Answered step by step

Verified Expert Solution

Question

1 Approved Answer

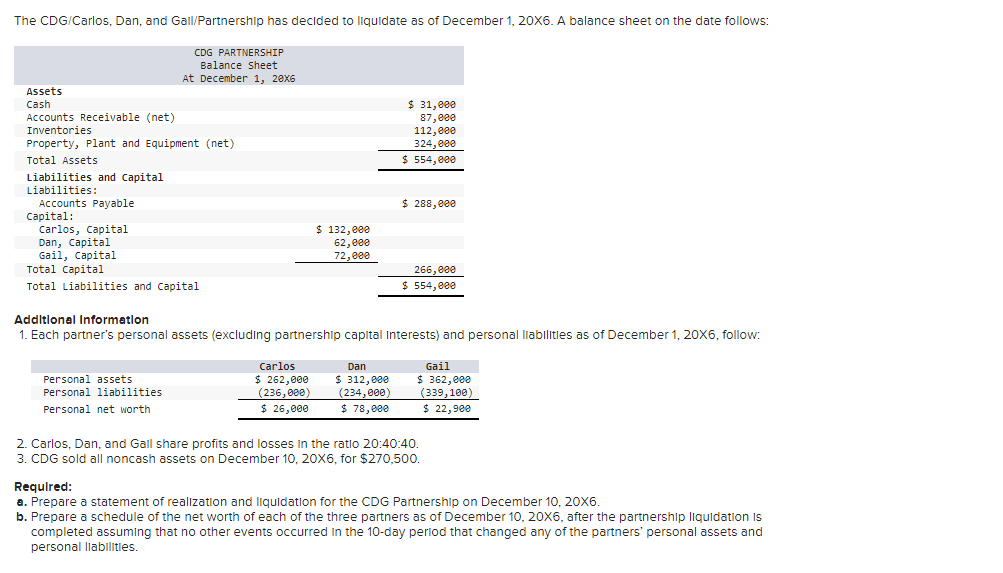

The CDG/Carlos, Dan, and Gail/Partnership has decided to liquidate as of December 1, 20X6. A balance sheet on the date follows: Assets Cash Accounts

The CDG/Carlos, Dan, and Gail/Partnership has decided to liquidate as of December 1, 20X6. A balance sheet on the date follows: Assets Cash Accounts Receivable (net) Inventories Property, Plant and Equipment (net) Total Assets Liabilities and Capital Liabilities: Accounts Payable Capital: Carlos, Capital Dan, Capital Gail, Capital CDG PARTNERSHIP Balance Sheet At December 1, 20x6 Total Capital Total Liabilities and Capital Personal assets Personal liabilities Personal net worth $ 132,000 62,000 72,000 Carlos $ 262,000 (236,000) $ 26,000 $ 31,000 87,000 112,000 324,000 $ 554,000 Additional Information 1. Each partner's personal assets (excluding partnership capital Interests) and personal liabilities as of December 1, 20X6, follow: Dan $ 312,000 (234,000) $ 78,000 $ 288,000 266,000 $ 554,000 Gail $362,000 (339,100) $ 22,900 2. Carlos, Dan, and Gall share profits and losses in the ratio 20:40:40. 3. CDG sold all noncash assets on December 10, 20X6, for $270,500. Required: a. Prepare a statement of realization and liquidation for the CDG Partnership on December 10, 20X6. b. Prepare a schedule of the net worth of each of the three partners as of December 10, 20X6, after the partnership liquidation is completed assuming that no other events occurred in the 10-day period that changed any of the partners' personal assets and personal liabilities.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Statement of Realization and Liquidation for CDG Partnership on December 10 20X6 Ca...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started