Answered step by step

Verified Expert Solution

Question

1 Approved Answer

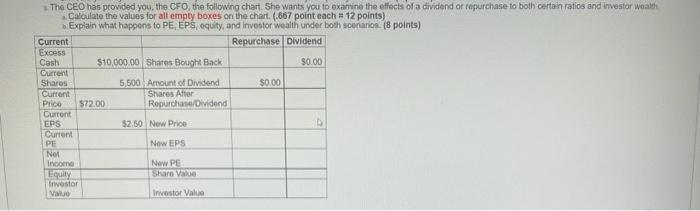

The CEO has provided you, the CFO, the following chart. She wants you to examine the effects of a dividend or repurchase to both

The CEO has provided you, the CFO, the following chart. She wants you to examine the effects of a dividend or repurchase to both certain ratios and investor wealth Calculate the values for all empty boxes on the chart. (.667 point each = 12 points) bExplain what happens to PE, EPS, equity, and investor wealth under both scenarios. (8 points) Current Repurchase Dividend Excess Cash $10,000.00 Shares Bought Back $0.00 Current Shares 5,500 $0.00 Amount of Dividend Shares After Current Price Current Repurchase/Dividend EPS $2.50 New Price 4 Current PE New EPS Not Income New PE Equity Share Value Investor Value Investor Value $72.00

Step by Step Solution

★★★★★

3.37 Rating (150 Votes )

There are 3 Steps involved in it

Step: 1

excess cash 10000 5500 Current Share current Price xorta E 72 Current EPS 25...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started