Answered step by step

Verified Expert Solution

Question

1 Approved Answer

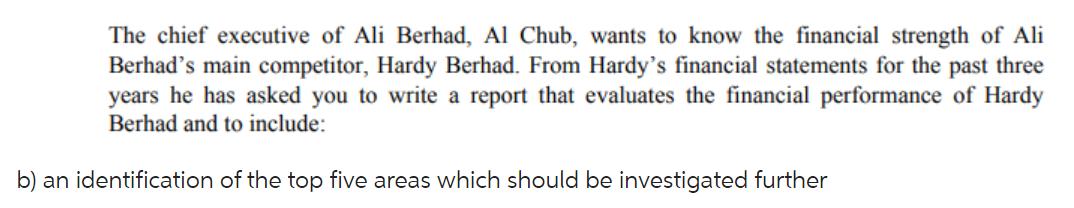

The chief executive of Ali Berhad, Al Chub, wants to know the financial strength of Ali Berhad's main competitor, Hardy Berhad. From Hardy's financial

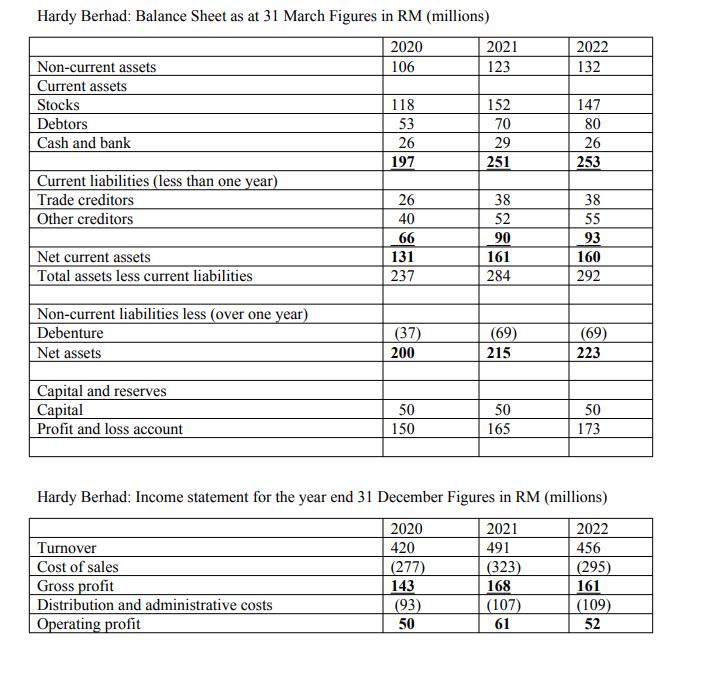

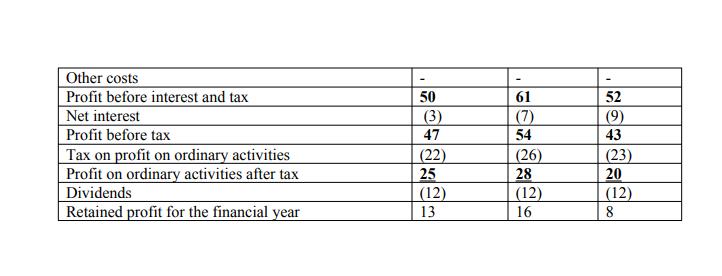

The chief executive of Ali Berhad, Al Chub, wants to know the financial strength of Ali Berhad's main competitor, Hardy Berhad. From Hardy's financial statements for the past three years he has asked you to write a report that evaluates the financial performance of Hardy Berhad and to include: b) an identification of the top five areas which should be investigated further Hardy Berhad: Balance Sheet as at 31 March Figures in RM (millions) 2020 106 Non-current assets Current assets Stocks Debtors Cash and bank Current liabilities (less than one year) Trade creditors Other creditors Net current assets Total assets less current liabilities Non-current liabilities less (over one year) Debenture Net assets Capital and reserves Capital Profit and loss account Turnover Cost of sales Gross profit 118 53 26 197 Distribution and administrative costs Operating profit 26 40 66 131 237 (37) 200 50 150 2021 123 (93) 50 152 70 29 251 38 52 90 161 284 (69) 215 50 165 (323) 168 2022 132 (107) 61 147 80 26 253 Hardy Berhad: Income statement for the year end 31 December Figures in RM (millions) 2020 2021 420 491 (277) 143 38 55 93 160 292 (69) 223 50 173 2022 456 (295) 161 (109) 52 Other costs Profit before interest and tax Net interest Profit before tax Tax on profit on ordinary activities Profit on ordinary activities after tax Dividends Retained profit for the financial year 50 (3) 47 (22) 25 (12) 13 61 (7) 54 (26) 28 (12) 16 52 (9) 43 (23) 20 (12) 8

Step by Step Solution

★★★★★

3.47 Rating (157 Votes )

There are 3 Steps involved in it

Step: 1

Here are the stepwise calculations for each of the top five areas identified for further investigati...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started