Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Penguin Limited (PL) has Class A and Class B ordinary shares, with 80 million shares of Rs. 10 each and 15 million shares of

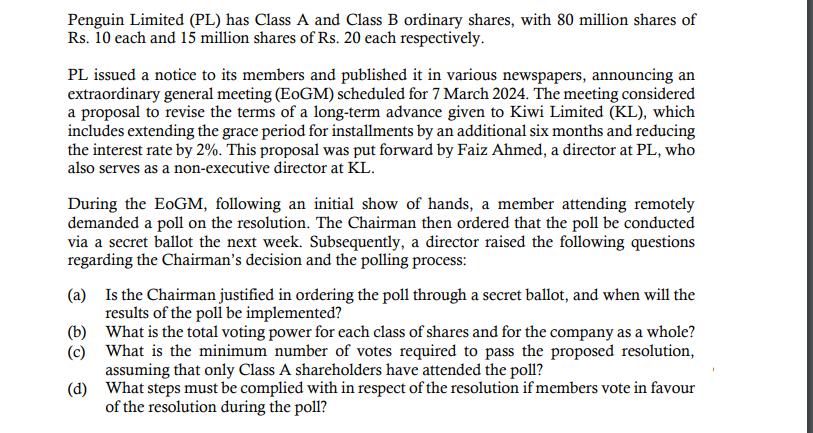

Penguin Limited (PL) has Class A and Class B ordinary shares, with 80 million shares of Rs. 10 each and 15 million shares of Rs. 20 each respectively. PL issued a notice to its members and published it in various newspapers, announcing an extraordinary general meeting (EOGM) scheduled for 7 March 2024. The meeting considered a proposal to revise the terms of a long-term advance given to Kiwi Limited (KL), which includes extending the grace period for installments by an additional six months and reducing the interest rate by 2%. This proposal was put forward by Faiz Ahmed, a director at PL, who also serves as a non-executive director at KL. During the EOGM, following an initial show of hands, a member attending remotely demanded a poll on the resolution. The Chairman then ordered that the poll be conducted via a secret ballot the next week. Subsequently, a director raised the following questions regarding the Chairman's decision and the polling process: (a) Is the Chairman justified in ordering the poll through a secret ballot, and when will the results of the poll be implemented? (b) What is the total voting power for each class of shares and for the company as a whole? What is the minimum number of votes required to pass the proposed resolution, assuming that only Class A shareholders have attended the poll? (d) What steps must be complied with in respect of the resolution if members vote in favour of the resolution during the poll?

Step by Step Solution

★★★★★

3.38 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Here are the answers to the questions raised a The Chairman is not justified in ordering a poll thro...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started