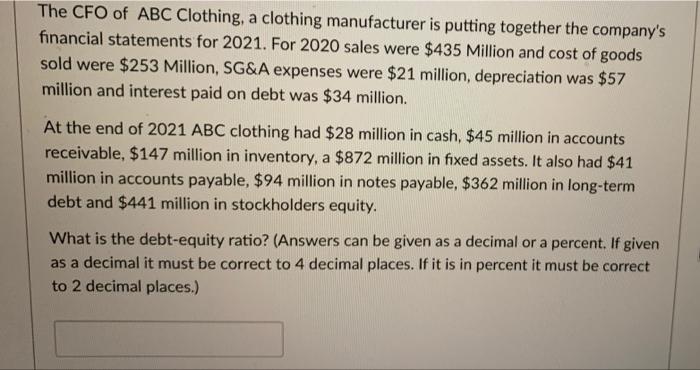

The CFO of ABC Clothing, a clothing manufacturer is putting together the company's financial statements for 2021. For 2020 sales were $435 Million and cost of goods sold were $253 Million, SG&A expenses were $21 million, depreciation was $57 million and interest paid on debt was $34 million. What is the Operating Cash Flow for 2021? (The answer can be given in millions of dollars or in actual dollars. If given in millions of dollars it must be correct to 3 decimal places.) Note: It will be useful to construct a balance sheet to answer the next few questions. At the end of 2021 ABC clothing had $28 million in cash, $45 million in accounts receivable, $147 million in inventory, a $872 million in fixed assets. It also had $41 million in accounts payable, $94 million in notes payable, $362 million in long-term debt and $441 million in stockholders equity. What are the retained earnings at the end of 2021? (The answer can be given in millions of dollars or in actual dollars. If given in millions of dollars it must be correct to 3 decimal places.) HINT: Create a balance sheet and recall the balance sheet identity. At the end of 2021 ABC clothing had $28 million in cash, $45 million in accounts receivable, $147 million in inventory, a $872 million in fixed assets. It also had $41 million in accounts payable, $94 million in notes payable, $362 million in long-term debt and $441 million in stockholders equity. What is the company's Net Working Capital? (The answer can be given in millions of dollars or in actual dollars. If given in millions of dollars it must be correct to 3 decimal places.) The CFO of ABC Clothing, a clothing manufacturer is putting together the company's financial statements for 2021. For 2020 sales were $435 Million and cost of goods sold were $253 Million, SG&A expenses were $21 million, depreciation was $57 million and interest paid on debt was $34 million. At the end of 2021 ABC clothing had $28 million in cash, $45 million in accounts receivable, $147 million in inventory, a $872 million in fixed assets. It also had $41 million in accounts payable, $94 million in notes payable, $362 million in long-term debt and $441 million in stockholders equity. What is ABC Clothing's cash ratio? (Answers can be given as a decimal or a percent. If given as a decimal it must be correct to 4 decimal places. If it is in percent it must be correct to 2 decimal places.) The CFO of ABC Clothing, a clothing manufacturer is putting together the company's financial statements for 2021. For 2020 sales were $435 Million and cost of goods sold were $253 Million, SG&A expenses were $21 million, depreciation was $57 million and interest paid on debt was $34 million. At the end of 2021 ABC clothing had $28 million in cash, $45 million in accounts receivable, $147 million in inventory, a $872 million in fixed assets. It also had $41 million in accounts payable, $94 million in notes payable, $362 million in long-term debt and $441 million in stockholders equity. What is the debt-equity ratio? (Answers can be given as a decimal or a percent. If given as a decimal it must be correct to 4 decimal places. If it is in percent it must be correct to 2 decimal places.)