Answered step by step

Verified Expert Solution

Question

1 Approved Answer

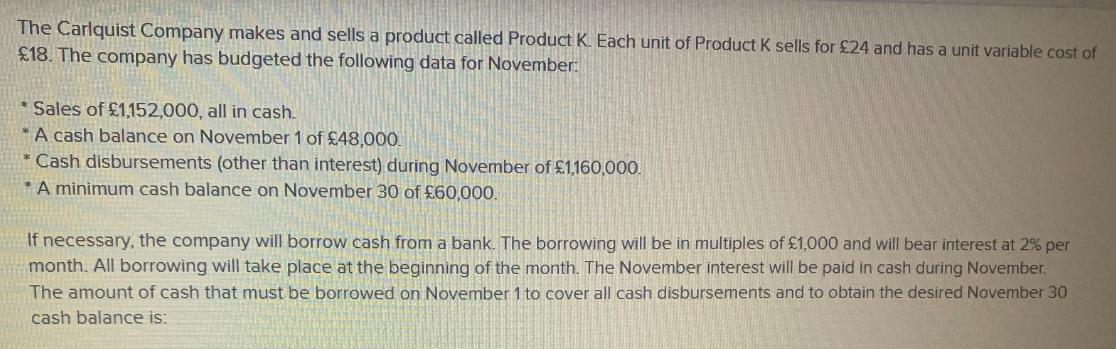

The Carlquist Company makes and sells a product called Product K. Each unit of Product K sells for 24 and has a unit variable

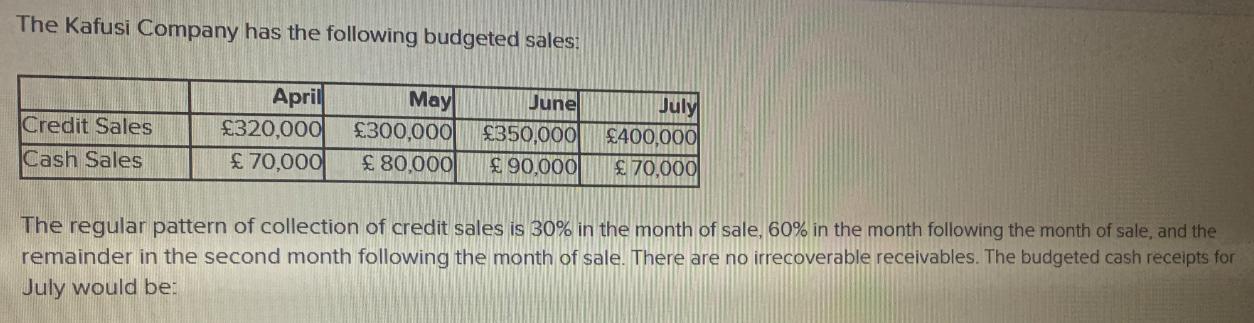

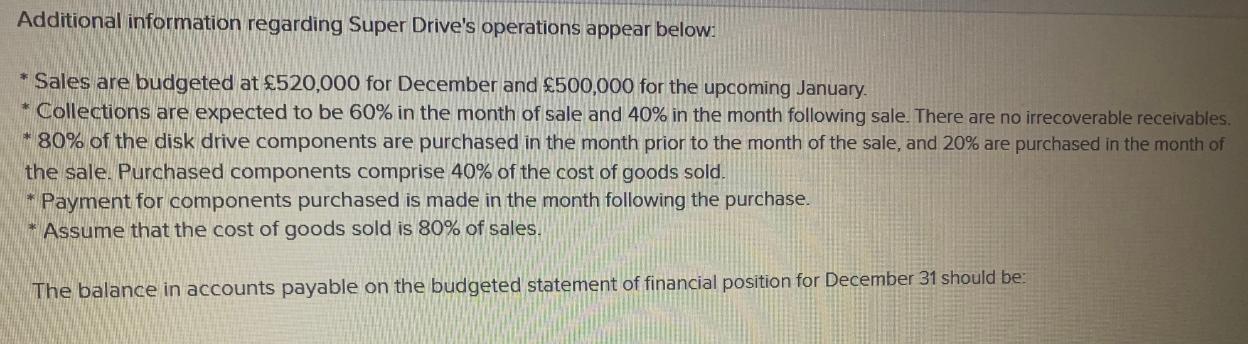

The Carlquist Company makes and sells a product called Product K. Each unit of Product K sells for 24 and has a unit variable cost of 18. The company has budgeted the following data for November: Sales of 1,152,000, all in cash. A cash balance on November 1 of 48,000. * Cash disbursements (other than interest) during November of 1,160,000. *A minimum cash balance on November 30 of 60,000. If necessary, the company will borrow cash from a bank. The borrowing will be in multiples of 1,000 and will bear interest at 2% per month. All borrowing will take place at the beginning of the month. The November interest will be paid in cash during November. The amount of cash that must be borrowed on November 1 to cover all cash disbursements and to obtain the desired November 30 cash balance is: The Kafusi Company has the following budgeted sales: Credit Sales Cash Sales April May June July 320,000 300,000 350,000 400,000 70,000 80,000 90,000 70,000 The regular pattern of collection of credit sales is 30% in the month of sale, 60% in the month following the month of sale, and the remainder in the second month following the month of sale. There are no irrecoverable receivables. The budgeted cash receipts for July would be: Berol Company plans to sell 200,000 units of finished product in July and anticipates a growth rate in sales of 5% per month. The desired monthly ending inventory in units of finished product is 80% of the next month's estimated sales. There are 150,000 finished units in inventory on June 30. Berol Company's production requirement in units of finished product for the three-month period ending September 30 is: Additional information regarding Super Drive's operations appear below: Sales are budgeted at 520,000 for December and 500,000 for the upcoming January. * Collections are expected to be 60% in the month of sale and 40% in the month following sale. There are no irrecoverable receivables. * 80% of the disk drive components are purchased in the month prior to the month of the sale, and 20% are purchased in the month of the sale. Purchased components comprise 40% of the cost of goods sold. * Payment for components purchased is made in the month following the purchase. * Assume that the cost of goods sold is 80% of sales. The balance in accounts payable on the budgeted statement of financial position for December 31 should be:

Step by Step Solution

★★★★★

3.32 Rating (146 Votes )

There are 3 Steps involved in it

Step: 1

To determine the amount of cash that must be borrowed on November 1 to cover all cash disbursements and achieve the desired November 30 cash balance w...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started