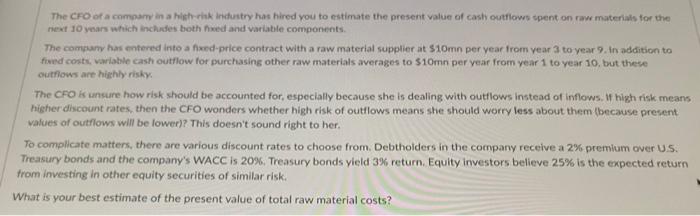

The CFO of a company in a high risk industry has hired you to estimate the present value of cash outflows spent on raw materials for the next 10 years which includes both wed and variabile components. The company has entered into a fixed price contract with a raw material supplier at somn per year from year 3 to year 9. In addition to fixed costs, variable cash outflow for purchasing other raw materials averages to $10mn per year from year 1 to year 10, but there outflows are highly risky The CFO is unsure how risk should be accounted for, especially because she is dealing with outflows instead of inflows. Whigh risk means higher discount rates, then the CFO wonders whether high risk of outflows means she should worry less about them because present values of outflows will be lower)? This doesn't sound right to her. To complicate matters, there are various discount rates to choose from. Debtholders in the company receive a 2% premium over US. Treasury bonds and the company's WACC is 20%. Treasury bonds yield 3% return. Equity Investors believe 25% is the expected return from investing in other equity securities of similar risk. What is your best estimate of the present value of total raw material costs? The CFO of a company in a high risk industry has hired you to estimate the present value of cash outflows spent on raw materials for the next 10 years which includes both wed and variabile components. The company has entered into a fixed price contract with a raw material supplier at somn per year from year 3 to year 9. In addition to fixed costs, variable cash outflow for purchasing other raw materials averages to $10mn per year from year 1 to year 10, but there outflows are highly risky The CFO is unsure how risk should be accounted for, especially because she is dealing with outflows instead of inflows. Whigh risk means higher discount rates, then the CFO wonders whether high risk of outflows means she should worry less about them because present values of outflows will be lower)? This doesn't sound right to her. To complicate matters, there are various discount rates to choose from. Debtholders in the company receive a 2% premium over US. Treasury bonds and the company's WACC is 20%. Treasury bonds yield 3% return. Equity Investors believe 25% is the expected return from investing in other equity securities of similar risk. What is your best estimate of the present value of total raw material costs