Answered step by step

Verified Expert Solution

Question

1 Approved Answer

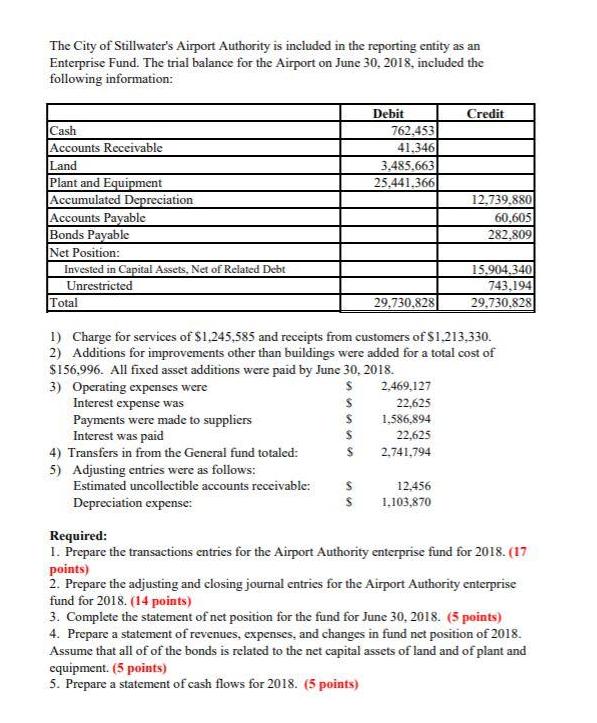

The City of Stillwater's Airport Authority is included in the reporting entity as an Enterprise Fund. The trial balance for the Airport on June

The City of Stillwater's Airport Authority is included in the reporting entity as an Enterprise Fund. The trial balance for the Airport on June 30, 2018, included the following information: Cash Accounts Receivable Land Plant and Equipment Accumulated Depreciation Accounts Payable Bonds Payable Net Position: Invested in Capital Assets, Net of Related Debt Unrestricted Total 3) Operating expenses were Interest expense was Payments were made to suppliers Interest was paid 4) Transfers in from the General fund totaled: 5) Adjusting entries were as follows: Debit Estimated uncollectible accounts receivable: Depreciation expense: 762,453 41,346 3.485,663 25,441,366 29,730,828 1) Charge for services of $1,245,585 and receipts from customers of $1,213,330. 2) Additions for improvements other than buildings were added for a total cost of $156,996. All fixed asset additions were paid by June 30, 2018. $ $ $ $ S 2,469,127 22,625 1,586,894 22,625 2,741,794 Credit S 12,456 S 1.103,870 12,739,880 60,605 282,809 15,904,340 743,194 29,730,828 Required: 1. Prepare the transactions entries for the Airport Authority enterprise fund for 2018. (17 points) 2. Prepare the adjusting and closing journal entries for the Airport Authority enterprise fund for 2018. (14 points) 3. Complete the statement of net position for the fund for June 30, 2018. (5 points) 4. Prepare a statement of revenues, expenses, and changes in fund net position of 2018. Assume that all of of the bonds is related to the net capital assets of land and of plant and equipment. (5 points) 5. Prepare a statement of cash flows for 2018. (5 points)

Step by Step Solution

★★★★★

3.38 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER 1 Transaction Entries for Airport Authority Enterprise Fund for 2018 a Charge for Services Debit Accounts Receivable 1245585 Credit Revenues 12...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started