Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The City of Milwaukee is contemplating privatizing the concessions operations of General Mitchell Airport. If it is executed, the transaction will close in 2 0

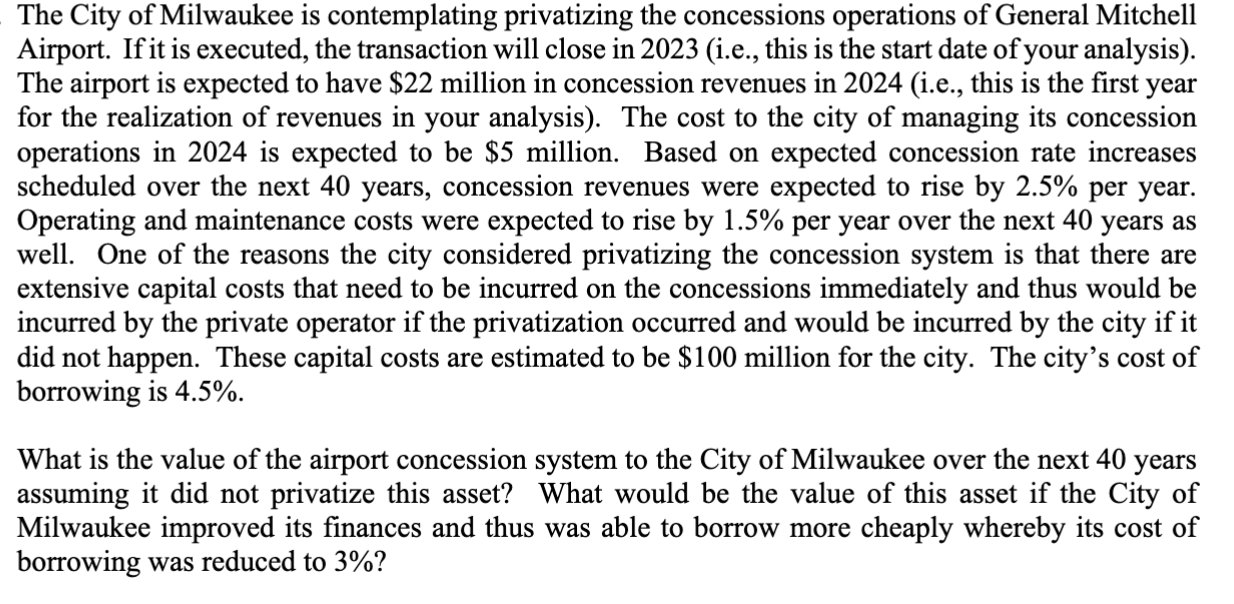

The City of Milwaukee is contemplating privatizing the concessions operations of General Mitchell Airport. If it is executed, the transaction will close in ie this is the start date of your analysis The airport is expected to have $ million in concession revenues in ie this is the first year for the realization of revenues in your analysis The cost to the city of managing its concession operations in is expected to be $ million. Based on expected concession rate increases scheduled over the next years, concession revenues were expected to rise by per year. Operating and maintenance costs were expected to rise by per year over the next years as well. One of the reasons the city considered privatizing the concession system is that there are extensive capital costs that need to be incurred on the concessions immediately and thus would be incurred by the private operator if the privatization occurred and would be incurred by the city if it did not happen. These capital costs are estimated to be $ million for the city. The city's cost of borrowing is

What is the value of the airport concession system to the City of Milwaukee over the next years assuming it did not privatize this asset? What would be the value of this asset if the City of Milwaukee improved its finances and thus was able to borrow more cheaply whereby its cost of borrowing was reduced to JP Morgan is the private firm bidding on the airport concessions system. JP Morgan views the concessions system as a less than average risk asset with a beta of year Tnotes are currently yielding and the market return on concession systems is averaging Because this firm is a private sector firm, it expects to be more efficient in constructing, operating and maintaining the concessions system. As such, it expects to be able to reduce capital, operating and maintenance costs by from what the city would incur. It is also expected that the firm would be able to raise concession rates higher than the city, specifically such that concession revenues rates would be per year more than if the city held on to the system.

What do you estimate JP Morgan would bid to lease this asset assuming a year privatization lease? Should the City of Milwaukee accept this bid? What would JP Morgan bid if the market return on concession systems changed to assuming a year privatization lease?

Please make your calculations using an excel spreadsheet showing all work for all valuation analyses. Then, provide a written description of your analyses in a couple paragraphs.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started