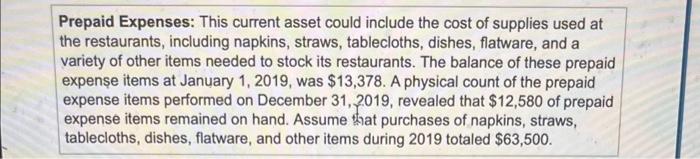

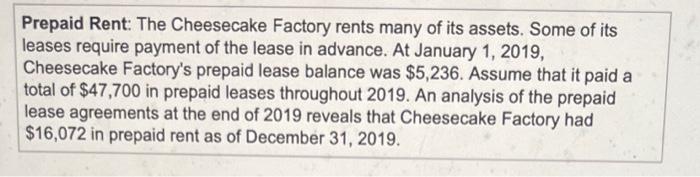

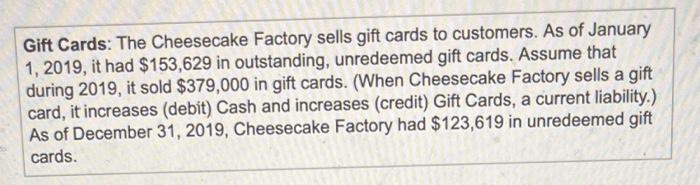

The Cheesecake Factory incorporated (NASDAQ: CAKE) is publelytheld and uses U.S. generaly accepted accounting principlos (GAAP) to proparo its financiai statoments. Its fiscal year-end Is the 52- or 53-weok period ending on the Tuesday dosest to December 3t. In 2019, its fiscal year end was December 31, 2019. At fiscal year-end, Cheesecake Factory makes several adjusfing entries so that its assets, labilties, income and expenses are recoeded property and in the correct fme period. Here is a partial Ist of some accounts that require adjusting enthes. Click the icon to view the Prepuid Expenset intormation.) (Click the icon to viow the Prepad Fent inlomation.) (Cick the icon to view the Gat Cards intormation) (Clck the icon lo view the Satary and Wages Payable information.) Al The Cheesecake Factory's fiscal yearend, ts adpusing ontry for supples would inelude a debit 1o: A. Prepaid experses 8. Supples experse c. Accounts peyobie D. Cash Prepaid Expenses: This current asset could include the cost of supplies used at the restaurants, including napkins, straws, tablecloths, dishes, flatware, and a variety of other items needed to stock its restaurants. The balance of these prepaid expense items at January 1,2019 , was $13,378. A physical count of the prepaid expense items performed on December 31,2019 , revealed that $12,580 of prepaid expense items remained on hand. Assume t.atat purchases of napkins, straws, tablecloths, dishes, flatware, and other items during 2019 totaled $63,500. Prepaid Rent: The Cheesecake Factory rents many of its assets. Some of its leases require payment of the lease in advance. At January 1, 2019, Cheesecake Factory's prepaid lease balance was $5,236. Assume that it paid a total of $47,700 in prepaid leases throughout 2019. An analysis of the prepaid lease agreements at the end of 2019 reveals that Cheesecake Factory had $16,072 in prepaid rent as of December 31,2019. Gift Cards: The Cheesecake Factory sells gift cards to customers. As of January 1,2019 , it had $153,629 in outstanding, unredeemed gift cards. Assume that during 2019 , it sold $379,000 in gift cards. (When Cheesecake Factory sells a gift card, it increases (debit) Cash and increases (credit) Gift Cards, a current liability.) As of December 31,2019 , Cheesecake Factory had $123,619 in unredeemed gift cards. Salaries and Wages Payable: The balance of Salaries and Wages Payable at January 1,2019 , was $31,570; this balance represented salaries and wages earned by Cheesecake Factory employees in 2018 that were then paid in January 2019. When Cheesecake Factory paid the $31,570 in January 2019 , it reduced (debited) Salaries and Wages Payable and reduced (credited) Cash. As of December 31, 2019, Cheesecake Factory employees had earned salaries and wages of $39,401 that would be paid in early January 2020