Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The case is Joseph v. State Farm Fire & Cas. Co., 2013 U.S. Dist. LEXIS 24511 (Feb. 22, 2013). In March 2009, Namon Joseph

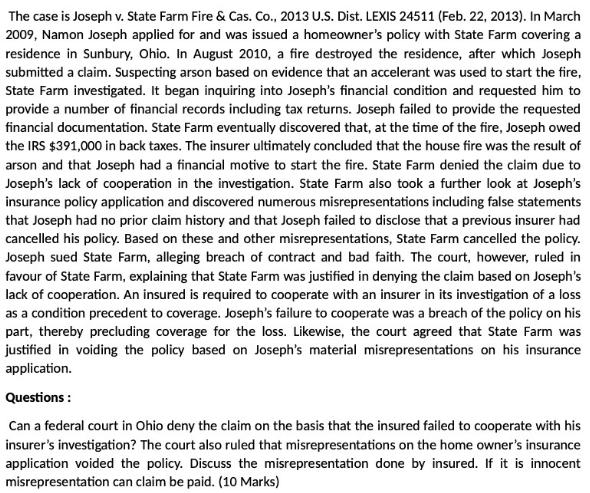

The case is Joseph v. State Farm Fire & Cas. Co., 2013 U.S. Dist. LEXIS 24511 (Feb. 22, 2013). In March 2009, Namon Joseph applied for and was issued a homeowner's policy with State Farm covering a residence in Sunbury, Ohio. In August 2010, a fire destroyed the residence, after which Joseph submitted a claim. Suspecting arson based on evidence that an accelerant was used to start the fire, State Farm investigated. It began inquiring into Joseph's financial condition and requested him to provide a number of financial records including tax returns. Joseph failed to provide the requested financial documentation. State Farm eventually discovered that, at the time of the fire, Joseph owed the IRS $391,000 in back taxes. The insurer ultimately concluded that the house fire was the result of arson and that Joseph had a financial motive to start the fire. State Farm denied the claim due to Joseph's lack of cooperation in the investigation. State Farm also took a further look at Joseph's insurance policy application and discovered numerous misrepresentations including false statements that Joseph had no prior claim history and that Joseph failed to disclose that a previous insurer had cancelled his policy. Based on these and other misrepresentations, State Farm cancelled the policy. Joseph sued State Farm, alleging breach of contract and bad faith. The court, however, ruled in favour of State Farm, explaining that State Farm was justified in denying the claim based on Joseph's lack of cooperation. An insured is required to cooperate with an insurer in its investigation of a loss as a condition precedent to coverage. Joseph's failure to cooperate was a breach of the policy on his part, thereby precluding coverage for the loss. Likewise, the court agreed that State Farm was justified in voiding the policy based on Joseph's material misrepresentations on his insurance application. Questions: Can a federal court in Ohio deny the claim on the basis that the insured failed to cooperate with his insurer's investigation? The court also ruled that misrepresentations on the home owner's insurance application voided the policy. Discuss the misrepresentation done by insured. If it is innocent misrepresentation can claim be paid. (10 Marks)

Step by Step Solution

★★★★★

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Yes a federal court in Ohio can deny the claim on the basis that the insured failed to cooperate wit...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started