Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The Clayton Company is a retail company that began operations on October 1, 2018, when it incorporated in the state of North Carolina. The

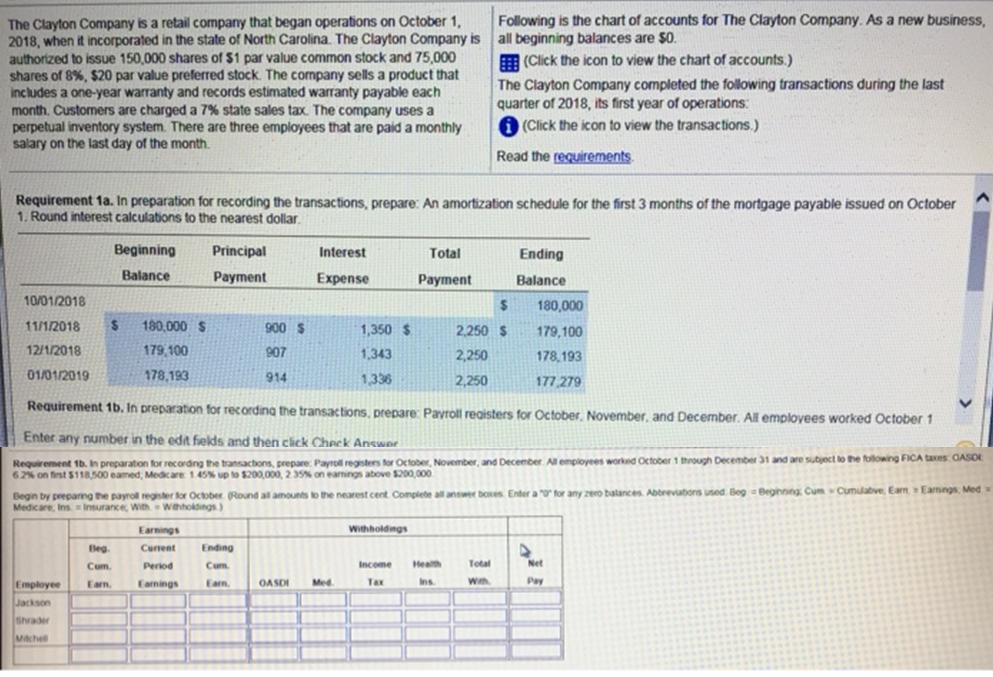

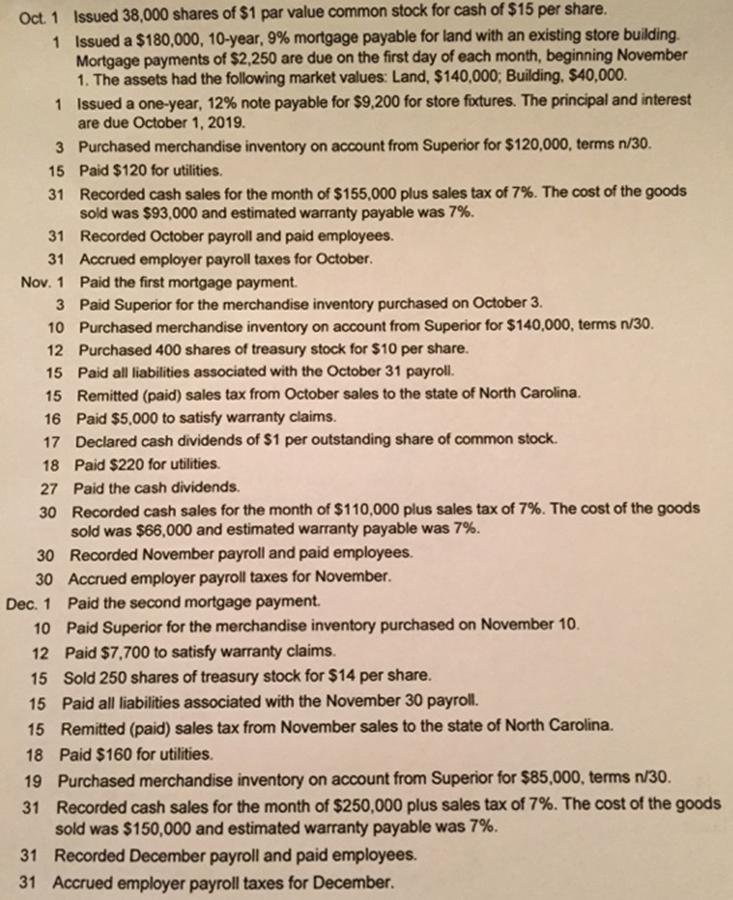

The Clayton Company is a retail company that began operations on October 1, 2018, when it incorporated in the state of North Carolina. The Clayton Company is all beginning balances are $0. authorized to issue 150,000 shares of $1 par value common stock and 75,000 shares of 8%, $20 par value preferred stock. The company sells a product that includes a one-year warranty and records estimated warranty payable each month. Customers are charged a 7% state sales tax. The company uses a perpetual inventory system. There are three employees that are paid a monthly salary on the last day of the month. Following is the chart of accounts for The Clayton Company. As a new business, E (Click the icon to view the chart of accounts.) The Clayton Company completed the following transactions during the last quarter of 2018, its first year of operations: O (Click the icon to view the transactions.) Read the requirements Requirement 1a. In preparation for recording the transactions, prepare: An amortization schedule for the first 3 months of the mortgage payable issued on October 1. Round interest calculations to the nearest dollar Beginning Principal Interest Total Ending Balance Payment Expense Payment Balance 10/01/2018 180,000 11/1/2018 180,000 S 900 S 1,350 $ 2,250 $ 179,100 12/1/2018 179 100 907 1,343 2,250 178.193 01/01/2019 178,193 914 1,336 2,250 177,279 Requirement 1b. In preparation for recording the transactions, prepare: Payroll registers for October, November, and December. All emplovees worked October 1 Enter any number in the edit fields and then cick Check Answor Requirement 1b. In preparaton for recording thhe transactons, prepare Payrol registers for October, November, and December All employees worked October 1 through December 31 and are sutect lo the following FICA taxes OASOE 62% on frst $118,500 eamed, Medicare 145% up to s200,000, 2 35% on eamings above $200,000 Begin by preparng the payrol regnter lor October (Round all amounts o the nearest cent Complete all answer boes Enter a o for any zero balances. Abbreviators used. Beg -Beginnng Cum Cumulabve, Eam Eamngs, Med Medicare, Ins Insurance, With wehholdings) Earnings Withholdings Beg. Current Ending Cum Period Cum Income Health Total Net Employee Eam Eamings Earm OASDI Med Tax Ins. Pay Jackson Shrader Mche Oct. 1 Issued 38,000 shares of $1 par value common stock for cash of $15 per share. 1 Issued a $180,000, 10-year, 9% mortgage payable for land with an existing store building. Mortgage payments of $2,250 are due on the first day of each month, beginning November 1. The assets had the following market values: Land, $140,000; Building, $40,000. 1 Issued a one-year, 12% note payable for $9,200 for store foxtures. The principal and interest are due October 1, 2019. 3 Purchased merchandise inventory on account from Superior for $120,000, terms n/30. 15 Paid $120 for utilities. 31 Recorded cash sales for the month of $155,000 plus sales tax of 7%. The cost of the goods sold was $93,000 and estimated warranty payable was 7%. 31 Recorded October payroll and paid employees. 31 Accrued employer payroll taxes for October. Nov. 1 Paid the first mortgage payment. 3 Paid Superior for the merchandise inventory purchased on October 3. 10 Purchased merchandise inventory on account from Superior for $140,000, terms n/30. 12 Purchased 400 shares of treasury stock for $10 per share. 15 Paid all liabilities associated with the October 31 payroll. 15 Remitted (paid) sales tax from October sales to the state of North Carolina. 16 Paid $5,000 to satisfy warranty claims. 17 Declared cash dividends of S1 per outstanding share of common stock. 18 Paid $220 for utilities. 27 Paid the cash dividends. 30 Recorded cash sales for the month of $110,000 plus sales tax of 7%. The cost of the goods sold was $66,000 and estimated warranty payable was 7%. 30 Recorded November payroll and paid employees. 30 Accrued employer payroll taxes for November. Dec. 1 Paid the second mortgage payment. 10 Paid Superior for the merchandise inventory purchased on November 10. 12 Paid $7,700 to satisfy warranty claims. 15 Sold 250 shares of treasury stock for $14 per share. 15 Paid all liabilities associated with the November 30 payroll. 15 Remitted (paid) sales tax from November sales to the state of North Carolina. 18 Paid $160 for utilities. 19 Purchased merchandise inventory on account from Superior for $85,000, terms n/30. 31 Recorded cash sales for the month of $250,000 plus sales tax of 7%. The cost of the goods sold was $150,000 and estimated warranty payable was 7%. 31 Recorded December payroll and paid employees. 31 Accrued employer payroll taxes for December.

Step by Step Solution

★★★★★

3.41 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

For October Beg Current End cum cumulative period ernings OASDI Med Income Health Tota...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started