Answered step by step

Verified Expert Solution

Question

1 Approved Answer

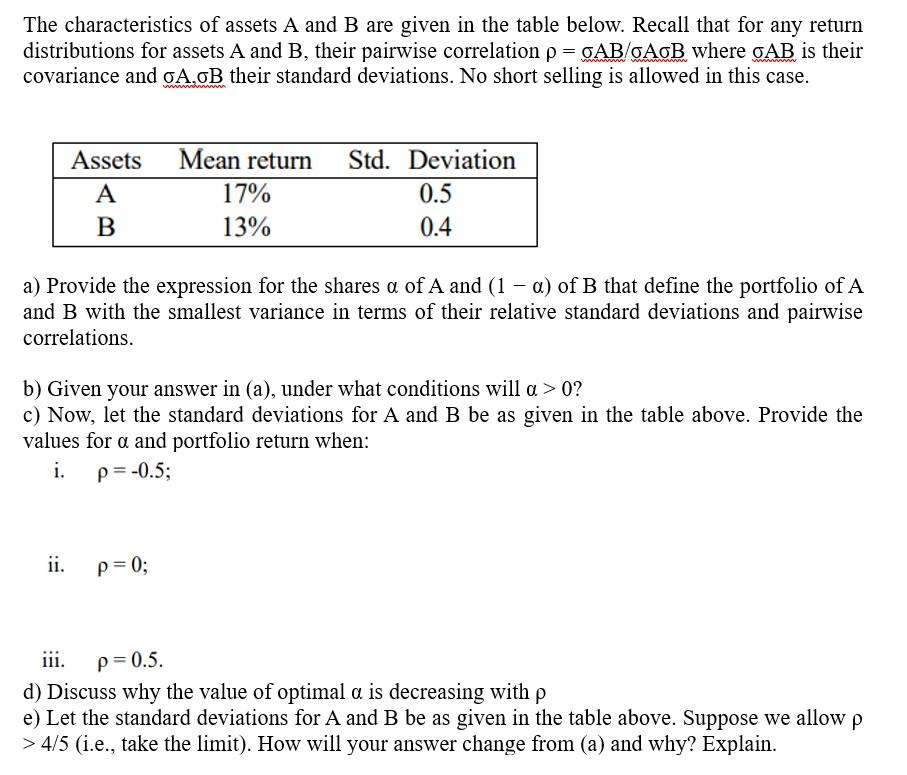

The characteristics of assets A and B are given in the table below. Recall that for any return distributions for assets A and B,

The characteristics of assets A and B are given in the table below. Recall that for any return distributions for assets A and B, their pairwise correlation p = OAB/GAOB where OAB is their covariance and GA.OB their standard deviations. No short selling is allowed in this case. Assets A B ii. Mean return Std. Deviation 0.5 0.4 a) Provide the expression for the shares a of A and (1 - a) of B that define the portfolio of A and B with the smallest variance in terms of their relative standard deviations and pairwise correlations. 17% 13% b) Given your answer in (a), under what conditions will a > 0? c) Now, let the standard deviations for A and B be as given in the table above. Provide the values for a and portfolio return when: i. p = -0.5; P = 0; iii. p=0.5. d) Discuss why the value of optimal a is decreasing with p e) Let the standard deviations for A and B be as given in the table above. Suppose we allow p > 4/5 (i.e., take the limit). How will your answer change from (a) and why? Explain.

Step by Step Solution

★★★★★

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

a The expression for the shares a of A and 1 a of B that define the portfolio of A and B with the sm...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started