Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The cash account for the Justice Company at June 30, 20X8 indicated a balance of $5900. The bank statement indicated a balance of $5800

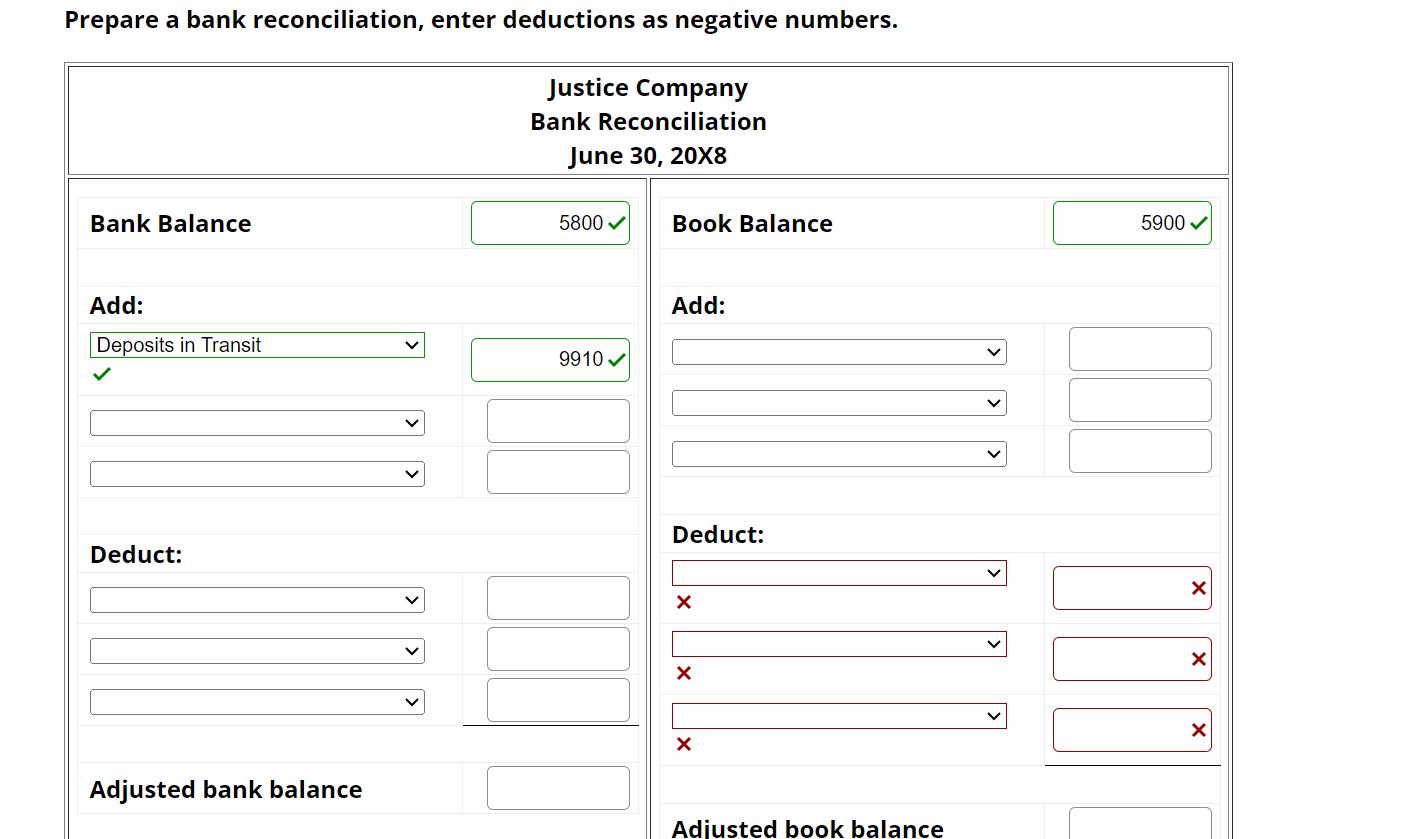

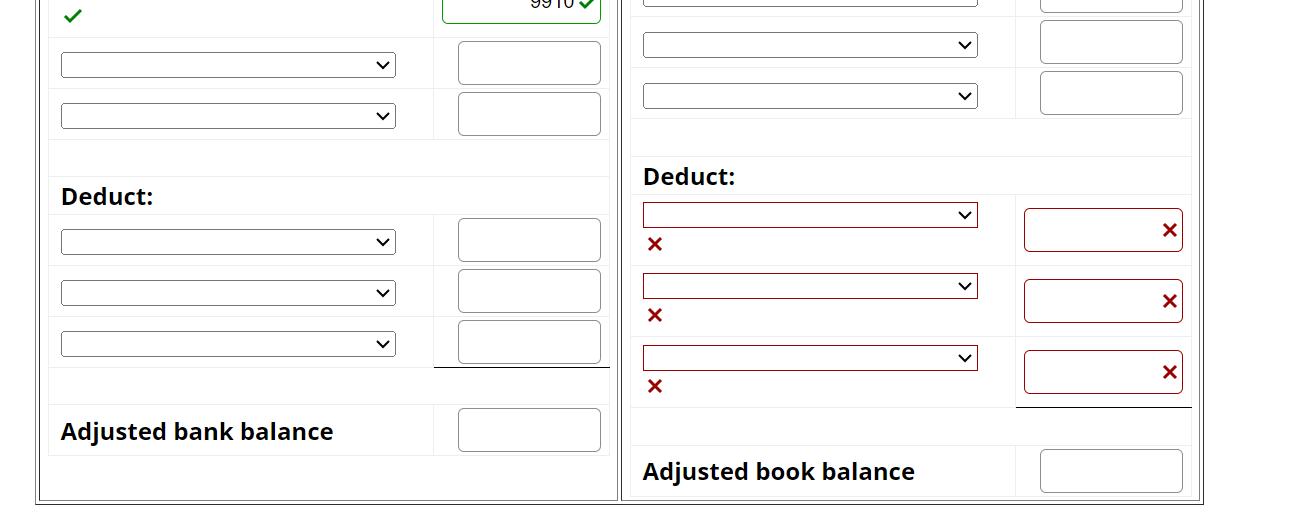

The cash account for the Justice Company at June 30, 20X8 indicated a balance of $5900. The bank statement indicated a balance of $5800 on June 30, 20X8. Comparing the bank statement and the accompanying canceled checks and memoranda with the records revealed the following reconciling items: The following information is provided for Justice Company as of June 30, 20X8. 1. Deposits in transit of $9910 2. Bank service charge: $100 3. A. check drawn for $320 had been erroneously charged by the bank as $3200. 4. The bank collected on a note in the amount of $8775; The face of the note was $8500. 5. A check written for $5310 had been incorrectly recorded by Justice as $5130. 6. Customer's check for $1695 was returned by the bank as uncollectable. 7. Outstanding checks totaled $5890. Prepare a bank reconciliation, enter deductions as negative numbers. Prepare a bank reconciliation, enter deductions as negative numbers. Justice Company Bank Reconciliation June 30, 20X8 Bank Balance 5800 Book Balance 5900 Add: Add: Deposits in Transit 9910 Deduct: Deduct: Adjusted bank balance Adjusted book balance X Deduct: Deduct: Adjusted bank balance Adjusted book balance

Step by Step Solution

★★★★★

3.51 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

To prepare a bank reconciliation we should adjust the balance per bank and the balance per books or companys records so that they both agree We have t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started