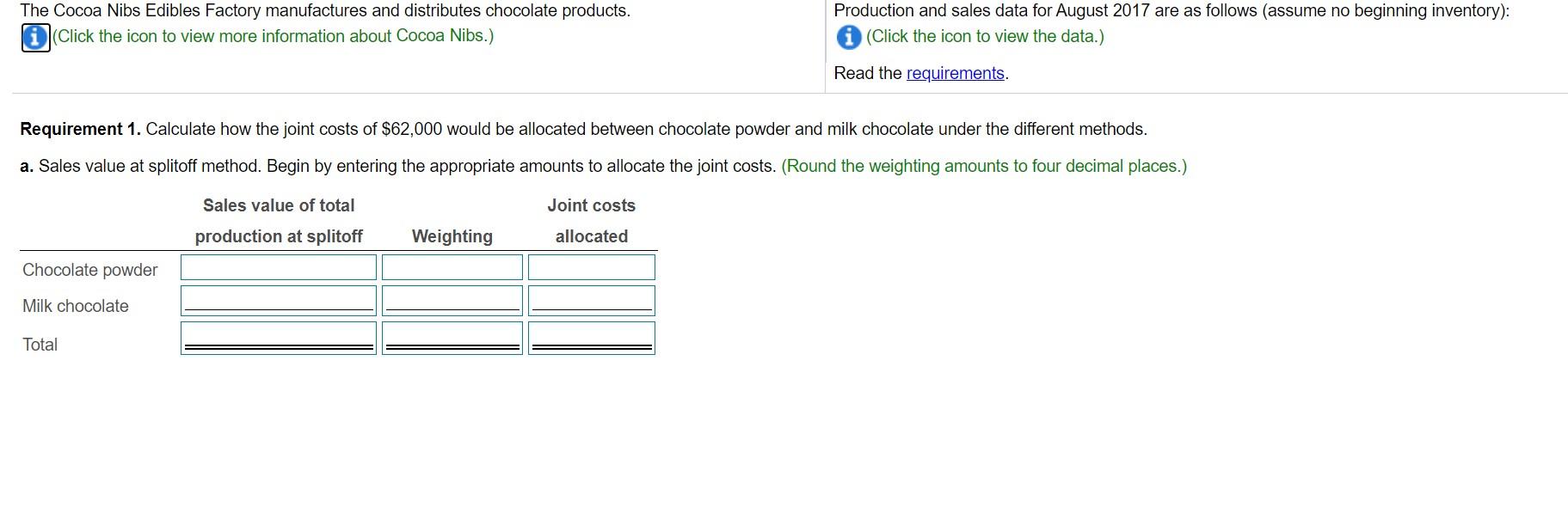

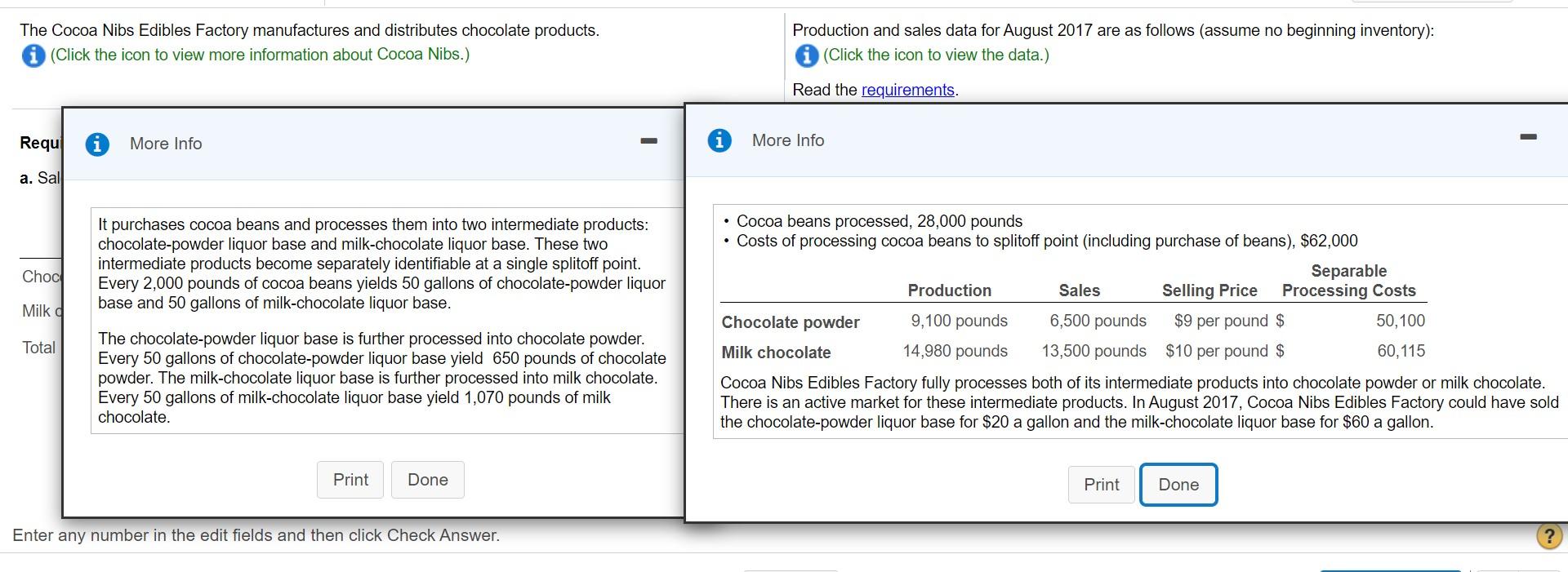

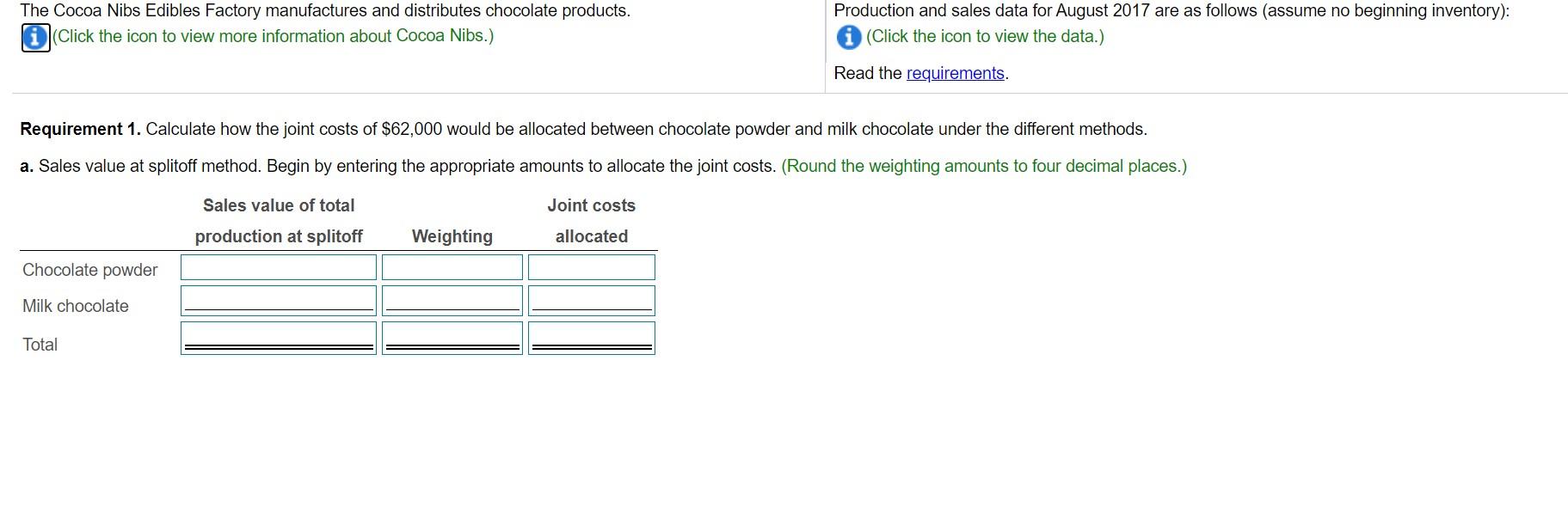

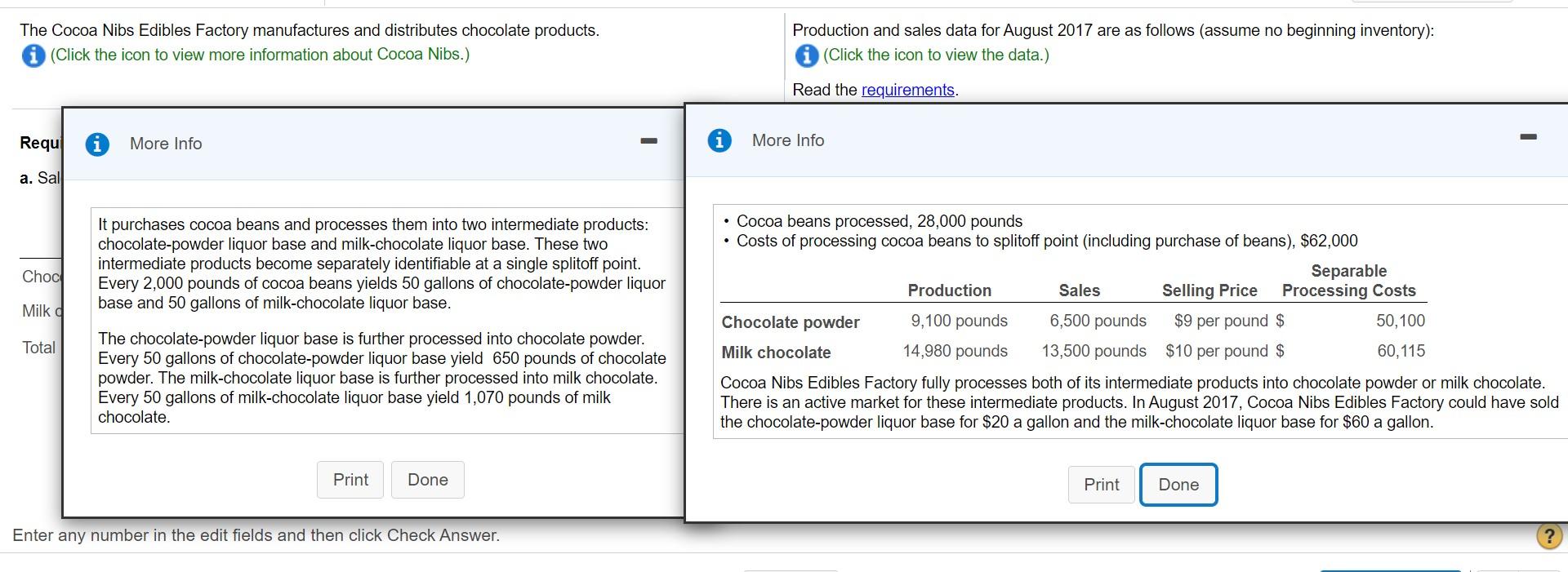

The Cocoa Nibs Edibles Factory manufactures and distributes chocolate products. Click the icon to view more information about Cocoa Nibs.) Production and sales data for August 2017 are as follows (assume no beginning inventory): (Click the icon to view the data.) Read the requirements. Requirement 1. Calculate how the joint costs of $62,000 would be allocated between chocolate powder and milk chocolate under the different methods. a. Sales value at splitoff method. Begin by entering the appropriate amounts to allocate the joint costs. (Round the weighting amounts to four decimal places.) Sales value of total Joint costs production at splitoff Weighting allocated Chocolate powder Milk chocolate Total The Cocoa Nibs Edibles Factory manufactures and distributes chocolate products. i (Click the icon to view more information about Cocoa Nibs.) Production and sales data for August 2017 are as follows (assume no beginning inventory): (Click the icon to view the data.) Read the requirements. Requ More Info More Info a. Sal It purchases cocoa beans and processes them into two intermediate products: chocolate-powder liquor base and milk-chocolate liquor base. These two intermediate products become separately identifiable at a single splitoff point. Every 2,000 pounds of cocoa beans yields 50 gallons of chocolate-powder liquor base and 50 gallons of milk-chocolate liquor base. Choc Milk a Cocoa beans processed, 28,000 pounds Costs of processing cocoa beans to splitoff point (including purchase of beans), $62,000 Separable Production Sales Selling Price Processing Costs Chocolate powder 9,100 pounds 6,500 pounds $9 per pound $ 50,100 Milk chocolate 14,980 pounds 13,500 pounds $10 per pound $ 60,115 Cocoa Nibs Edibles Factory fully processes both of its intermediate products into chocolate powder or milk chocolate. There is an active market for these intermediate products. In August 2017, Cocoa Nibs Edibles Factory could have sold the chocolate powder liquor base for $20 a gallon and the milk-chocolate liquor base for $60 a gallon. Total The chocolate powder liquor base is further processed into chocolate powder. Every 50 gallons of chocolate-powder liquor base yield 650 pounds of chocolate powder. The milk-chocolate liquor base is further processed into milk chocolate. Every 50 gallons of milk-chocolate liquor base yield 1,070 pounds of milk chocolate. Print Done Print Done Enter any number in the edit fields and then click Check