Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The co - op would like to build an aquaponic system to increase their production of greens and also start producing tilapia. The new system

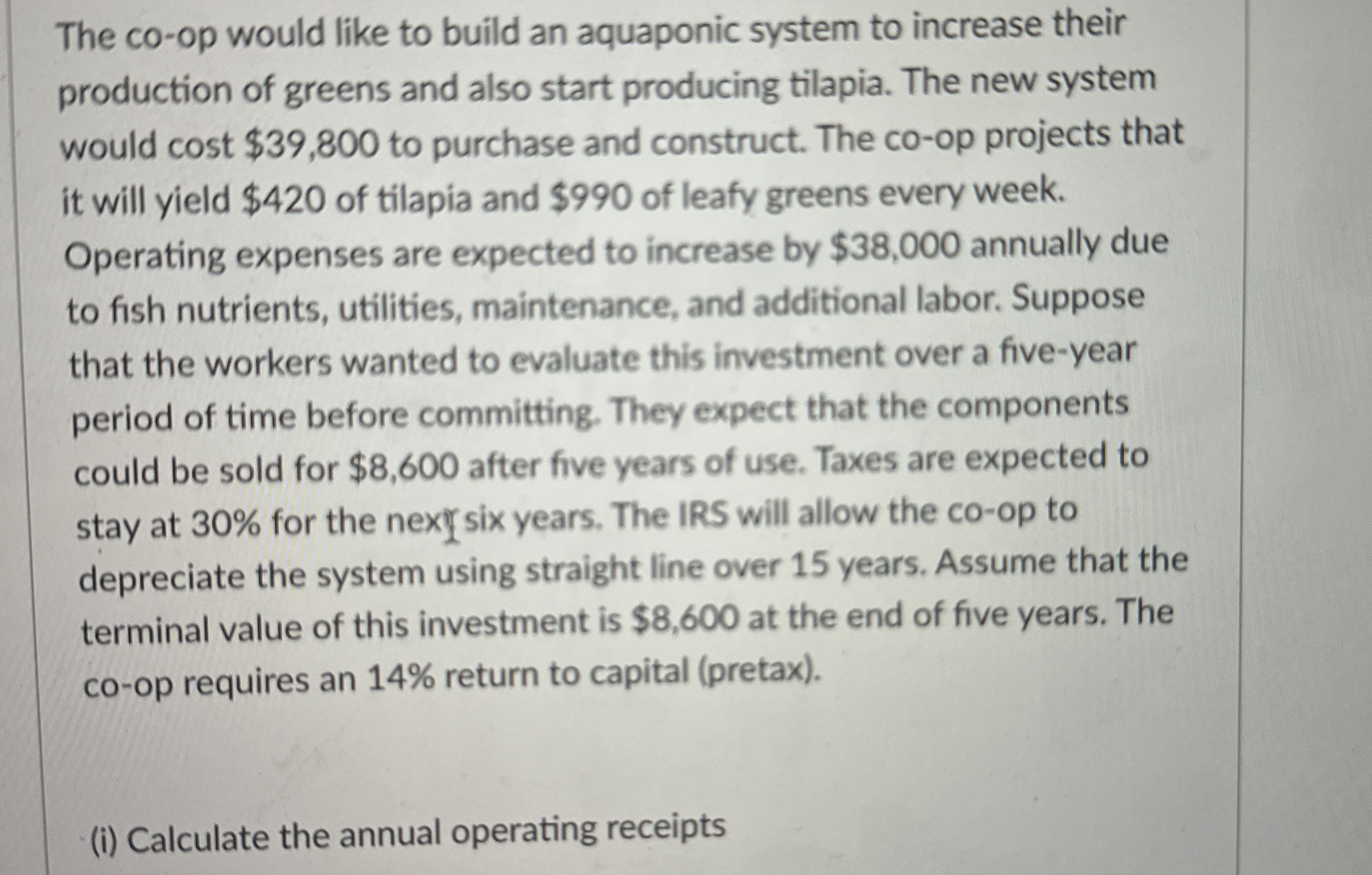

The coop would like to build an aquaponic system to increase their

production of greens and also start producing tilapia. The new system

would cost $ to purchase and construct. The coop projects that

it will yield $ of tilapia and $ of leafy greens every week.

Operating expenses are expected to increase by $ annually due

to fish nutrients, utilities, maintenance, and additional labor. Suppose

that the workers wanted to evaluate this investment over a fiveyear

period of time before committing. They expect that the components

could be sold for $ after five years of use. Taxes are expected to

stay at for the nexis six years. The IRS will allow the coop to

depreciate the system using straight line over years. Assume that the

terminal value of this investment is $ at the end of five years. The

coop requires an return to capital pretax

i Calculate the annual operating receipts

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started