Question

THE CLIENT During the initial meeting, Lisa indicated that her investment return objective was to earn a 9% total return per year. You helped her

THE CLIENT

During the initial meeting, Lisa indicated that her investment return objective was to earn a 9% total return per year. You helped her assess her risk preferences and it was concluded that she could accept up to a 20% portfolio volatility, measured by standard deviation in her portfolio in any one year.

Investment 1:

A year ago, Lisa bought 100 shares of TD bank stock on margin at $80 per share. Initial margin is 50% and the maintenance margin is 40%. TD Bank paid an annual dividend of C$3.06 per share last year. Interest rate for the margin loan is 5%. The stock price drops to $62 now after one year. Due to the high growth in business, TD's dividends are expected to grow by 10% for the next 3 years. From year 4 on, the dividends will grow constantly at the sustainable growth rate. TD bank follows a stable dividend payout ratio of 45%. As of the second quarter of 2020, The company has net profit margin of 27.5%, asset turnover of 0.0218 and equity multiplier of 17.84. The required rate of return of TD stock is 7.5%

Investment 2:

3 months ago, an independent investment counsellor suggested Lisa to take a short position in Cineplex Inc. as the revenue is expected to drop further in the third quarter of 2020 because of Covid-19. Lisa took the investment counsellor's advice and sold short 1,000 shares of Cineplex for $14 per share. The stock currently pays $1 annual dividend. The initial margin requirement is 50%.

YOUR RECOMMENDATION

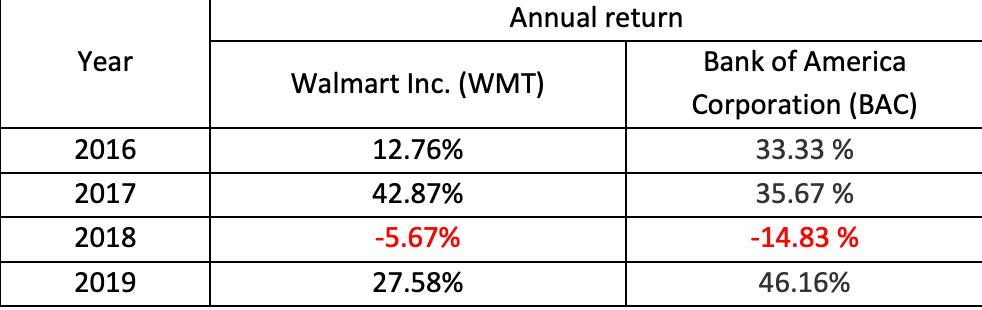

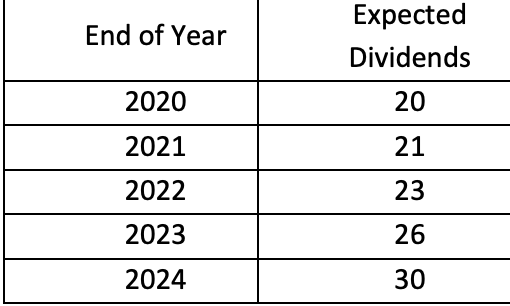

After thorough analysis on Lisa's financial and personal circumstances, you suggest a new investment portfolio that includes Walmart Inc. (WMT) and Bank of America Corporation (BAC) stocks. You suggested the asset mix to be 40% allocation in WMT, and 60% in BAC. You supplemented this recommendation with the historical returns of the two stocks for last 4 years, as well as the expected dividends and expected values for $1,000 original investments in this portfolio. You have also calculated the correlation between WMT and BAC, which is 0.81.

Exhibit 1 Historical annual returns of WMT and BAC from 2016 to 2019 is seen below:

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started