Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Chinese Renminbi (RMB) is very strong against the US dollar due to increased supply of dollars and has moved from 8 RMB/$1 to

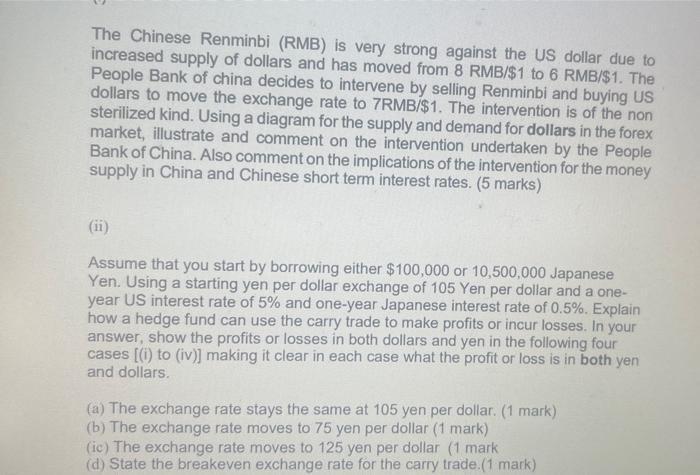

The Chinese Renminbi (RMB) is very strong against the US dollar due to increased supply of dollars and has moved from 8 RMB/$1 to 6 RMB/$1. The People Bank of china decides to intervene by selling Renminbi and buying US dollars to move the exchange rate to 7RMB/$1. The intervention is of the non sterilized kind. Using a diagram for the supply and demand for dollars in the forex market, illustrate and comment on the intervention undertaken by the People Bank of China. Also comment on the implications of the intervention for the money supply in China and Chinese short term interest rates. (5 marks) (ii) Assume that you start by borrowing either $100,000 or 10,500,000 Japanese Yen. Using a starting yen per dollar exchange of 105 Yen per dollar and a one- year US interest rate of 5% and one-year Japanese interest rate of 0.5%. Explain how a hedge fund can use the carry trade to make profits or incur losses. In your answer, show the profits or losses in both dollars and yen in the following four cases [(i) to (iv)] making it clear in each case what the profit or loss is in both yen and dollars. (a) The exchange rate stays the same at 105 yen per dollar. (1 mark) (b) The exchange rate moves to 75 yen per dollar (1 mark) (ic) The exchange rate moves to 125 yen per dollar (1 mark (d) State the breakeven exchange rate for the carry trade.(1 mark)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

i Intervention by the Peoples Bank of China The intervention by the Peoples Bank of China involves selling Renminbi RMB and buying US dollars in the f...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started