Question

The CFO of Wheat Inc. is deciding whether to use options, futures or forwards to hedge the price of its wheat production. Appraise the three

The CFO of Wheat Inc. is deciding whether to use options, futures or forwards to hedge the price of its wheat production.

Appraise the three (3) choices, rank them and explain the rankings:

(i) Rank from lowest to highest cost, given that the wheat price at harvest is predicted to be higher than the price when the wheat was hedged.

(ii) Rank from lowest to highest risk, given that the wheat price at harvest is predicted to be lower than the price when the wheat was hedged.

(b) Jenny, a new trader in the commodity market, was observing the change in the transaction volume for an oil futures contract and the change in the open interest. She was puzzled by the seemingly lack of correlation between the two variables of transaction volume and open interest. She is puzzled why the open interest can decrease one day despite a higher transaction volume compared to the day before, or increase when the transaction volume went down, or remain the same, whether the transaction volume went up or down. Analyze and explain how the three (3) situations can arise.

(c) Tom and his friend Jerry, both commodity traders, are having a discussion about the market. "Times are hard these days," says Tom. "In previous years, I could make a fair amount of profit from today's spot and 1-year futures prices for oil of $60 and $63, respectively. Today these prices allow me to barely cover my costs."

Appraise the situation Tom is talking about and give three (3) reasons that could explain his last statement.

Question 2

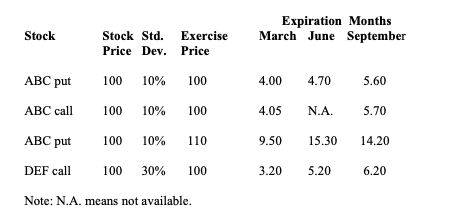

(a) You are an options trader for a hedge fund. Your assistant prepared the following sheet containing the prices of various American options on Jan 2. Assume the options expire at the end of the expiration month. Assume a transaction cost of 2%.

Expiration Months Stock Stock Std. Exercise March June September Price Dev. Price ABC put 100 10% 100 4.00 4.70 5.60 ABC call 100 10% 100 4.05 N.A. 5.70 ABC put 100 10% 110 9.50 15.30 14.20 DEF call 100 30% 100 3.20 5.20 6.20 Note: N.A. means not available.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started