Question

* The carrying value of these debentures is 103 while the face value is 100. The company marks these debentures to market each period because

* The carrying value of these debentures is 103 while the face value is 100. The company marks these debentures to market each period because the debentures are hedged with interest-rate swaps. The swap and the debentures are both marked to market, where any gains and losses offset each other.

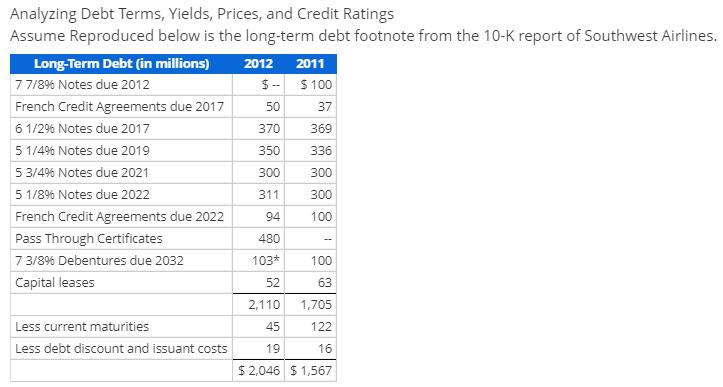

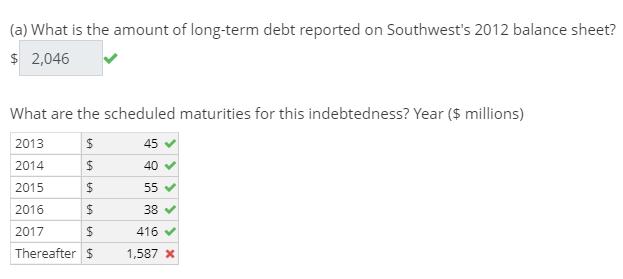

As of December 31, 2012, aggregate annual principal maturities of debt and capital leases (not including amounts associated with interest rate swap agreements and interest on capital leases) for the five-year period ending December 31, 2017, were $45 million in 2013, $40 million in 2014, $55 million in 2015, $38 million in 2016, $416 million in 2017, and $1.5 billion thereafter.

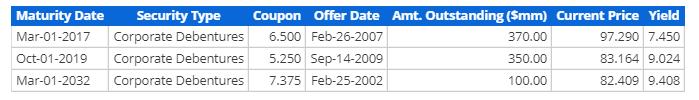

Assume below is a summary of the market values of the Southwest Airlines' bonds maturing from 2017 to 2032 (from Capital IQ).

Analyzing Debt Terms, Yields, Prices, and Credit Ratings Assume Reproduced below is the long-term debt footnote from the 10-K report of Southwest Airlines. Long-Term Debt (in millions) 7 7/8% Notes due 2012 2012 $-- 2011 $100 French Credit Agreements due 2017 50 37 6 1/2% Notes due 2017 370 369 5 1/4% Notes due 2019 350 336 5 3/4% Notes due 2021 300 300 5 1/8% Notes due 2022 311 300 French Credit Agreements due 2022 94 100 Pass Through Certificates 480 - 7 3/8% Debentures due 2032 103* 100 Capital leases 52 88 63 2,110 1,705 Less current maturities 45 122 Less debt discount and issuant costs 19 16 $2,046 $1,567

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 Marking to Market The company marks the debentures to market each period with the carrying value b...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started