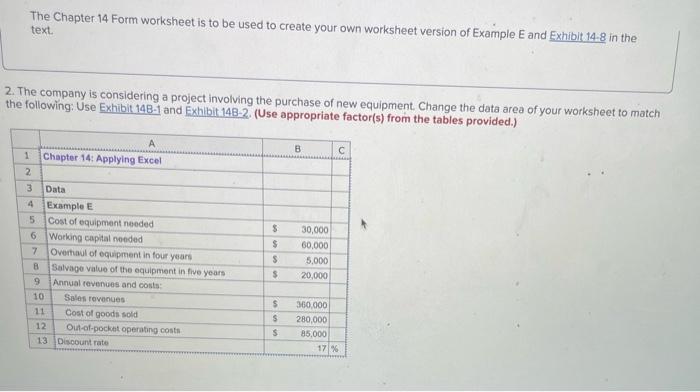

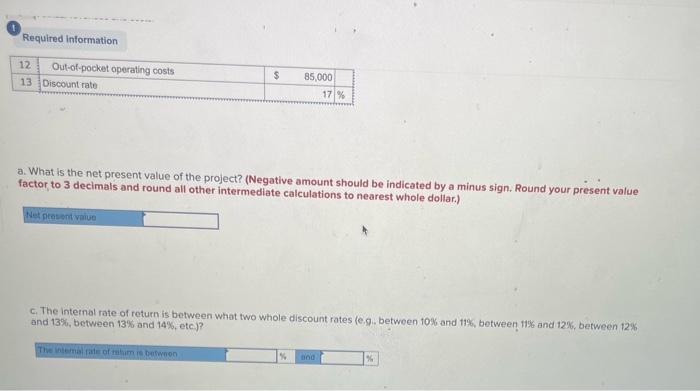

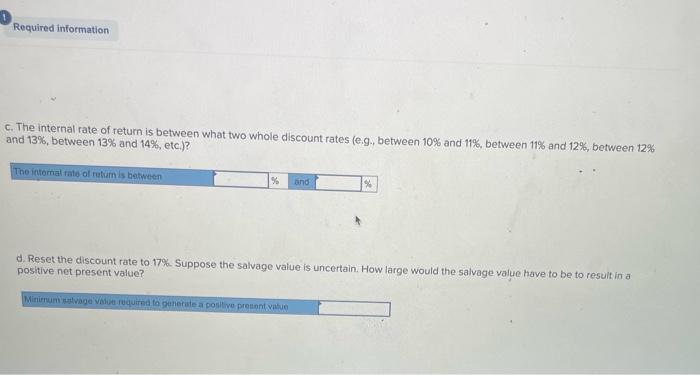

The Chapter 14 Form worksheet is to be used to create your own worksheet version of Example E and Exhibit 14.8 in the text. 2. The company is considering a project involving the purchase of new equipment. Change the data area of your worksheet to match the following: Use Exhibit 148-1 and Exhibit 148-2. (Use appropriate factor(s) from the tables provided.) a. What is the net present value of the project? (Negative amount should be indicated by a minus sign. Round your present value factor to 3 decimals and round all other intermediate calculations to nearest whole dollar.) c. The internal rate of return is between what two whole discount rates le. g. between 10% and 11%, between 11% and 12%, between 12% and 13%, between 13% and 14%, etcj? C. The internal rate of return is between what two whole discount rates (e.g. between 10% and 11%, between 11% and 12%, between 12% and 13%, between 13% and 14%, etc.)? d. Reset the discount rate to 17% Suppose the salvage value is uncertain. How large would the salvage value have to be to result in a positive net present value? The Chapter 14 Form worksheet is to be used to create your own worksheet version of Example E and Exhibit 14.8 in the text. 2. The company is considering a project involving the purchase of new equipment. Change the data area of your worksheet to match the following: Use Exhibit 148-1 and Exhibit 148-2. (Use appropriate factor(s) from the tables provided.) a. What is the net present value of the project? (Negative amount should be indicated by a minus sign. Round your present value factor to 3 decimals and round all other intermediate calculations to nearest whole dollar.) c. The internal rate of return is between what two whole discount rates le. g. between 10% and 11%, between 11% and 12%, between 12% and 13%, between 13% and 14%, etcj? C. The internal rate of return is between what two whole discount rates (e.g. between 10% and 11%, between 11% and 12%, between 12% and 13%, between 13% and 14%, etc.)? d. Reset the discount rate to 17% Suppose the salvage value is uncertain. How large would the salvage value have to be to result in a positive net present value