Answered step by step

Verified Expert Solution

Question

1 Approved Answer

. The City of Stewart levies property taxes of $1,800,000 for its current fiscal year. The City expects to collect all of the property taxes

.

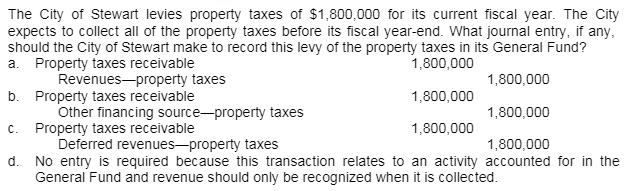

. The City of Stewart levies property taxes of $1,800,000 for its current fiscal year. The City expects to collect all of the property taxes before its fiscal year-end. What journal entry, if any, should the City of Stewart make to record this levy of the property taxes in its General Fund? a. Property taxes receivable 1,800,000 Revenues-property taxes 1,800,000 b. Property taxes receivable 1,800,000 Other financing source-property taxes 1,800,000 c. Property taxes receivable 1,800,000 Deferred revenues-property taxes 1,800,000 d. No entry is required because this transaction relates to an activity accounted for in the General Fund and revenue should only be recognized when it is collected.

Step by Step Solution

★★★★★

3.45 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

A C 1 Particulars Debit Credit 2 Propert...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

635d6a25c1861_175371.pdf

180 KBs PDF File

635d6a25c1861_175371.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started