Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The City of Waterman established a capital projects fund for the construction of an access ramp from the parking garage to the city's office

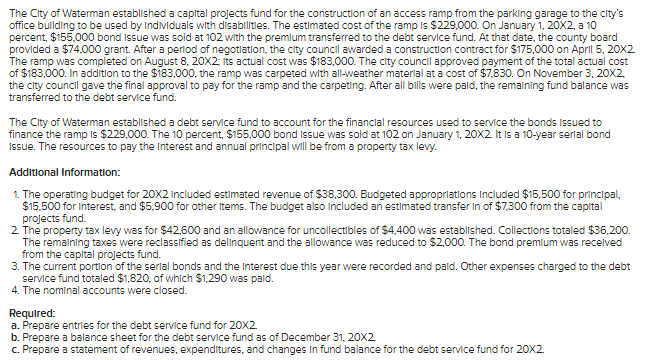

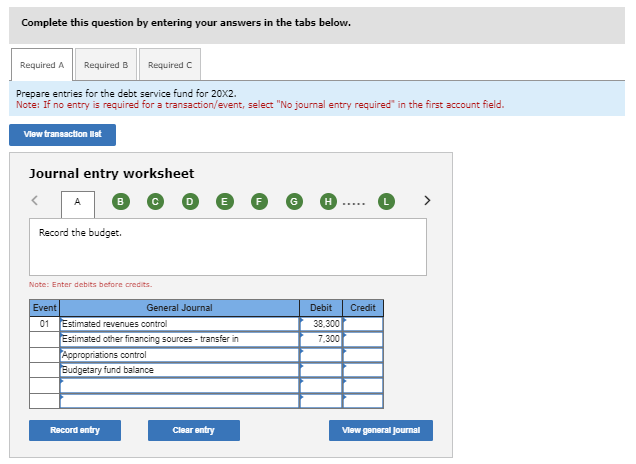

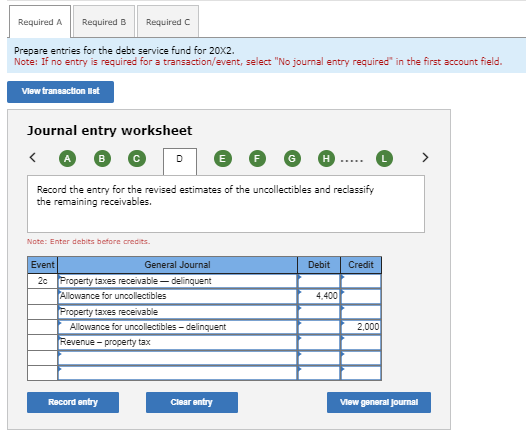

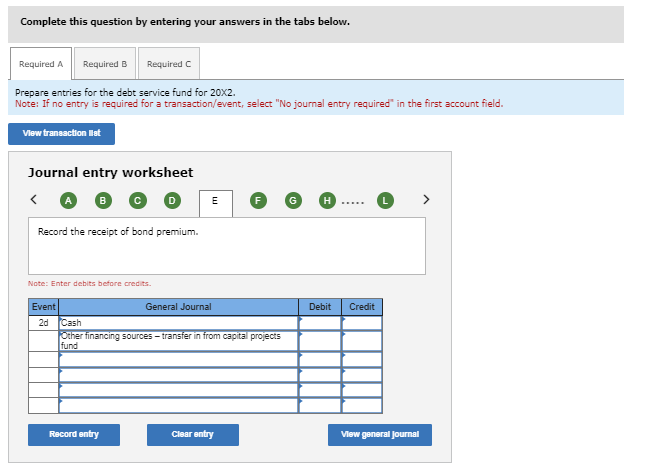

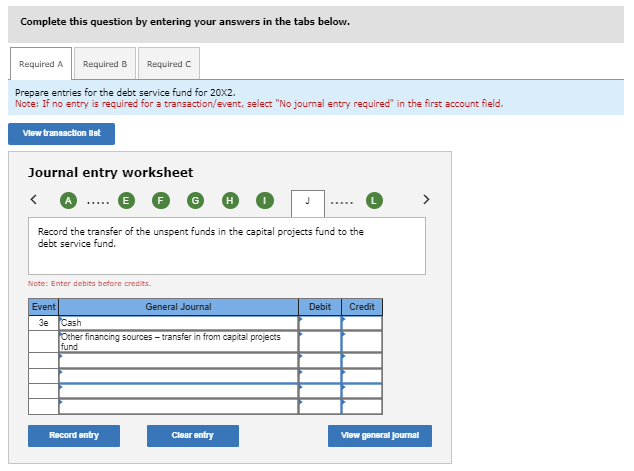

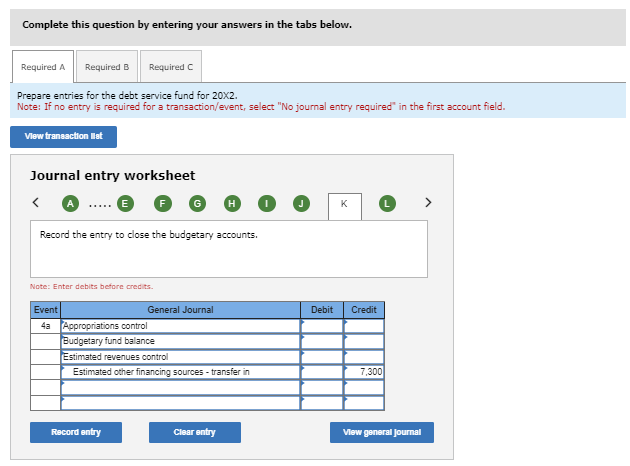

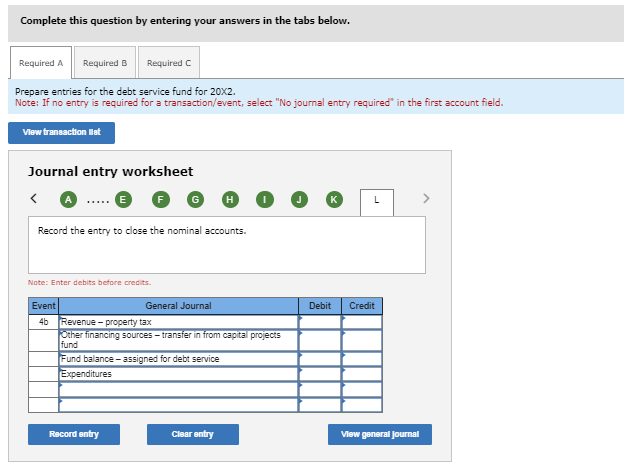

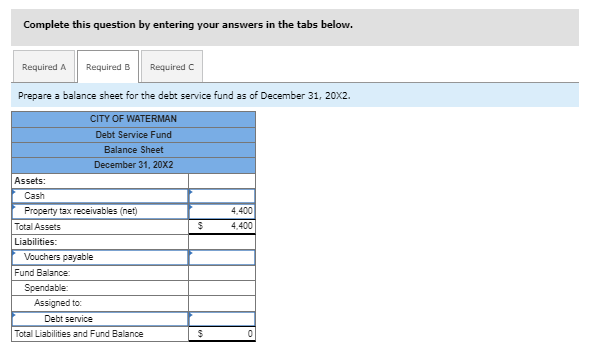

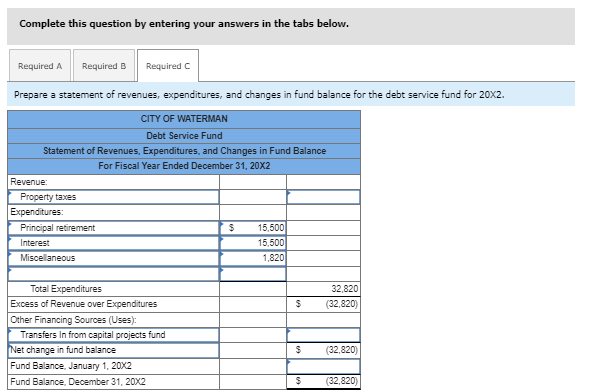

The City of Waterman established a capital projects fund for the construction of an access ramp from the parking garage to the city's office building to be used by Individuals with disabilities. The estimated cost of the ramp is $229,000. On January 1, 20X2, a 10 percent, $155,000 bond issue was sold at 102 with the premium transferred to the debt service fund. At that date, the county board provided a $74,000 grant. After a period of negotiation, the city council awarded a construction contract for $175,000 on April 5, 20X2 The ramp was completed on August 8, 20X2; its actual cost was $183,000. The city council approved payment of the total actual cost of $183,000. In addition to the $183,000, the ramp was carpeted with all-weather material at a cost of $7,830. On November 3, 20X2, the city council gave the final approval to pay for the ramp and the carpeting. After all bills were paid, the remaining fund balance was transferred to the debt service fund. The City of Waterman established a debt service fund to account for the financial resources used to service the bonds issued to finance the ramp Is $229,000. The 10 percent, $155,000 bond issue was sold at 102 on January 1, 20X2. It is a 10-year serial bond Issue. The resources to pay the Interest and annual principal will be from a property tax levy. Additional Information: 1. The operating budget for 20X2 Included estimated revenue of $38,300. Budgeted appropriations Included $15,500 for principal, $15,500 for Interest, and $5,900 for other items. The budget also included an estimated transfer in of $7,300 from the capital projects fund. 2. The property tax levy was for $42,600 and an allowance for uncollectibles of $4,400 was established. Collections totaled $36,200. The remaining taxes were reclassified as delinquent and the allowance was reduced to $2,000. The bond premium was received from the capital projects fund. 3. The current portion of the serial bonds and the Interest due this year were recorded and paid. Other expenses charged to the debt service fund totaled $1,820, of which $1,290 was paid. 4. The nominal accounts were closed. Required: a. Prepare entries for the debt service fund for 20X2. b. Prepare a balance sheet for the debt service fund as of December 31, 20X2 c. Prepare a statement of revenues, expenditures, and changes in fund balance for the debt service fund for 20X2. Complete this question by entering your answers in the tabs below. Required A Required B Required C Prepare entries for the debt service fund for 20X2. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. View transaction list Journal entry worksheet A B Record the budget. Note: Enter debits before credits. D F G H L Event General Journal Debit Credit 01 Estimated revenues control 38,300 Estimated other financing sources - transfer in 7,300 Appropriations control Budgetary fund balance Record entry Clear entry View general journal Required A Required B Required C Prepare entries for the debt service fund for 20x2. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. View transaction let Journal entry worksheet > B C D G H Record the entry for the revised estimates of the uncollectibles and reclassify the remaining receivables. Note: Enter debits before credits. Event General Journal Debit Credit 2c Property taxes receivable - delinquent Allowance for uncollectibles Property taxes receivable Allowance for uncollectibles-delinquent Revenue-property tax 4,400 2,000 Record entry Clear entry View general Journal Complete this question by entering your answers in the tabs below. Required A Required B Required C Prepare entries for the debt service fund for 20x2. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. View transaction st Journal entry worksheet D E G H Record the receipt of bond premium. Note: Enter debits before credits. Event 2d Cash General Journal Other financing sources - transfer in from capital projects fund Debit Credit Record entry Clear entry View general journal Complete this question by entering your answers in the tabs below. Required A Required B Required C Prepare entries for the debt service fund for 20x2. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. View transaction st Journal entry worksheet Record the transfer of the unspent funds in the capital projects fund to the debt service fund. Note: Enter debits before credits. Event Cash General Journal Other financing sources - transfer in from capital projects fund Debit Credit Record entry Clear entry View general journal Complete this question by entering your answers in the tabs below. Required A Required B Required C Prepare entries for the debt service fund for 20X2. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. View transaction list Journal entry worksheet F G H K Record the entry to close the budgetary accounts. Note: Enter debits before credits. Event General Journal Debit Credit 4a Appropriations control Budgetary fund balance Estimated revenues control Estimated other financing sources - transfer in Record entry Clear entry 7,300 View general journal Complete this question by entering your answers in the tabs below. Required A Required B Required C Prepare entries for the debt service fund for 20X2. Note: If no entry is required for a transaction/event, select "No journal entry required" in the first account field. View transaction st Journal entry worksheet < A ..... H L > Record the entry to close the nominal accounts. Note: Enter debits before credits. Event 4b General Journal Revenue-property tax Other financing sources - transfer in from capital projects fund Fund balance-assigned for debt service Expenditures Debit Credit Record entry Clear entry View general journal Complete this question by entering your answers in the tabs below. Required A Required B Required C Prepare a balance sheet for the debt service fund as of December 31, 202. CITY OF WATERMAN Debt Service Fund Balance Sheet December 31, 20X2 Assets: Cash Property tax receivables (net) Total Assets Liabilities: Vouchers payable Fund Balance: Spendable: Assigned to: Debt service Total Liabilities and Fund Balance 4,400 $ 4,400 $ 0 Complete this question by entering your answers in the tabs below. Required A Required B Required C Prepare a statement of revenues, expenditures, and changes in fund balance for the debt service fund for 20X2. Revenue: CITY OF WATERMAN Debt Service Fund Statement of Revenues, Expenditures, and Changes in Fund Balance Property taxes Expenditures: For Fiscal Year Ended December 31, 20X2 Principal retirement Interest Miscellaneous Total Expenditures Excess of Revenue over Expenditures Other Financing Sources (Uses): $ 15,500 15,500 1,820 32,820 $ (32,820) Transfers In from capital projects fund Net change in fund balance $ (32,820) Fund Balance, January 1, 20X2 Fund Balance, December 31, 20X2 $ (32,820)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started