Answered step by step

Verified Expert Solution

Question

1 Approved Answer

The companies that I chose were NRG Energy Inc and UGI Corp NRG Energy UGI Corp Part 1: Your answer to my question (250 word

The companies that I chose were NRG Energy Inc and UGI Corp

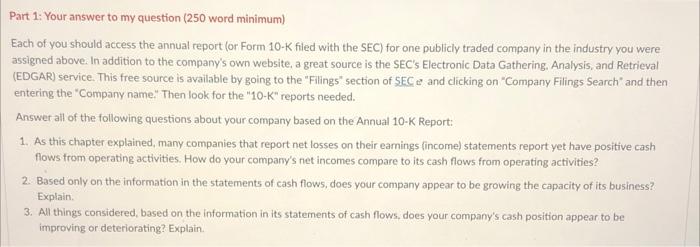

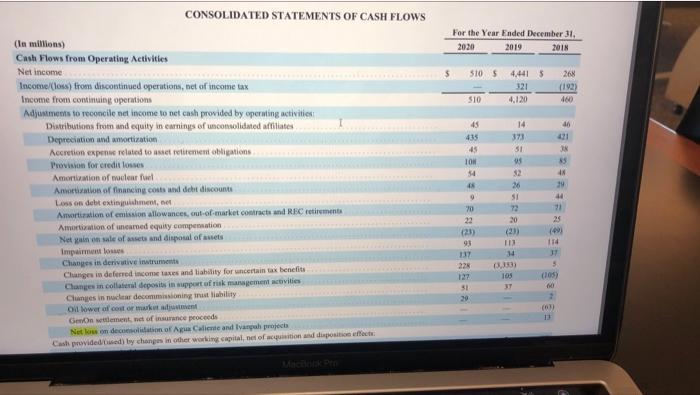

NRG Energy

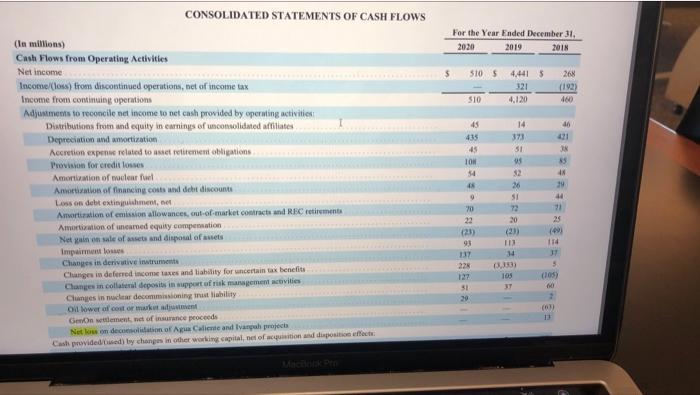

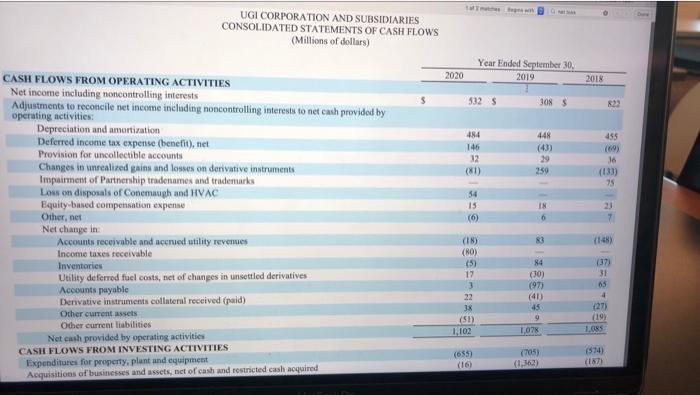

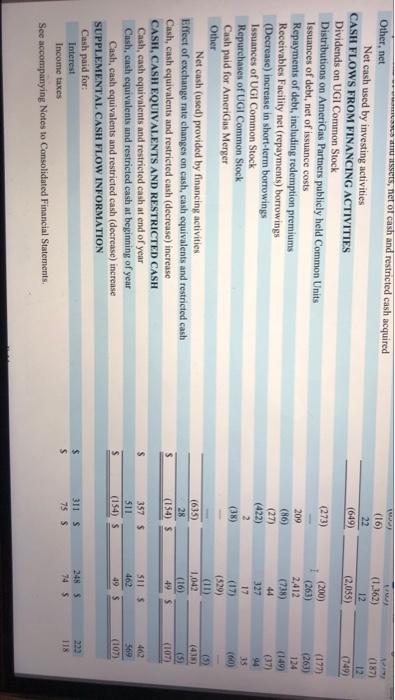

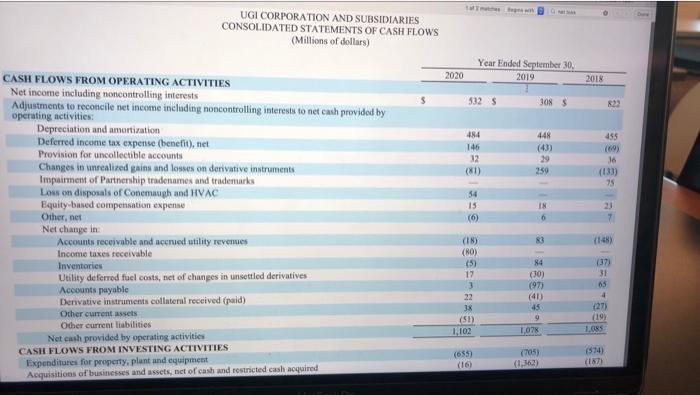

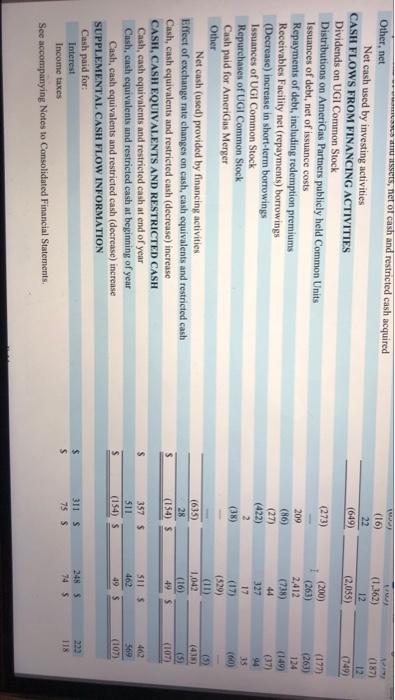

Part 1: Your answer to my question (250 word minimum) Each of you should access the annual report for Form 10-K filed with the SEC) for one publicly traded company in the industry you were assigned above. In addition to the company's own website, a great source is the SEC's Electronic Data Gathering, Analysis, and Retrieval (EDGAR) service. This free source is available by going to the "Filings" section of SECe and clicking on "Company Filings Search and then entering the Company name' Then look for the "10-K" reports needed. Answer all of the following questions about your company based on the Annual 10-K Report: 1. As this chapter explained many companies that report net losses on their earnings (income) statements report yet have positive cash flows from operating activities. How do your company's net incomes compare to its cash flows from operating activities? 2. Based only on the information in the statements of cash flows, does your company appear to be growing the capacity of its business? Explain 3. All things considered, based on the information in its statements of cash flows, does your company's cash position appear to be improving or deteriorating? Explain. CONSOLIDATED STATEMENTS OF CASH FLOWS For the Year Ended December 31, 2020 2019 2018 5105 4.4415 321 4.120 268 (192) 460 510 373 16 421 18 45 435 45 TON 54 45 = (Ie millions) Cash Flows from Operating Activities Net income Income/(los) from discontinued operations, net of income tax Income from continuing operations Adjustments to reconcile net income to net cash provided by operating activities Distributions from und equity in earnings of unconsolidated after Depreciation and amortization Accretion expense related to set rotitement obligations Provision for credit losses Amortization of clear fuel Amortation of financing costs and debt discounts Los on debt extinment, Amortization of emission allowances, out-of-market contracts and RBC retirement Amortization of named equity compensation Net pain on sale of art and disposal of niets impairmento Changes in derivative Instruments Changes in deferred income taxes and liability for uncertain tax benefits Changes in collateral deposits in support of risk management activities Clunges in nuclear decommissioning that liability Olt lower of cost or weten Gewon element, et of insurance proceeds Netlou om det of Agua Caliente and Ivanpah projects Cas provided used by changes in other working capital, net of acquisition and dispositif 4N 19 44 . 70 22 25 95 228 13 105 IT JT 5 (105) 10 2 (0 20 UGI CORPORATION AND SUBSIDIARIES CONSOLIDATED STATEMENTS OF CASH FLOWS (Millions of dollars) Year Ended September 30, 2020 2019 2018 $ 532S 308$ 822 484 146 12 (81) 448 (43) 19 250 455 (69) Jo 75 54 15 (6) IN 0 23 7 CASH FLOWS FROM OPERATING ACTIVITIES Net income including noncontrolling interests Adjustments to reconcile net income including noncontrolling interests to net cash provided by operating activities: Depreciation and amortization Deferred income tax expense (benefit), net Provision for uncollectible accounts Changes in nalized gains and losses on derivative Instruments Impairment of Partnership tradenames and trademarks Low on disposals of Conemaugh and HVAC Equity-based compensation expense Other, net Net change in Accounts receivable and accrued utility revenues Income taxes receivable Inventories Utility deferred fuel costs, net of changes in unsettled derivatives Accounts payable Derivative instruments collateral received (paid) Other current assets Other current liabilities Net cash provided by operating activities CASH FLOWS FROM INVESTING ACTIVITIES Expenditures for property, plant and equipment Acquisitions of businesses and assets, net of cash and restricted cash acquired 83 (148) (18) (NO) (5) 17 22 38 (51) 1,102 84 (30) (97) (40) 45 9 1,078 (37) 31 65 4 (27) (19) 1.0RS (655) (16) (705) (1.12) (574) (187) (16) 22 (649) w (1.362) 12 (2,055) (1871 12 (749) (273) 209 (86) (27) (422) 2 (38) as an assets, net of cash and restricted cash acquired Other, net Net cash used by investing activities CASH FLOWS FROM FINANCING ACTIVITIES Dividends on UGI Common Stock Distributions on AmeriGas Partners publicly held Common Units Issuances of debt, net of issuance costs Repayments of debt, including redemption premiums Receivables Facility net (repayments) borrowings (Decrease) increase in short-term borrowings Issuances of UGI Common Stock Repurchases of UGI Common Stock Cash paid for AmeriGas Merger Other Net cash (used) provided by financing activities Effect of exchange rate changes on cash, cash equivalents and restricted cash Cash, cash equivalents and restricted cash (decrease) increase CASH, CASH EQUIVALENTS AND RESTRICTED CASH Cash, cash equivalents and restricted cash at end of year Cash, cash equivalents and restricted cash at beginning of your Cash, cash equivalents and restricted cash (decrease) increase SUPPLEMENTAL CASH FLOW INFORMATION Cash paid for Interest Income taxes See accompanying Notes to Consolidated Financial Statements, 1 (200) (263) 2,412 (738) 44 327 17 (17) (529) (11) 1,042 (16) 495 (177) (261) 124 (149) (37) 04 35 (60) (635) 28 (154) S (5) (410 2 (107) 357 S 511 (154) SIIS 462 49 $ 402 569 (107) 311 S 75 S 2485 74 S 222 118

UGI Corp

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started