the company's WACC. Answer

Step by Step Solution

3.39 Rating (152 Votes )

There are 3 Steps involved in it

Flotation costs 13 for new bonds Market prices 3 per Share for preferred shares BOND 105... View full answer

Get step-by-step solutions from verified subject matter experts