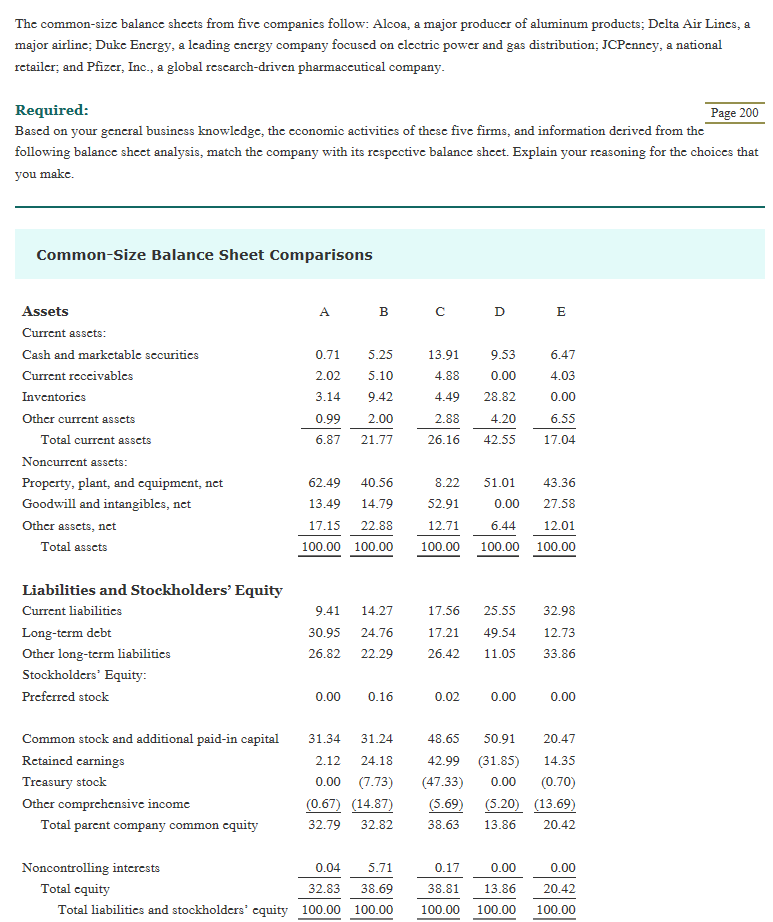

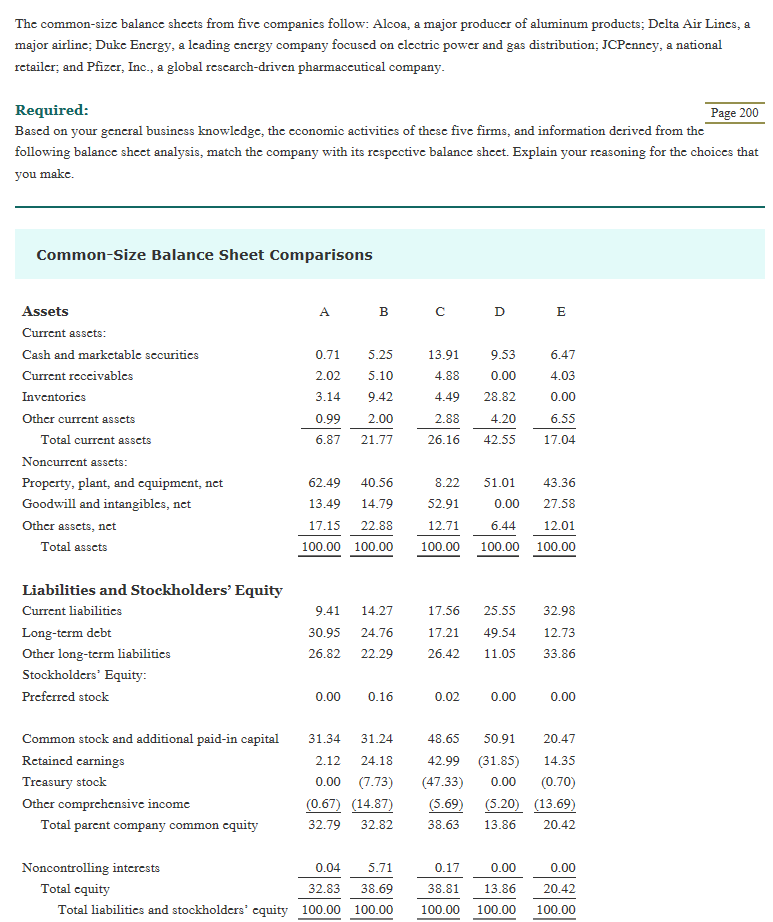

The common-size balance sheets from five companies follow: Alcoa, a major producer of aluminum products; Delta Air Lines, a major airlinc: Duke Encrgy, a lcadin focuscd on cli powcr and gas distribution: JCPcnncv, a national retailer; and Pfizer, Inc., a global rescarch-driven plh g cncrgy company company Required: Based on your general business knowledge, the economic activities of these five firms, and information derived from the following balance shecet analysis, match the company with its respective balance sheet. Explain your reasoning for the choices that you makc. Page 200 Common-Size Balance Sheet Comparisons Assets Current asscts Cash and markctable sccuritics Current reccivables Inventorics Other current assets 0.71 5.25 2.02 5.10 3.14 9.42 0.99 2.00 6.87 21.77 13.91 9.53 4.88 4.49 28.82 2.88 6.47 4.03 0.00 6.55 0.00 Total current asscts 26.16 42.55 17.04 Noncurrent asscts Property, plant, and cquipment, net Goodwill and intangibles, nct Other asscts, nct 62.49 40.56 13.49 14.79 17.15 22.88 100.00 100.00 52.91 12.71 100.00100.00 8.22 51.01 43.36 0.00 27.58 6.44 12.01 00.00 100.00 100.00 Total asscts Liabilities and Stockholders' Equity Current liabilitics Long-term debt Other long-term liabilitics Stockholders' Equity: Preferred stock 9.41 14.27 0.95 24.76 26.82 22.29 17.56 25.55 32.98 17.21 49.54 12.73 26.42 11.05 33.86 0.00 0.16 0.02 0.00 0.00 Common stock and additional paid-in capital Rctaincd carnings Treasurys Other comprchensive income 48.65 50.9 20.47 2.12 24.18 42.99 (31.85) 14.35 0.00 (7.73) (47.33) 0.00 (0.70) (0.67) 14.87 5.69 5.20) 13.69) 38.63 13.86 20.42 31.34 31.24 Total parent company common cquity 32.79 32.82 Noncontrolling interests 0.00 38.81 13.86 20.42 Total liabilitics and stockholders' cquity 100.00 100.00 100.00 100.00 100.00 0.04 5.71 0.17 0.00 Total cquity 32.83 38.69 The common-size balance sheets from five companies follow: Alcoa, a major producer of aluminum products; Delta Air Lines, a major airlinc: Duke Encrgy, a lcadin focuscd on cli powcr and gas distribution: JCPcnncv, a national retailer; and Pfizer, Inc., a global rescarch-driven plh g cncrgy company company Required: Based on your general business knowledge, the economic activities of these five firms, and information derived from the following balance shecet analysis, match the company with its respective balance sheet. Explain your reasoning for the choices that you makc. Page 200 Common-Size Balance Sheet Comparisons Assets Current asscts Cash and markctable sccuritics Current reccivables Inventorics Other current assets 0.71 5.25 2.02 5.10 3.14 9.42 0.99 2.00 6.87 21.77 13.91 9.53 4.88 4.49 28.82 2.88 6.47 4.03 0.00 6.55 0.00 Total current asscts 26.16 42.55 17.04 Noncurrent asscts Property, plant, and cquipment, net Goodwill and intangibles, nct Other asscts, nct 62.49 40.56 13.49 14.79 17.15 22.88 100.00 100.00 52.91 12.71 100.00100.00 8.22 51.01 43.36 0.00 27.58 6.44 12.01 00.00 100.00 100.00 Total asscts Liabilities and Stockholders' Equity Current liabilitics Long-term debt Other long-term liabilitics Stockholders' Equity: Preferred stock 9.41 14.27 0.95 24.76 26.82 22.29 17.56 25.55 32.98 17.21 49.54 12.73 26.42 11.05 33.86 0.00 0.16 0.02 0.00 0.00 Common stock and additional paid-in capital Rctaincd carnings Treasurys Other comprchensive income 48.65 50.9 20.47 2.12 24.18 42.99 (31.85) 14.35 0.00 (7.73) (47.33) 0.00 (0.70) (0.67) 14.87 5.69 5.20) 13.69) 38.63 13.86 20.42 31.34 31.24 Total parent company common cquity 32.79 32.82 Noncontrolling interests 0.00 38.81 13.86 20.42 Total liabilitics and stockholders' cquity 100.00 100.00 100.00 100.00 100.00 0.04 5.71 0.17 0.00 Total cquity 32.83 38.69