Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The City of Malcolm has a recreation center that is partially supported by the arnings from a nonexpendable trust, the Joshua Malcolm Endowment Fund

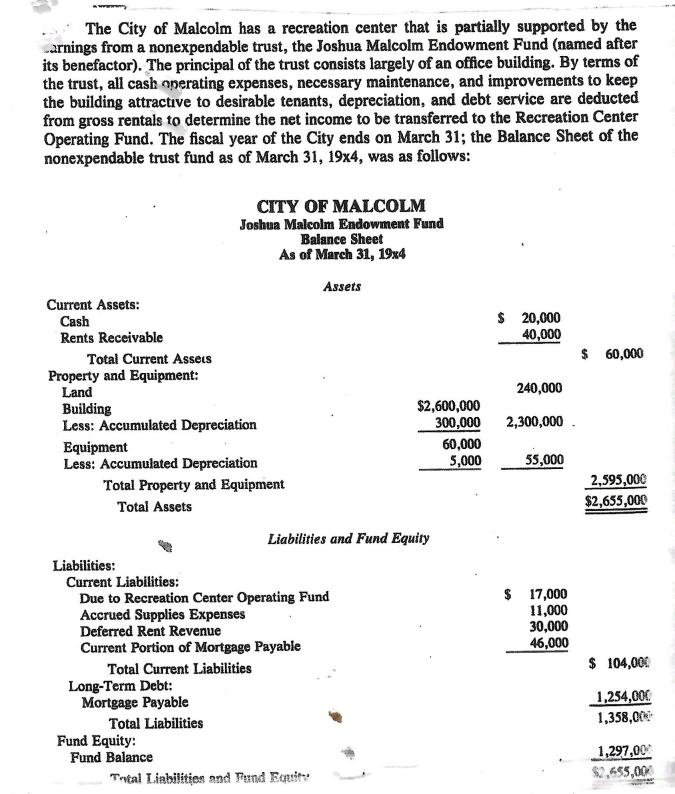

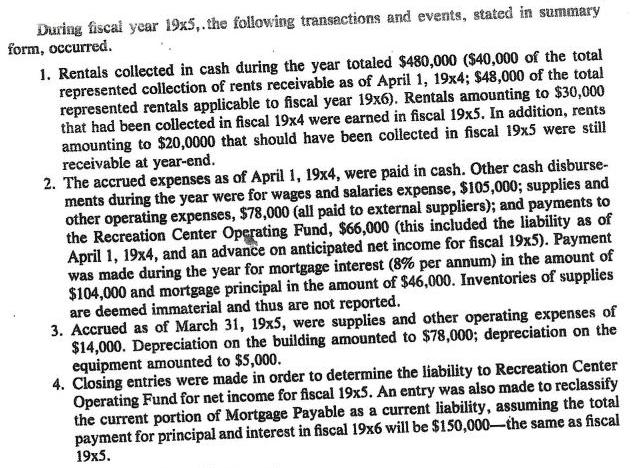

The City of Malcolm has a recreation center that is partially supported by the arnings from a nonexpendable trust, the Joshua Malcolm Endowment Fund (named after its benefactor). The principal of the trust consists largely of an office building. By terms of the trust, all cash operating expenses, necessary maintenance, and improvements to keep the building attractive to desirable tenants, depreciation, and debt service are deducted from gross rentals to determine the net income to be transferred to the Recreation Center Operating Fund. The fiscal year of the City ends on March 31; the Balance Sheet of the nonexpendable trust fund as of March 31, 19x4, was as follows: Current Assets: Cash Rents Receivable Total Current Assets Property and Equipment: Land Building Less: Accumulated Depreciation Equipment Less: Accumulated Depreciation Total Property and Equipment Total Assets Liabilities: Long-Term Debt: CITY OF MALCOLM Joshua Malcolm Endowment Fund Balance Sheet As of March 31, 19x4 Mortgage Payable Current Liabilities: Due to Recreation Center Operating Fund Accrued Supplies Expenses Deferred Rent Revenue Current Portion of Mortgage Payable Total Current Liabilities Total Liabilities Fund Equity: Fund Balance Assets Liabilities and Fund Equity Total Liabilities and Fund Equity $2,600,000 300,000 60,000 5,000 $ 20,000 40,000 240,000 2,300,000 55,000 $ 17,000 11,000 30,000 46,000 $ 60,000 2,595,000 $2,655,000 $ 104,000 1,254,000 1,358,00 1,297,00 $2,455,000 During fiscal year 19x5,. the following transactions and events, stated in summary form, occurred. 1. Rentals collected in cash during the year totaled $480,000 ($40,000 of the total represented collection of rents receivable as of April 1, 19x4; $48,000 of the total represented rentals applicable to fiscal year 19x6). Rentals amounting to $30,000 that had been collected in fiscal 19x4 were earned in fiscal 19x5. In addition, rents amounting to $20,0000 that should have been collected in fiscal 19x5 were still receivable at year-end. 2. The accrued expenses as of April 1, 19x4, were paid in cash. Other cash disburse- ments during the year were for wages and salaries expense, $105,000; supplies and other operating expenses, $78,000 (all paid to external suppliers); and payments to the Recreation Center Operating Fund, $66,000 (this included the liability as of April 1, 19x4, and an advance on anticipated net income for fiscal 19x5). Payment was made during the year for mortgage interest (8% per annum) in the amount of $104,000 and mortgage principal in the amount of $46,000. Inventories of supplies are deemed immaterial and thus are not reported. 3. Accrued as of March 31, 19x5, were supplies and other operating expenses of $14,000. Depreciation on the building amounted to $78,000; depreciation on the equipment amounted to $5,000. 4. Closing entries were made in order to determine the liability to Recreation Center Operating Fund for net income for fiscal 19x5. An entry was also made to reclassify the current portion of Mortgage Payable as a current liability, assuming the total payment for principal and interest in fiscal 19x6 will be $150,000-the same as fiscal 19x5. prepare balance sheet, income statement and statement of cash flows

Step by Step Solution

★★★★★

3.43 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Answer lets Start by preparing balance sheet Balance Sheet Assets Amount USD Current Assets Cash 580...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started