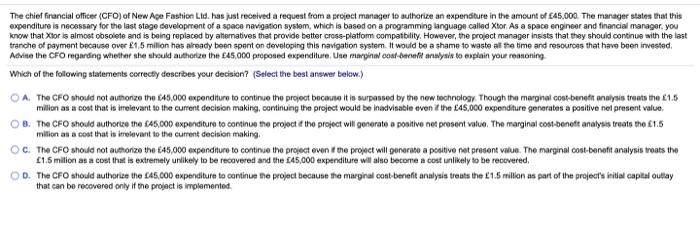

The chief financial Officer (CFO) of New Ape Fashion Ltd. has just received a request from a project manager to authorize an expenditure in the amount of 45,000. The manager states that this expenditure is necessary for the last stage development of a space navigation system, which is based on a programming language called Xtor As a space engineer and financial manager, you know that Xlor is almost obsolete and is being replaced by alternatives that provide better cross-platfom compatibility. However, the project manager insists that they should continue with the last tranche of payment because over 1,5 milion has already been spent on developing this navigation system. It would be a shame to waste all the time and resources that have been invested Adrite the CFO regarding whether the should authorize the 45,000 proposed expenditure. Use marginal cost- belit analysis to explain your reasoning Which of the following statements correctly describes your decision? (Select the best answer below.) A The CFO should not authorize the 45.000 expenditure to continue the project because it is surpassed by the new technology. Though the marginal cost-benefit anys treats the 1.5 million as a cost that is irrelevant to the current decision m n making, continuing the project would be inadvisable even if the 45,000 expenditure generates a positive nel present value 8. The CFO should authorize the $45.000 expenditure to continue the project at the project will generate a positivo net prosent value. The marginal cost-beneft analysis treats the 61.5 million as a cost that is relevant to the current decision making C. The CFO should not authonze the 45,000 expenditure to continue the project even the project will generate a positive net present value. The marginal cost-benefit analysis treats the 1.5 million as a cost that is extremely unlikely to be recovered and the 45,000 expenditure will also become a cost unlikely to be recovered. OD. The CFO should authorize the 145.000 expenditure to continue the project because the marginal cost-benefit analysis treats the 1.5 millor as part of the project's initial capital outlay that can be recovered only if the project is implemented The chief financial Officer (CFO) of New Ape Fashion Ltd. has just received a request from a project manager to authorize an expenditure in the amount of 45,000. The manager states that this expenditure is necessary for the last stage development of a space navigation system, which is based on a programming language called Xtor As a space engineer and financial manager, you know that Xlor is almost obsolete and is being replaced by alternatives that provide better cross-platfom compatibility. However, the project manager insists that they should continue with the last tranche of payment because over 1,5 milion has already been spent on developing this navigation system. It would be a shame to waste all the time and resources that have been invested Adrite the CFO regarding whether the should authorize the 45,000 proposed expenditure. Use marginal cost- belit analysis to explain your reasoning Which of the following statements correctly describes your decision? (Select the best answer below.) A The CFO should not authorize the 45.000 expenditure to continue the project because it is surpassed by the new technology. Though the marginal cost-benefit anys treats the 1.5 million as a cost that is irrelevant to the current decision m n making, continuing the project would be inadvisable even if the 45,000 expenditure generates a positive nel present value 8. The CFO should authorize the $45.000 expenditure to continue the project at the project will generate a positivo net prosent value. The marginal cost-beneft analysis treats the 61.5 million as a cost that is relevant to the current decision making C. The CFO should not authonze the 45,000 expenditure to continue the project even the project will generate a positive net present value. The marginal cost-benefit analysis treats the 1.5 million as a cost that is extremely unlikely to be recovered and the 45,000 expenditure will also become a cost unlikely to be recovered. OD. The CFO should authorize the 145.000 expenditure to continue the project because the marginal cost-benefit analysis treats the 1.5 millor as part of the project's initial capital outlay that can be recovered only if the project is implemented