Question

The case puts you in the shoes of a research analyst who is examining the jet fuel hedging strategy of JetBlue Airways for the coming

The case puts you in the shoes of a research analyst who is examining the jet fuel hedging strategy of JetBlue Airways for the coming year 2012. Airlines cross-hedge their jet fuel price risk using derivatives contracts on other oil products such as WTI and Brent crude oil. Consequently, an airline is exposed to basis risk. In 2011, dislocations in the oil market led to a Brent-WTI premium wherein jet fuel started to move with Brent instead of WTI, as it traditionally did. Several U.S. airlines started to change their hedging strategies, moving away from WTI. Entering 2012, should JetBlue also switch its hedging instruments toward Brent. The hedging strategy is for 20 million gallons per month. Each WTI and Brent futures contract size equals 42,000 gallons (1,000 barrels).

Q.1 Given the high price of jet fuel at the end of 2011, should JetBlue hedge its fuel costs for 2012? And, if so, should it increase or decrease the percentage hedged for 2012? Provide your reason with a brief explanation.

Q.2 What is the effect of other competing U.S. airlines’ decisions to hedge on JetBlue’s own decision? Does it matter if competitor airlines hedged at high levels (as in Europe) or instead hedged very little (as in Asia)? Briefly provide your arguments.

Q.2 What is the effect of other competing U.S. airlines’ decisions to hedge on JetBlue’s own decision? Does it matter if competitor airlines hedged at high levels (as in Europe) or instead hedged very little (as in Asia)? Briefly provide your arguments.

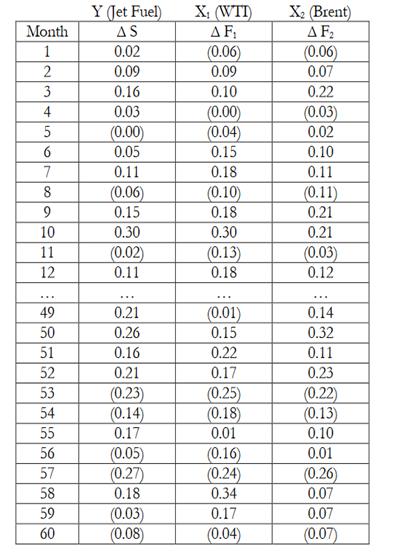

Month 1 2 3 4 5 6 7 8 9 10 11 12 49 50 51 52 53 54 55 56 57 58 59 60 Y (Jet Fuel) AS 0.02 0.09 0.16 0.03 (0.00) 0.05 0.11 (0.06) 0.15 0.30 (0.02) 0.11 0.21 0.26 0.16 0.21 (0.23) (0.14) 0.17 (0.05) (0.27) 0.18 (0.03) (0.08) X (WTI) AF (0.06) 0.09 0.10 (0.00) (0.04) 0.15 0.18 (0.10) 0.18 0.30 (0.13) 0.18 (0.01) 0.15 0.22 0.17 (0.25) (0.18) 0.01 (0.16) (0.24) 0.34 0.17 (0.04) X (Brent) A F (0.06) 0.07 0.22 (0.03) 0.02 0.10 0.11 (0.11) 0.21 0.21 (0.03) 0.12 0.14 0.32 0.11 0.23 (0.22) (0.13) 0.10 0.01 (0.26) 0.07 0.07 (0.07)

Step by Step Solution

3.45 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

To determine whether JetBlue should hedge its fuel costs for 2012 you need to consider the historical data provided especially the changes in jet fuel ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started