Question

The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased. The labor

The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.

The labor rate variance for January is:

Multiple Choice

-

$415 F

-

$415 U

-

$3,785 U

-

$3,785 F

-

2-

Tharaldson Corporation makes a product with the following standard costs:

Standard Quantity or Hours Standard Price or Rate Standard Cost Per Unit Direct materials 5.8 ounces $ 3.00 per ounce $ 17.40 Direct labor 0.5 hours $ 12.00 per hour $ 6.00 Variable overhead 0.5 hours $ 5.00 per hour $ 2.50 The company reported the following results concerning this product in June.

Originally budgeted output 3,800 units Actual output 3,400 units Raw materials used in production 20,800 ounces Purchases of raw materials 21,900 ounces Actual direct labor-hours 520 hours Actual cost of raw materials purchases $ 42,500 Actual direct labor cost $ 13,800 Actual variable overhead cost $ 3,900 The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.

The labor efficiency variance for June is:

Multiple Choice

-

$16,560 F

-

$14,160 U

-

$16,560 U

-

$14,160 F

-

3-

Tharaldson Corporation makes a product with the following standard costs:

Standard Quantity or Hours Standard Price or Rate Standard Cost Per Unit Direct materials 7.1 ounces $ 4.00 per ounce $ 28.40 Direct labor 0.2 hours $ 11.00 per hour $ 2.20 Variable overhead 0.2 hours $ 3.00 per hour $ .60 The company reported the following results concerning this product in June.

Originally budgeted output 2,500 units Actual output 3,000 units Raw materials used in production 21,500 ounces Purchases of raw materials 19,400 ounces Actual direct labor-hours 560 hours Actual cost of raw materials purchases $ 45,100 Actual direct labor cost $ 12,500 Actual variable overhead cost $ 3,500 The company applies variable overhead on the basis of direct labor-hours. The direct materials purchases variance is computed when the materials are purchased.

The variable overhead rate variance for June is:

Multiple Choice

-

$1,832 U

-

$1,832 F

-

$1,820 F

-

$1,820 U

-

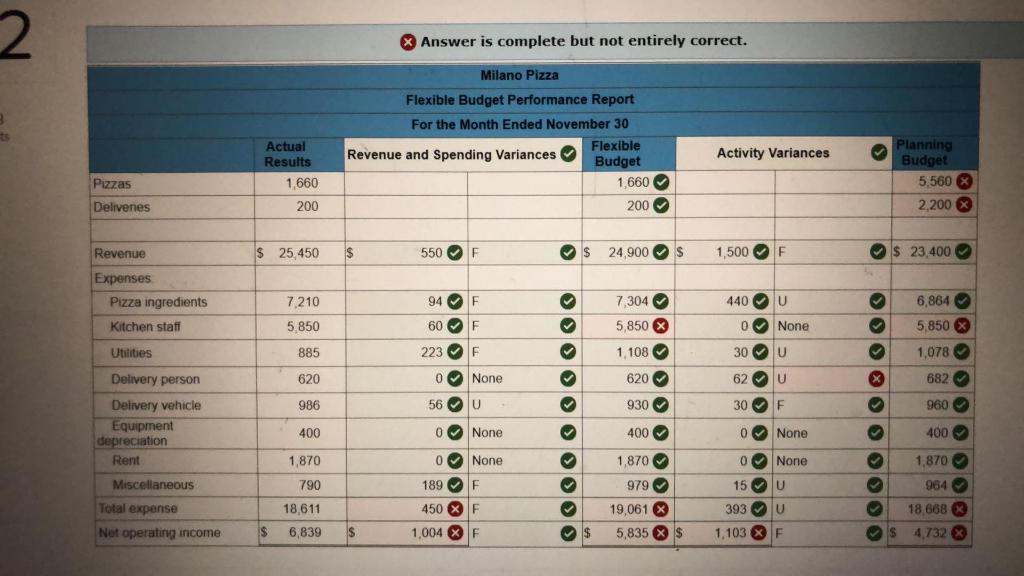

Milano Pizza is a small neighborhood pizzeria that has a small area for in-store dining as well as offering take-out and free home delivery services. The pizzerias owner has determined that the shop has two major cost driversthe number of pizzas sold and the number of deliveries made.

The pizzerias cost formulas appear below:

Fixed Cost per Month Cost per Pizza Cost per Delivery Pizza ingredients $ 4.40 Kitchen staff $ 5,910 Utilities $ 610 $ 0.30 Delivery person $ 3.10 Delivery vehicle $ 630 $ 1.50 Equipment depreciation $ 400 Rent $ 1,870 Miscellaneous $ 730 $ 0.15 In November, the pizzeria budgeted for 1,560 pizzas at an average selling price of $15 per pizza and for 220 deliveries.

Data concerning the pizzerias actual results in November appear below:

Actual Results Pizzas 1,660 Deliveries 200 Revenue $ 25,450 Pizza ingredients $ 7,210 Kitchen staff $ 5,850 Utilities $ 885 Delivery person $ 620 Delivery vehicle $ 986 Equipment depreciation $ 400 Rent $ 1,870 Miscellaneous $ 790

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started