Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Central Valley Company is a merchandising firm that sells a single product. The company's revenues and expenses for the last three months are

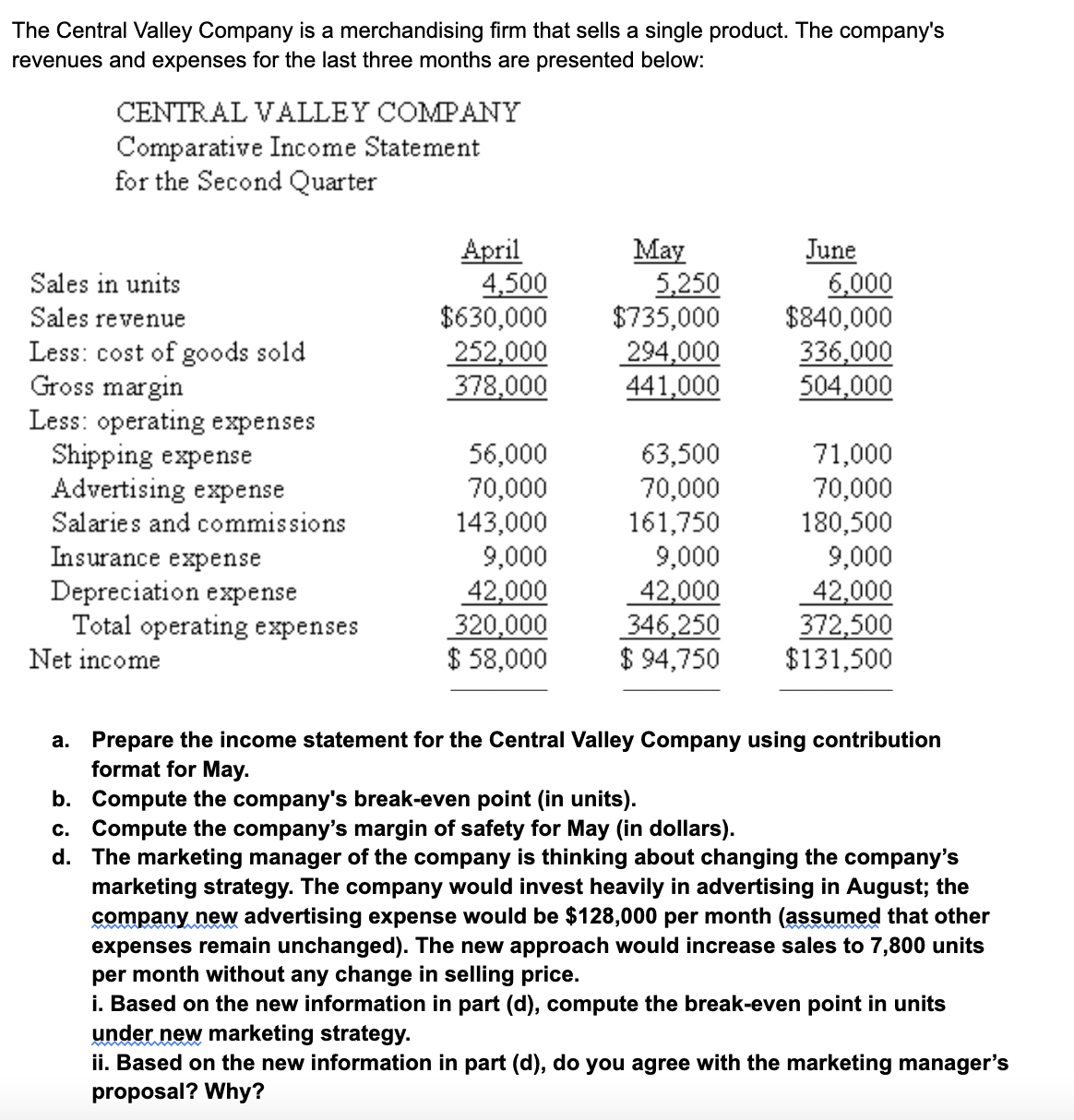

The Central Valley Company is a merchandising firm that sells a single product. The company's revenues and expenses for the last three months are presented below: CENTRAL VALLEY COMPANY Comparative Income Statement for the Second Quarter April May June Sales in units 4,500 5,250 6,000 Sales revenue $630,000 $735,000 $840,000 Less: cost of goods sold 252,000 294,000 336,000 Gross margin 378,000 441,000 504,000 Less: operating expenses Shipping expense 56,000 63,500 71,000 Advertising expense 70,000 70,000 70,000 Salaries and commissions 143,000 161,750 180,500 Insurance expense 9,000 9,000 9,000 Depreciation expense 42,000 42,000 42,000 Total operating expenses 320,000 346,250 372,500 Net income $ 58,000 $ 94,750 $131,500 a. Prepare the income statement for the Central Valley Company using contribution format for May. b. Compute the company's break-even point (in units). c. Compute the company's margin of safety for May (in dollars). d. The marketing manager of the company is thinking about changing the company's marketing strategy. The company would invest heavily in advertising in August; the company new advertising expense would be $128,000 per month (assumed that other expenses remain unchanged). The new approach would increase sales to 7,800 units per month without any change in selling price. i. Based on the new information in part (d), compute the break-even point in units under new marketing strategy. ii. Based on the new information in part (d), do you agree with the marketing manager's proposal? Why?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started