Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The City of Fremont's fiscal year ends June 30. The city issued the following general obligation bonds: 1. On July 1, 2017, the city

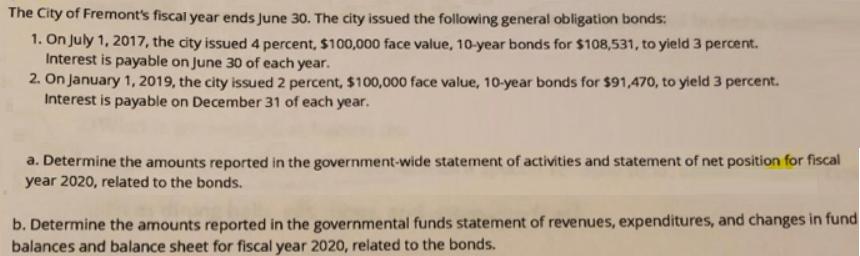

The City of Fremont's fiscal year ends June 30. The city issued the following general obligation bonds: 1. On July 1, 2017, the city issued 4 percent, $100,000 face value, 10-year bonds for $108,531, to yield 3 percent. Interest is payable on June 30 of each year. 2. On January 1, 2019, the city issued 2 percent, $100,000 face value, 10-year bonds for $91,470, to yield 3 percent. Interest is payable on December 31 of each year. a. Determine the amounts reported in the government-wide statement of activities and statement of net position for fiscal year 2020, related to the bonds. b. Determine the amounts reported in the governmental funds statement of revenues, expenditures, and changes in fund balances and balance sheet for fiscal year 2020, related to the bonds.

Step by Step Solution

★★★★★

3.48 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

a Governmentwide statement of activities Interest expense 4 bonds 4000 2 bonds 2000 Total in...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started