Answered step by step

Verified Expert Solution

Question

1 Approved Answer

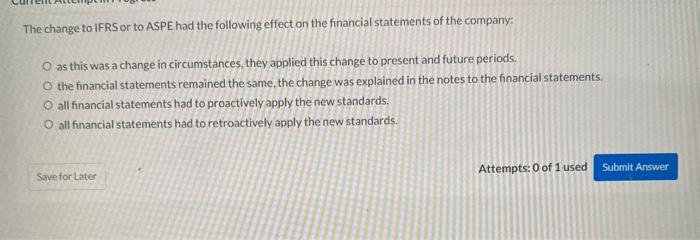

The change to IFRS or to ASPE had the following effect on the financial statements of the company: O as this was a change in

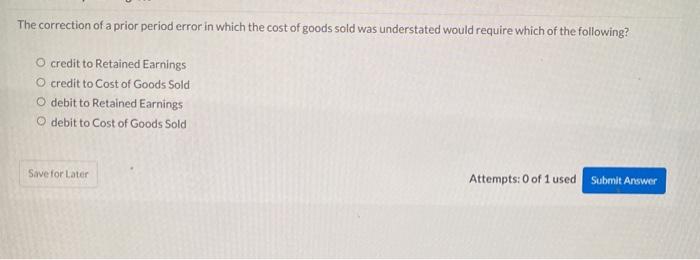

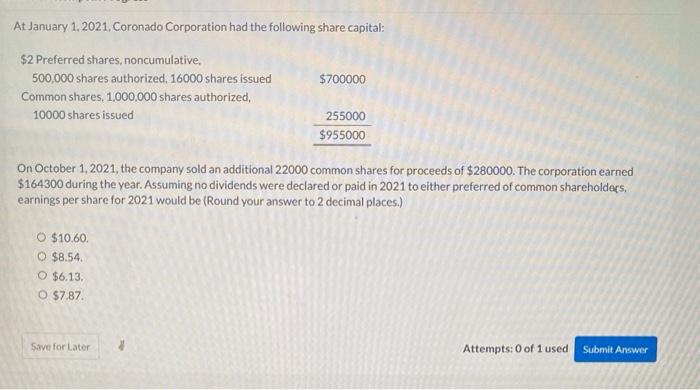

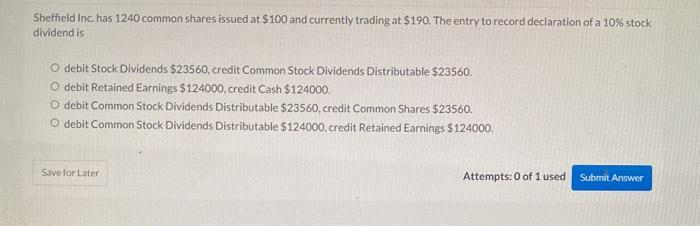

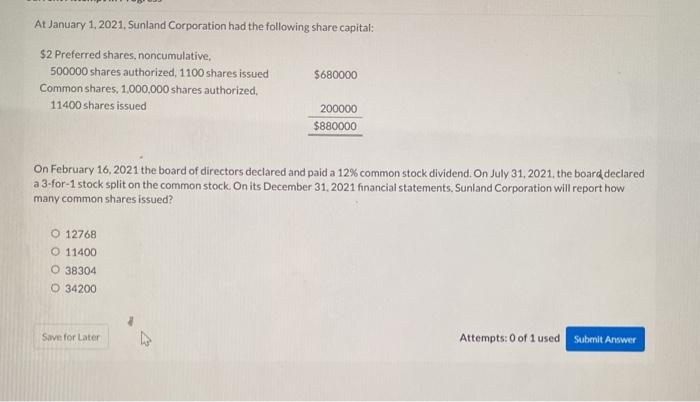

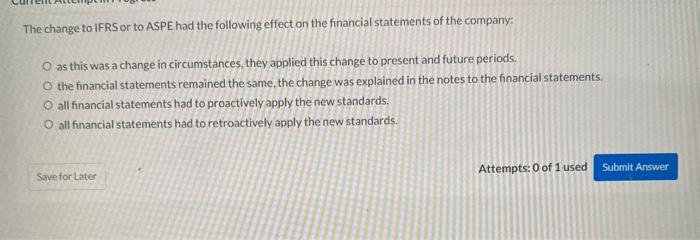

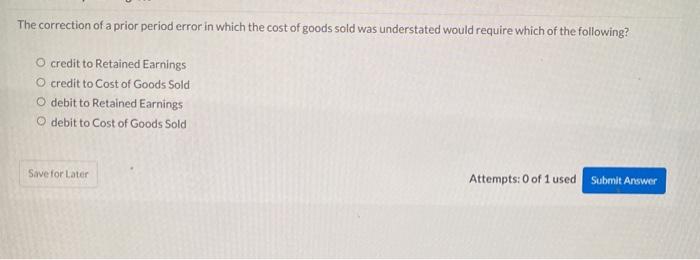

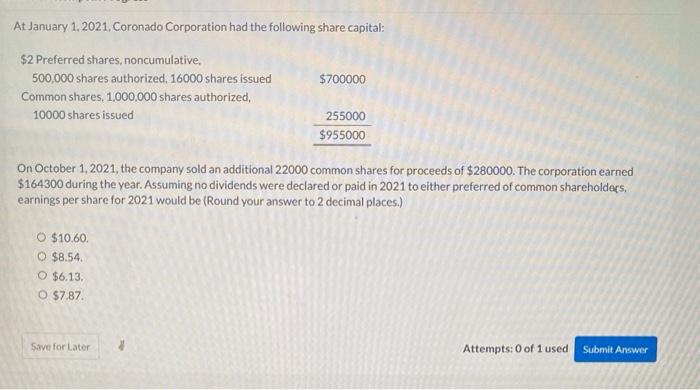

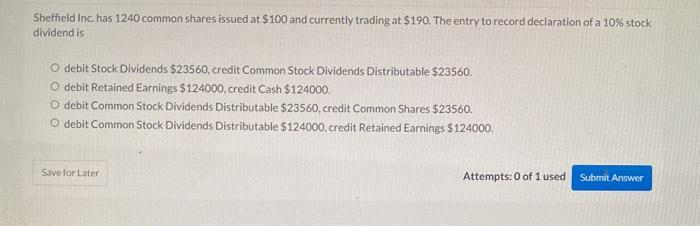

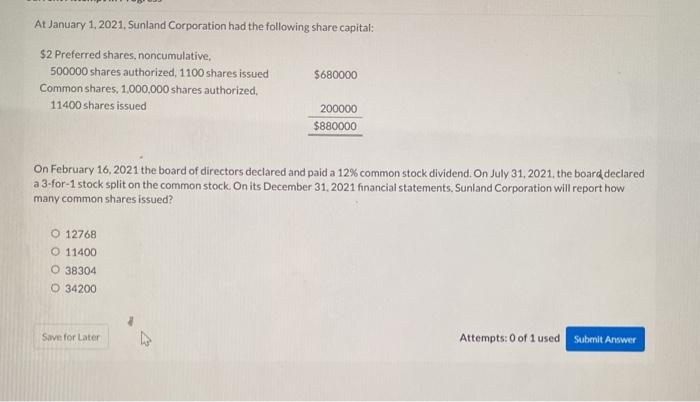

The change to IFRS or to ASPE had the following effect on the financial statements of the company: O as this was a change in circumstances, they applied this change to present and future periods. the financial statements remained the same, the change was explained in the notes to the financial statements. O all financial statements had to proactively apply the new standards, O all financial statements had to retroactively apply the new standards. Save for Later Attempts:0 of 1 used Submit Answer The correction of a prior period error in which the cost of goods sold was understated would require which of the following? O credit to Retained Earnings O credit to Cost of Goods Sold O debit to Retained Earnings O debit to Cost of Goods Sold Save for Later Attempts: 0 of 1 used Submit Answer At January 1, 2021, Coronado Corporation had the following share capital: $700000 $2 Preferred shares, noncumulative, 500,000 shares authorized, 16000 shares issued Common shares, 1,000,000 shares authorized, 10000 shares issued 255000 $955000 On October 1, 2021, the company sold an additional 22000 common shares for proceeds of $280000. The corporation earned $164300 during the year. Assuming no dividends were declared or paid in 2021 to either preferred of common shareholders. earnings per share for 2021 would be (Round your answer to 2 decimal places.) O $10.60 O $8.54. O $6.13 O $7.87 Save for Later 4 Attempts: 0 of 1 used Submit Answer Sheffield Inc. has 1240 common shares issued at $100 and currently trading at $190. The entry to record declaration of a 10% stock dividend is O debit Stock Dividends $23560, credit Common Stock Dividends Distributable $23560. O debit Retained Earnings $124000, credit Cash $124000. O debit Common Stock Dividends Distributable $23560, credit Common Shares $23560. O debit Common Stock Dividends Distributable $124000, credit Retained Earnings $124000. Save for Later Attempts: 0 of 1 used Submit Answer At January 1, 2021. Sunland Corporation had the following share capital: $2 Preferred shares, noncumulative, 500000 shares authorized, 1100 shares issued Common shares, 1,000,000 shares authorized, 11400 shares issued $680000 200000 $880000 On February 16, 2021 the board of directors declared and paid a 12% common stock dividend. On July 31, 2021, the board declared a 3-for-1 stock split on the common stock. Onits December 31, 2021 financial statements, Sunland Corporation will report how many common shares issued? O 12768 0 11400 O 38304 O 34200 Save for Later Attempts: 0 of 1 used Submit

The change to IFRS or to ASPE had the following effect on the financial statements of the company: O as this was a change in circumstances, they applied this change to present and future periods. the financial statements remained the same, the change was explained in the notes to the financial statements. O all financial statements had to proactively apply the new standards, O all financial statements had to retroactively apply the new standards. Save for Later Attempts:0 of 1 used Submit Answer The correction of a prior period error in which the cost of goods sold was understated would require which of the following? O credit to Retained Earnings O credit to Cost of Goods Sold O debit to Retained Earnings O debit to Cost of Goods Sold Save for Later Attempts: 0 of 1 used Submit Answer At January 1, 2021, Coronado Corporation had the following share capital: $700000 $2 Preferred shares, noncumulative, 500,000 shares authorized, 16000 shares issued Common shares, 1,000,000 shares authorized, 10000 shares issued 255000 $955000 On October 1, 2021, the company sold an additional 22000 common shares for proceeds of $280000. The corporation earned $164300 during the year. Assuming no dividends were declared or paid in 2021 to either preferred of common shareholders. earnings per share for 2021 would be (Round your answer to 2 decimal places.) O $10.60 O $8.54. O $6.13 O $7.87 Save for Later 4 Attempts: 0 of 1 used Submit Answer Sheffield Inc. has 1240 common shares issued at $100 and currently trading at $190. The entry to record declaration of a 10% stock dividend is O debit Stock Dividends $23560, credit Common Stock Dividends Distributable $23560. O debit Retained Earnings $124000, credit Cash $124000. O debit Common Stock Dividends Distributable $23560, credit Common Shares $23560. O debit Common Stock Dividends Distributable $124000, credit Retained Earnings $124000. Save for Later Attempts: 0 of 1 used Submit Answer At January 1, 2021. Sunland Corporation had the following share capital: $2 Preferred shares, noncumulative, 500000 shares authorized, 1100 shares issued Common shares, 1,000,000 shares authorized, 11400 shares issued $680000 200000 $880000 On February 16, 2021 the board of directors declared and paid a 12% common stock dividend. On July 31, 2021, the board declared a 3-for-1 stock split on the common stock. Onits December 31, 2021 financial statements, Sunland Corporation will report how many common shares issued? O 12768 0 11400 O 38304 O 34200 Save for Later Attempts: 0 of 1 used Submit

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started