Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Class A shares have voting rights and Adidas Ltd has no obligation to repay the capital on these shares. Class A shareholders will only

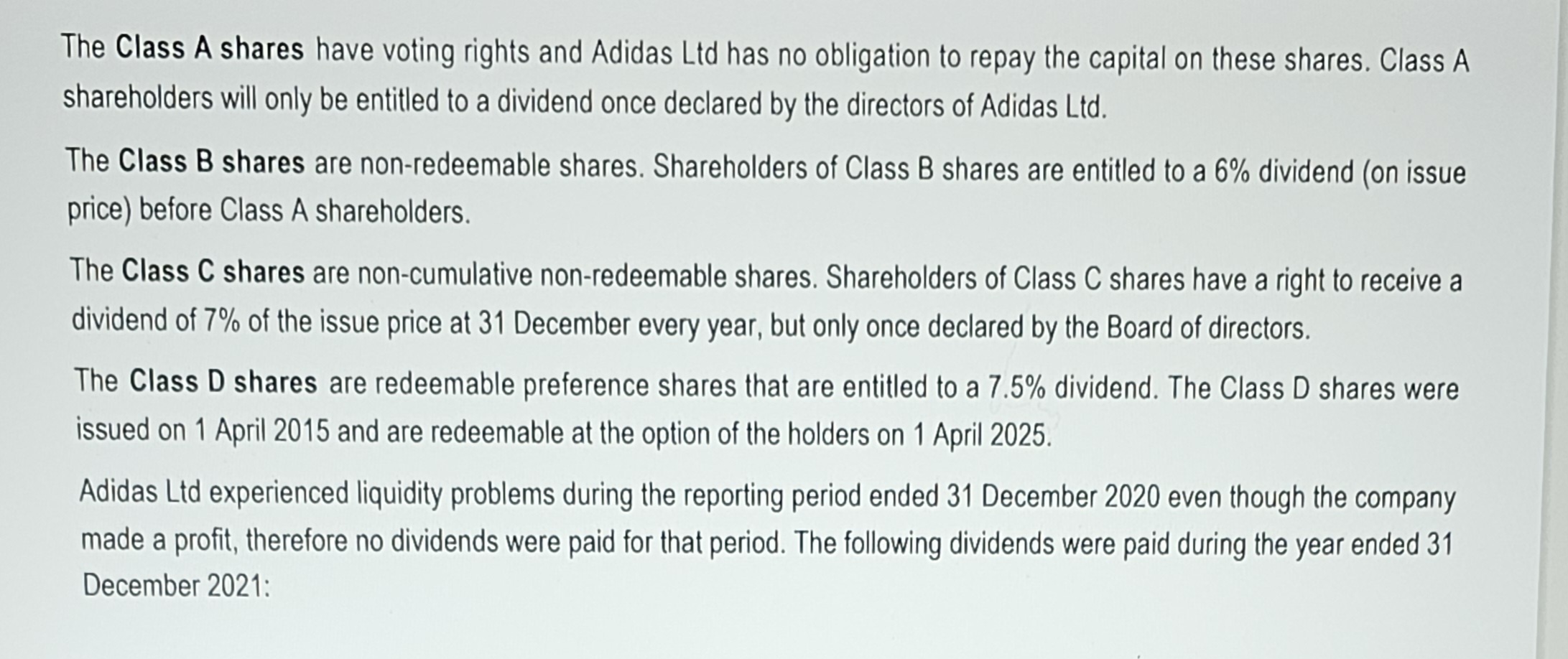

The Class A shares have voting rights and Adidas Ltd has no obligation to repay the capital on these shares. Class A

shareholders will only be entitled to a dividend once declared by the directors of Adidas Ltd

The Class B shares are nonredeemable shares. Shareholders of Class B shares are entitled to a dividend on issue

price before Class A shareholders.

The Class C shares are noncumulative nonredeemable shares. Shareholders of Class shares have a right to receive a

dividend of of the issue price at December every year, but only once declared by the Board of directors.

The Class D shares are redeemable preference shares that are entitled to a dividend. The Class D shares were

issued on April and are redeemable at the option of the holders on April

Adidas Ltd experienced liquidity problems during the reporting period ended December even though the company

made a profit, therefore no dividends were paid for that period. The following dividends were paid during the year ended

December :

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started