Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The CEO of Hillton is considering splitting the firm into two separate firms, Nicole Corp and Paris Corp, in a spin-off. After reading the

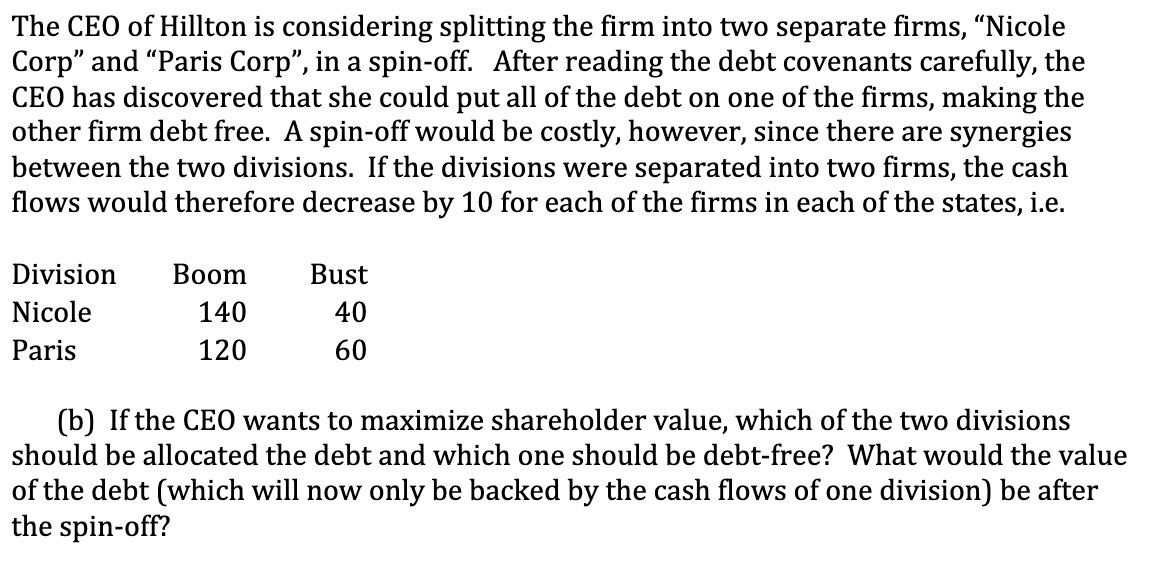

The CEO of Hillton is considering splitting the firm into two separate firms, "Nicole Corp" and "Paris Corp", in a spin-off. After reading the debt covenants carefully, the CEO has discovered that she could put all of the debt on one of the firms, making the other firm debt free. A spin-off would be costly, however, since there are synergies between the two divisions. If the divisions were separated into two firms, the cash flows would therefore decrease by 10 for each of the firms in each of the states, i.e. Division Boom Nicole 140 Paris 120 Bust 40 60 (b) If the CEO wants to maximize shareholder value, which of the two divisions should be allocated the debt and which one should be debt-free? What would the value of the debt (which will now only be backed by the cash flows of one division) be after the spin-off?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine which division should be allocated the debt and which one should be debtfree to maximiz...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started