Question

The cash flow diagram shown below, capitalized monthly, refers to a project in which US$ 150,000.00 is invested at the beginning. It is estimated that

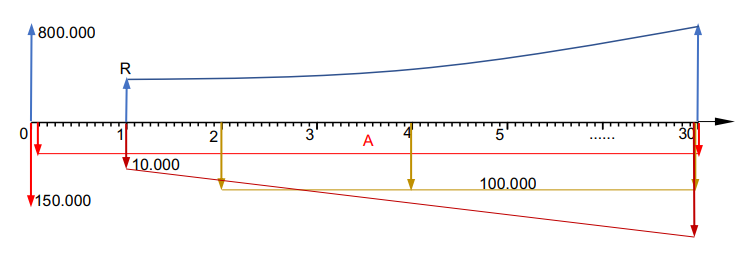

The cash flow diagram shown below, capitalized monthly, refers to a project in which US$ 150,000.00 is invested at the beginning. It is estimated that maintenance expenses will be US$ 10,000.00 at the end of the first year, growing around US$ 5,000.00 per year, until the end of the project, whose duration will be 30 years. The investor will have to make biannual payments in the amount of US$ 100,000.00 as royalties to an affiliate abroad, throughout the entire period. To build working capital, a loan in the amount of US$ 800,000.00 was taken out to be paid monthly at a nominal interest rate of 7% p.y., for a period of 30 years. The entrepreneur's expectation is to obtain an annual net income, increasing at a rate of 5% p.y. Considering a minimum rate of project attractiveness of 10% per year, determine:

a) The value of the financing provision;

b) The minimum initial annual revenue (R), in order to make the project viable;

c) The Internal Rate of Return p.y. of the project, considering R = US$ 75,000.00 and comment on your comparison with the Minimum rate of attractiveness.

Answers:

a) A = US$5.322,42

b) R > US$58.680,76

c) 3,9%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started