Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The chief accountant of Thomas Co. has made the following estimations about the probability of collection for accounts receivable: 97% for balances under two

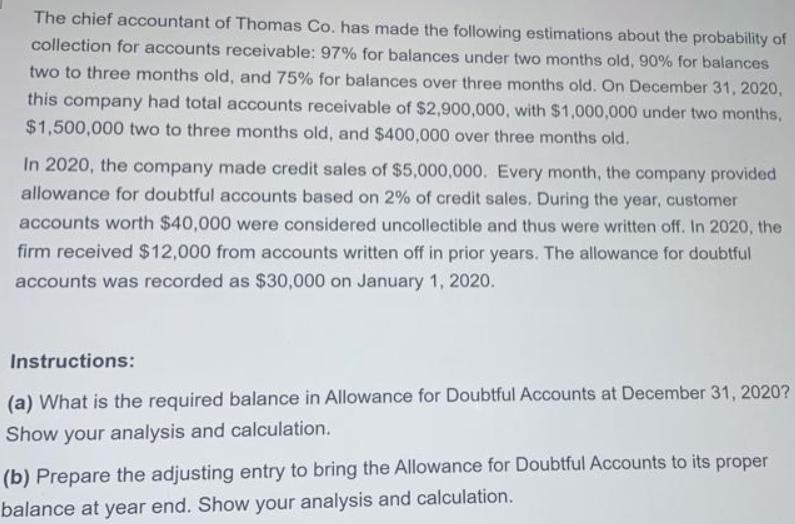

The chief accountant of Thomas Co. has made the following estimations about the probability of collection for accounts receivable: 97% for balances under two months old, 90% for balances two to three months old, and 75% for balances over three months old. On December 31, 2020, this company had total accounts receivable of $2,900,000, with $1,000,000 under two months, $1,500,000 two to three months old, and $400,000 over three months old. In 2020, the company made credit sales of $5,000,000. Every month, the company provided allowance for doubtful accounts based on 2% of credit sales. During the year, customer accounts worth $40,000 were considered uncollectible and thus were written off. In 2020, the firm received $12,000 from accounts written off in prior years. The allowance for doubtful accounts was recorded as $30,000 on January 1, 2020. Instructions: (a) What is the required balance in Allowance for Doubtful Accounts at December 31, 2020? Show your analysis and calculation. (b) Prepare the adjusting entry to bring the Allowance for Doubtful Accounts to its proper balance at year end. Show your analysis and calculation.

Step by Step Solution

★★★★★

3.37 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

a Probability of collection for accounts receivable Ageing Collectible portion A Uncollectible porti...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started