Question

The CEO of the ESG Corp has hired you to advise her and her company about whether or not to acquire Greenerton, a privately held

The CEO of the ESG Corp has hired you to advise her and her company about whether or not to acquire Greenerton, a privately held company with no outstanding debt. If ESG Corp moves forward with the acquisition, it will finance the deal with equity and no debt.

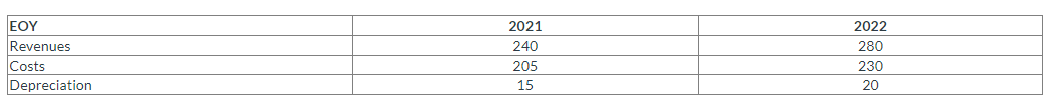

You have produced the following projections (in $ million) for Greenerton's revenues, costs of goods sold, and depreciation over the next two years (assume that today is 2020).

There are no other revenues or expenditures to consider. Today (in 2020), Greenerton's net working capital (NWC) is $26 million. For 2021 and 2022, you estimate that Greenerton's net working capital will be 10% of revenues.

Because neither ESG or Greenerton are publicly traded, you have gathered data about BlueSky, a publicly traded firm whose operations are similar in risk to Greenerton's. BlueSky has 200,000 shares outstanding, and they are currently trading at $42 a share. It also has $2.8 million in debt. BlueSky has an equity beta (betaβE) of 1.8, and the firm borrows at a rate of 5.6%.

The corporate tax rate is 40%, the market risk premium, E[Rm]-rf, is 8%, and the risk-free rate is 4%.

a. What are Greenerton's free cash flows for 2021 and 2022?

b. What is the unlevered cost of capital (rU) for BlueSky?

c. You can use the unlevered cost of capital (rU) for BlueSky as the weighted average cost of capital (rWACC) for the Greenerton acquisition. Write one to two sentences explaining why.

d. You estimate that Greenerton's free cash flows will grow at 5% forever after 2022. Calculate the terminal value of Greenerton at the end of 2022, and the maximum value that ESG should be willing to pay to acquire Greenerton.

Revenues Costs Depreciation 2021 240 205 15 2022 280 230 20

Step by Step Solution

3.52 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

a Greenertons free cash flows for 2021 and 2022 are 2021 Revenues COGS Depr...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started