Question

The Catt, Dogg, and Eustus partnership was established by the partners early February 2008. The business was highly successful up till the year 2017. However,

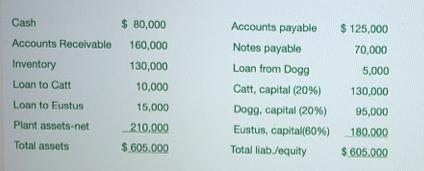

The Catt, Dogg, and Eustus partnership was established by the partners early February 2008. The business was highly successful up till the year 2017. However, starting 2018, a downturn started due to economic and marketing factors causing sales to drop drastically and hence, the result of operations for the year 2018 was a $25,000 loss. On August 1, 2019, the partnership's balance sheet showed the following information before starting with the business liquidation:

Liquidation events in august were as follows: -

Receivables recorded at $120,000 were collected at $110,000; - I

nventory costing of $80,000 was sold at a loss of $20,000; -

Plant assets were sold for $140,000 cash, resulting in a 40,000 gain.

Required:

Determine how the available cash on August 31, 2019 should be distributed.

Cash $ 80,000 Accounts payable $ 125,000 Accounts Receivable 160,000 Notes payable 70,000 Inventory 130,000 Loan from Dogg 5,000 Loan to Catt 10,000 Catt, capital (20%) 130,000 Loan to Eustus 15,000 Dogg, capital (20%) 95,000 Plant assets-net 210.000 Eustus, capital(60%) 180.000 Total assets $ 605.000 Total liab./equity $ 605.000

Step by Step Solution

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started