Answered step by step

Verified Expert Solution

Question

1 Approved Answer

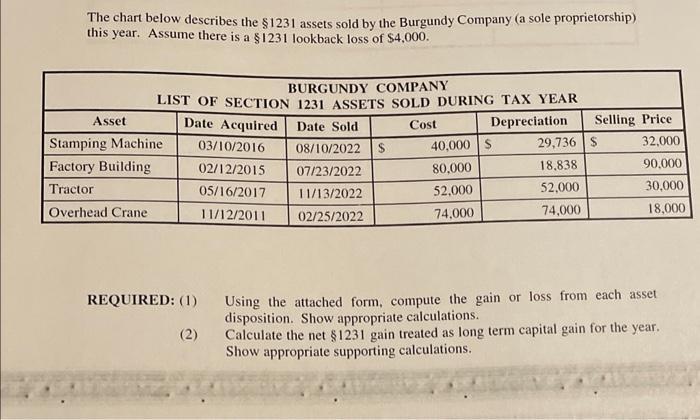

The chart below describes the $1231 assets sold by the Burgundy Company (a sole proprietorship) this year. Assume there is a $1231 lookback loss

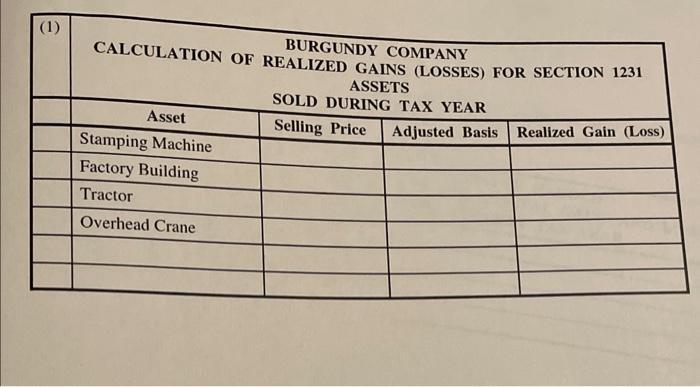

The chart below describes the $1231 assets sold by the Burgundy Company (a sole proprietorship) this year. Assume there is a $1231 lookback loss of $4,000. Asset BURGUNDY COMPANY LIST OF SECTION 1231 ASSETS SOLD DURING TAX YEAR Date Sold Cost Depreciation Date Acquired 03/10/2016 02/12/2015 05/16/2017 11/12/2011 Stamping Machine Factory Building Tractor Overhead Crane REQUIRED: (1) (2) 08/10/2022 $ 07/23/2022 11/13/2022 02/25/2022 40,000 $ 80,000 52,000 74,000 Selling Price 29,736 S 18,838 52,000 74,000 32,000 90,000 30,000 18,000 Using the attached form, compute the gain or loss from each asset disposition. Show appropriate calculations. Calculate the net $1231 gain treated as long term capital gain for the year. Show appropriate supporting calculations. (1) BURGUNDY COMPANY CALCULATION OF REALIZED GAINS (LOSSES) FOR SECTION 1231 ASSETS SOLD DURING TAX YEAR Selling Price Adjusted Basis Realized Gain (Loss) Asset Stamping Machine Factory Building Tractor Overhead Crane

Step by Step Solution

★★★★★

3.31 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

BURGUNDY COMPANY Calculation of realized gainsloses for section 1231 assets sold during tax year Ass...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started