Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The CFO of TDW Manufacturing is attempting to determine which of the firm's four main competitors is the most undervalued as compared to the

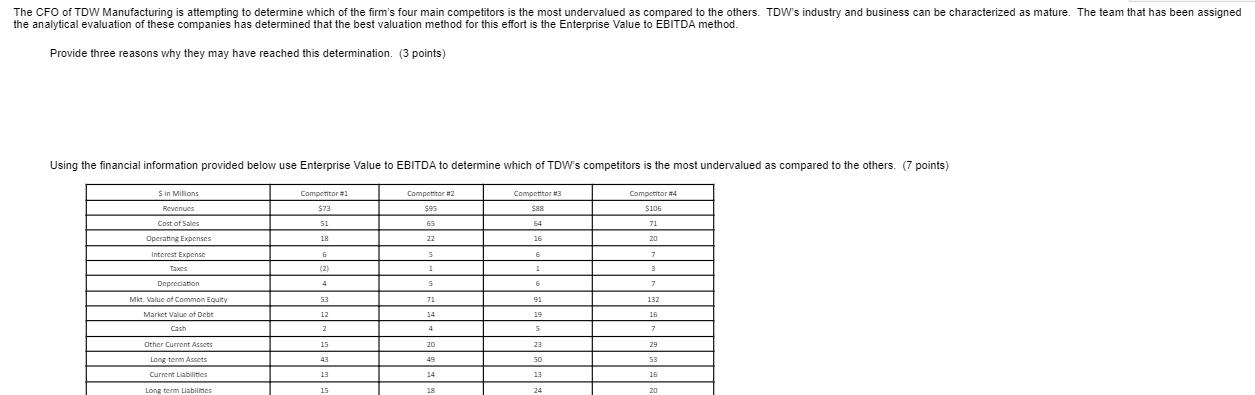

The CFO of TDW Manufacturing is attempting to determine which of the firm's four main competitors is the most undervalued as compared to the others. TDW's industry and business can be characterized as mature. The team that has been assigned the analytical evaluation of these companies has determined that the best valuation method for this effort is the Enterprise Value to EBITDA method. Provide three reasons why they may have reached this determination. (3 points) Using the financial information provided below use Enterprise Value to EBITDA to determine which of TDW's competitors is the most undervalued as compared to the others. (7 points) Sin Millions Revenues Competitor #1 $73 Competitor #2 $95 Competitor #3 $88 Cost of Sales 51 65 64 Operating Expenses 22 Interest Expense Taxes Depreciation Mkt. Value of Common Equity Market Value of Debt Cash Other Current Assets Long term Assets Current Liabilities Long term Liabilmes 18 6 (2) 2 4 53 12 2 15 43 13 15 5 - 1 S 71 14 4 20 49 14 18 16 6 1 = 6 91 5 23 50 13 24 Competitor #4 $106 71 20 7 3 27 132 16 7 7 29 53 16 20

Step by Step Solution

★★★★★

3.41 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

a The team may have chosen the Enterprise Value to EBITDA valuation method because it is a ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started