Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Chief Financial Officer of Deutsch Bank Ltd is reviewing a capital project and is undecided as to whether it should be financed using

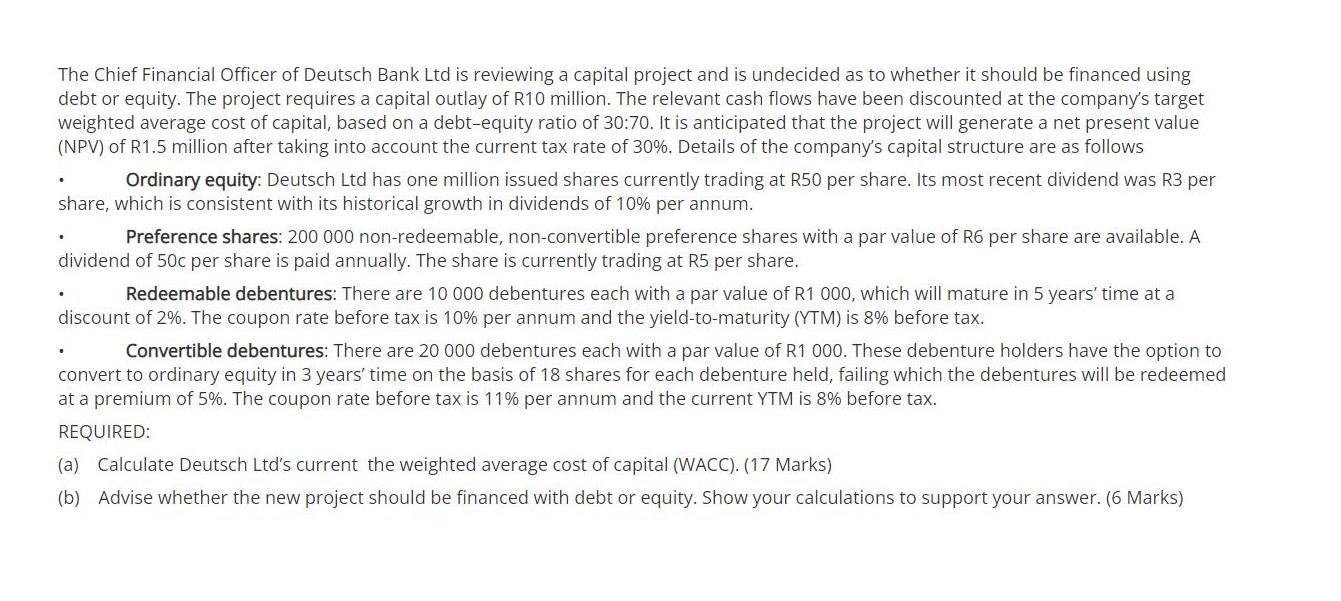

The Chief Financial Officer of Deutsch Bank Ltd is reviewing a capital project and is undecided as to whether it should be financed using debt or equity. The project requires a capital outlay of R10 million. The relevant cash flows have been discounted at the company's target weighted average cost of capital, based on a debt-equity ratio of 30:70. It is anticipated that the project will generate a net present value (NPV) of R1.5 million after taking into account the current tax rate of 30%. Details of the company's capital structure are as follows Ordinary equity: Deutsch Ltd has one million issued shares currently trading at R50 per share. Its most recent dividend was R3 per share, which is consistent with its historical growth in dividends of 10% per annum. Preference shares: 200 000 non-redeemable, non-convertible preference shares with a par value of R6 per share are available. A dividend of 50c per share is paid annually. The share is currently trading at R5 per share. Redeemable debentures: There are 10 000 debentures each with a par value of R1 000, which will mature in 5 years' time at a discount of 2%. The coupon rate before tax is 10% per annum and the yield-to-maturity (YTM) is 8% before tax. Convertible debentures: There are 20 000 debentures each with a par value of R1 000. These debenture holders have the option to convert to ordinary equity in 3 years' time on the basis of 18 shares for each debenture held, failing which the debentures will be redeemed at a premium of 5%. The coupon rate before tax is 11% per annum and the current YTM is 8% before tax. REQUIRED: (a) Calculate Deutsch Ltd's current the weighted average cost of capital (WACC). (17 Marks) (b) Advise whether the new project should be financed with debt or equity. Show your calculations to support your answer. (6 Marks)

Step by Step Solution

★★★★★

3.25 Rating (143 Votes )

There are 3 Steps involved in it

Step: 1

To calculate Deutsch Ltds current weighted average cost of capital WACC well need to consider the cost of different components of its capital structur...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started