Question

11 A fund manager estimated a market model (i.e., equation (3) in lecture 6) on stock ABC and stock XYZ, respectively, and obtained the

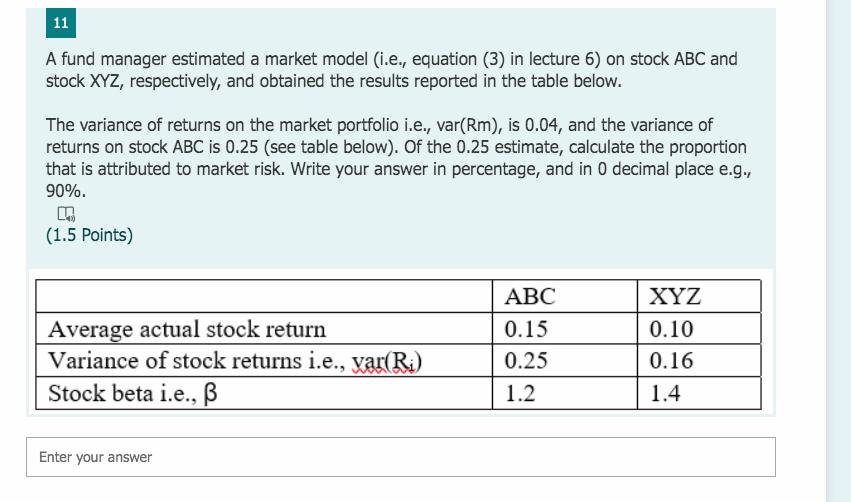

11 A fund manager estimated a market model (i.e., equation (3) in lecture 6) on stock ABC and stock XYZ, respectively, and obtained the results reported in the table below. The variance of returns on the market portfolio i.e., var(Rm), is 0.04, and the variance of returns on stock ABC is 0.25 (see table below). Of the 0.25 estimate, calculate the proportion that is attributed to market risk. Write your answer in percentage, and in 0 decimal place e.g., 90%. (1.5 Points) Average actual stock return Variance of stock returns i.e., yar(R) Stock beta i.e., B Enter your answer ABC 0.15 0.25 1.2 XYZ 0.10 0.16 1.4

Step by Step Solution

3.47 Rating (170 Votes )

There are 3 Steps involved in it

Step: 1

Answer Market variance 004 Beta of fundamentals 12 Risk thanks to market Beta2 ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Statistics

Authors: Robert S. Witte, John S. Witte

11th Edition

1119254515, 978-1119254515

Students also viewed these General Management questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App