Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The CFO of Renoir, Inc., Sally Renoir, is debating an investment. The investment is projected to earn $100,000 annually and will require the company to

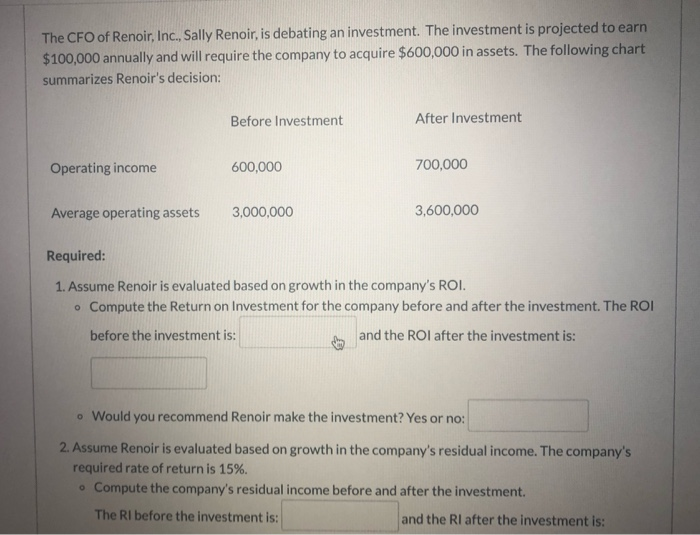

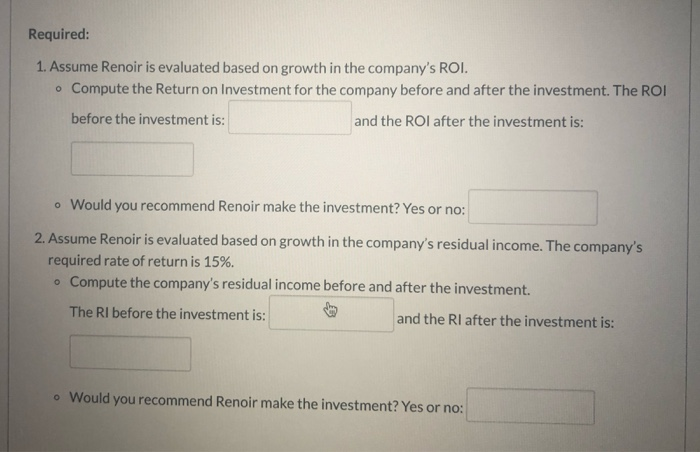

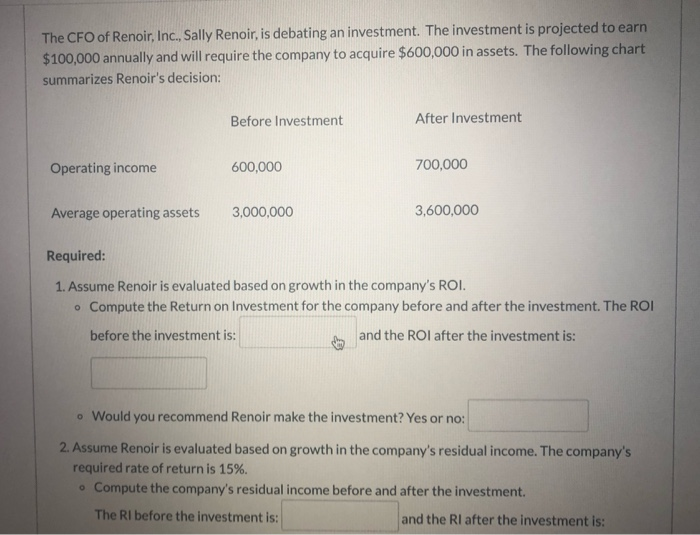

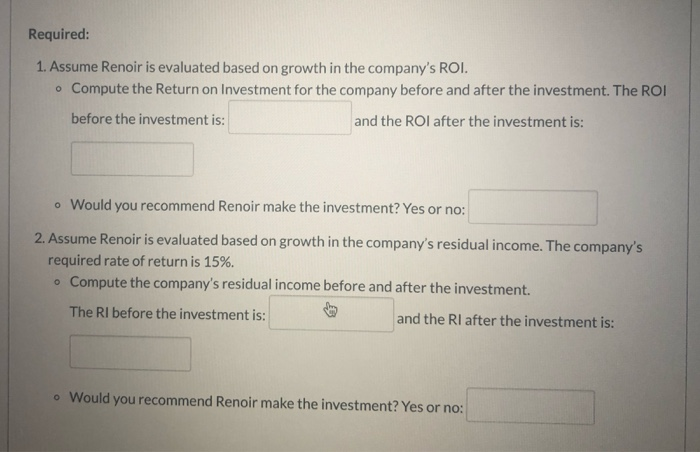

The CFO of Renoir, Inc., Sally Renoir, is debating an investment. The investment is projected to earn $100,000 annually and will require the company to acquire $600,000 in assets. The following chart summarizes Renoir's decision: After Investment Before Investment 700,000 Operating income 600,000 3,600,000 Average operating assets 3,000,000 Required: 1. Assume Renoir is evaluated based on growth in the company's ROI. Compute the Return on Investment for the company before and after the investment. The RO and the ROI after the investment is: before the investment is: Would you recommend Renoir make the investment? Yes or no: 2. Assume Renoir is evaluated based on growth in the company's residual income. The company's required rate of return is 15%. Compute the company's residual income before and after the investment. The RI before the investment is: and the RI after the investment is: Required: 1. Assume Renoir is evaluated based on growth in the company's ROI Compute the Return on Investment for the company before and after the investment. The ROI and the ROI after the investment is: before the investment is: Would you recommend Renoir make the investment? Yes or no: 2. Assume Renoir is evaluated based on growth in the company's residual income. The company's required rate of return is 15% Compute the company's residual income before and after the investment. The RI before the investment is: and the RI after the investment is: Would you recommend Renoir make the investment? Yes or no

The CFO of Renoir, Inc., Sally Renoir, is debating an investment. The investment is projected to earn $100,000 annually and will require the company to acquire $600,000 in assets. The following chart summarizes Renoir's decision: After Investment Before Investment 700,000 Operating income 600,000 3,600,000 Average operating assets 3,000,000 Required: 1. Assume Renoir is evaluated based on growth in the company's ROI. Compute the Return on Investment for the company before and after the investment. The RO and the ROI after the investment is: before the investment is: Would you recommend Renoir make the investment? Yes or no: 2. Assume Renoir is evaluated based on growth in the company's residual income. The company's required rate of return is 15%. Compute the company's residual income before and after the investment. The RI before the investment is: and the RI after the investment is: Required: 1. Assume Renoir is evaluated based on growth in the company's ROI Compute the Return on Investment for the company before and after the investment. The ROI and the ROI after the investment is: before the investment is: Would you recommend Renoir make the investment? Yes or no: 2. Assume Renoir is evaluated based on growth in the company's residual income. The company's required rate of return is 15% Compute the company's residual income before and after the investment. The RI before the investment is: and the RI after the investment is: Would you recommend Renoir make the investment? Yes or no

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started