Answered step by step

Verified Expert Solution

Question

1 Approved Answer

. The capital structure of a company consists of 8,00,000 equity shares of Rs.10 each and 1,00,000 preference shares of Rs.10 each. The dividend

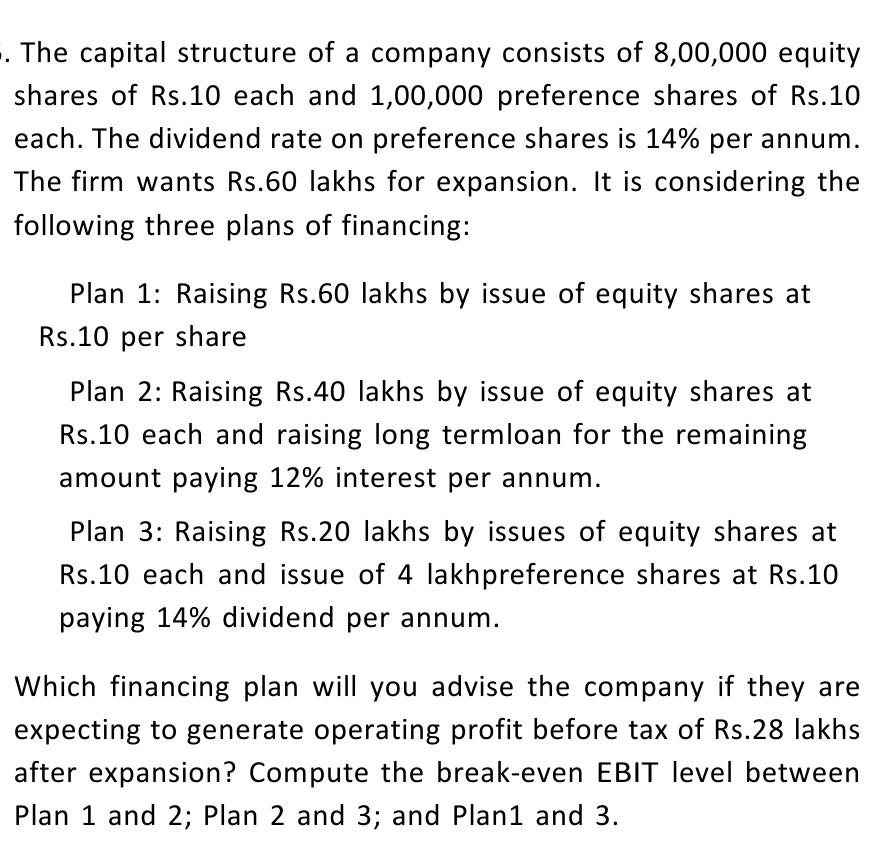

. The capital structure of a company consists of 8,00,000 equity shares of Rs.10 each and 1,00,000 preference shares of Rs.10 each. The dividend rate on preference shares is 14% per annum. The firm wants Rs.60 lakhs for expansion. It is considering the following three plans of financing: Plan 1: Raising Rs.60 lakhs by issue of equity shares at Rs.10 per share Plan 2: Raising Rs.40 lakhs by issue of equity shares at Rs.10 each and raising long term loan for the remaining amount paying 12% interest per annum. Plan 3: Raising Rs.20 lakhs by issues of equity shares at Rs.10 each and issue of 4 lakhpreference shares at Rs.10 paying 14% dividend per annum. Which financing plan will you advise the company if they are expecting to generate operating profit before tax of Rs.28 lakhs after expansion? Compute the break-even EBIT level between Plan 1 and 2; Plan 2 and 3; and Plan1 and 3.

Step by Step Solution

★★★★★

3.52 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

To determine which financing plan is advisable and to compute the breakeven EBIT Earnings Before Interest and Taxes levels we need to analyze the thre...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started