Question

THE COMPANY: Aylmer Industries Inc. (Aylmer) has been in business since Y4. Aylmer has two main business segments. This first segment is the construction of

THE COMPANY:

Aylmer Industries Inc. (Aylmer) has been in business since Y4. Aylmer has two main business segments. This first segment is the construction of large-scale projects. In Y7, Aylmer had two large construction projects in process. The other segment is the sale of construction equipment. Details of the construction projects and the sale of construction equipment can be found later in this document and in the accompanying Excel file.

Aylmer has 75,000 common shares outstanding, and the shares are publicly traded. Since Aylmer is a publicly traded company, it follows IFRS.

There are no preferred shares outstanding.

Aylmer posted accounting transactions throughout the year. The Excel unadjusted trial balance was prepared from the recorded transactions. Aylmers fiscal year-end is December 31st. As a year-end review, management of Aylmer discovered that the following items have NOT been recorded and are NOT reflected in the unadjusted trial balance provided at December 31, Y7. For any journal entries, use December 31 as the date for the entries.

The accompanying Excel spreadsheet has important information and requirements. Please review the entire file carefully.

The unadjusted trial balance at December 31, Y7 and final trial balance at December 31, Y6 are provided in the Excel file for comparison purposes. Please see the Excel tab labelled Trial Balance. Use this Excel file and this tab to post journal entries as required, and to ensure that the worksheet remains in balance. You should use the worksheet to provide the ending balances needed to prepare the financial statements at December 31, Y7.

Ignore income taxes for this project.

REQUIRED (please read the entire document before starting the project)

Analyze and review the following items (a s) and determine the appropriate journal entry, if any, required. Record the appropriate journal entry in the Excel tab labelled journal entries. Use the various tabs in the Excel file to perform calculations and use the tabs as support for your journal entries, financial statement preparation, and notes to the financial statements.

Read the transactions below very carefully and the requirements that follow.

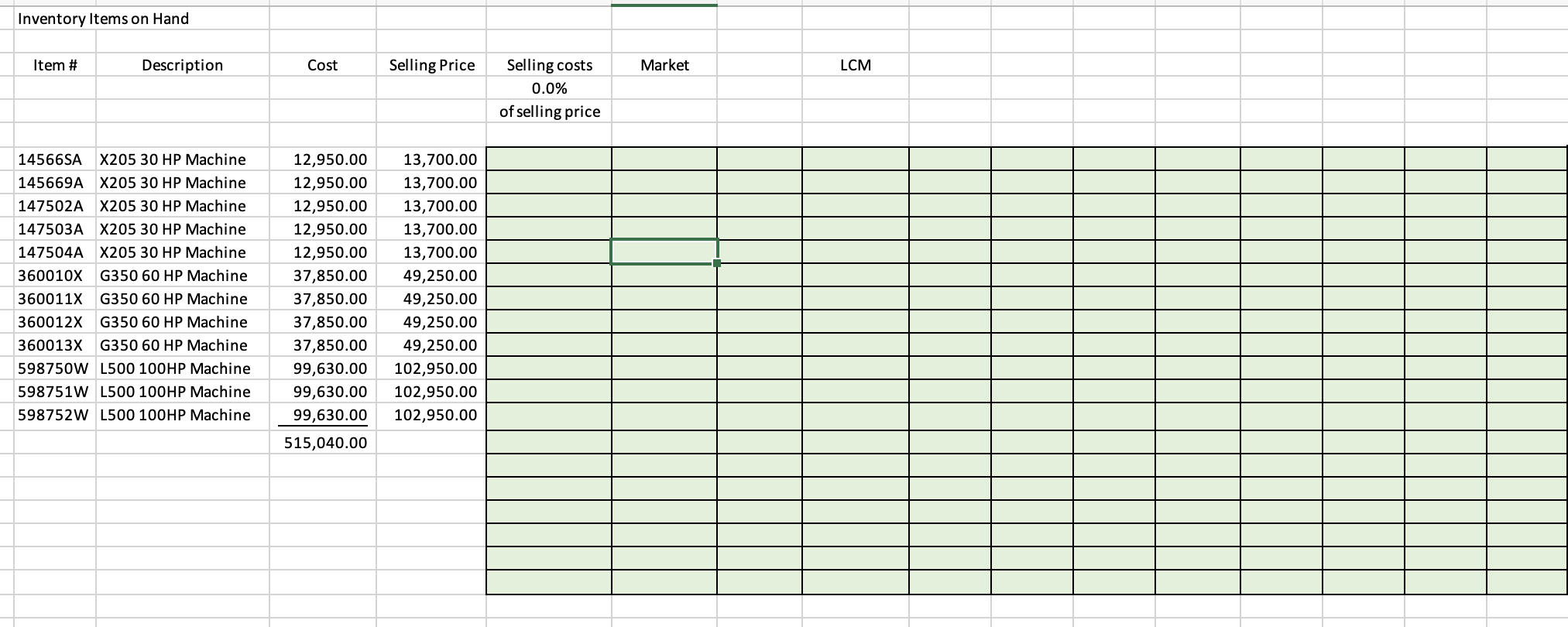

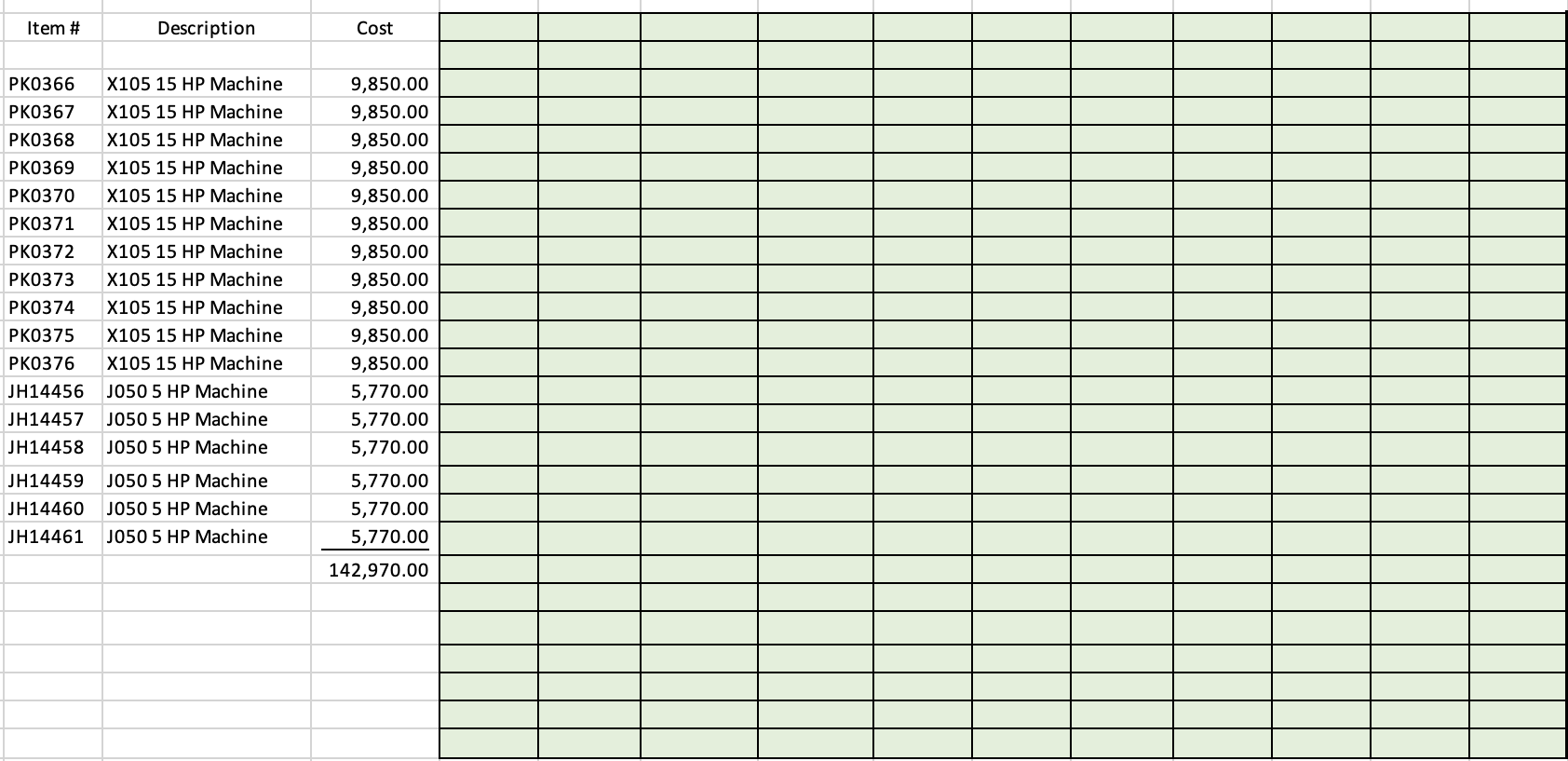

- Inventory

The company has the policy of stating all inventory on hand at the lower of cost and net realizable value. The company uses the direct method for any adjustments to inventory.

NOTE on the Statement of Earnings use Cost of Goods Sold from the trial balance as the expense there is NO need to calculate the cost of goods sold, since it is given.

In the Excel spreadsheet, see the tab Inventory Detail to perform any necessary calculations.

- Inventory on Consignment

At December 31, Y7; the company received the following information for inventory on consignment:

- All X105 machines were sold for $13,450 each.

- Three of the J050 machines were sold for $6,880 each.

The consignee received 5.2% commission on each sale and was allowed a 2.50% allowance for advertising. The consignee will pay the company the amount owed on January 15, Y8.

In the Excel spreadsheet, see the tab Inventory on Consignment to perform any necessary calculations. Use Other Accounts Receivable if needed for this transaction.

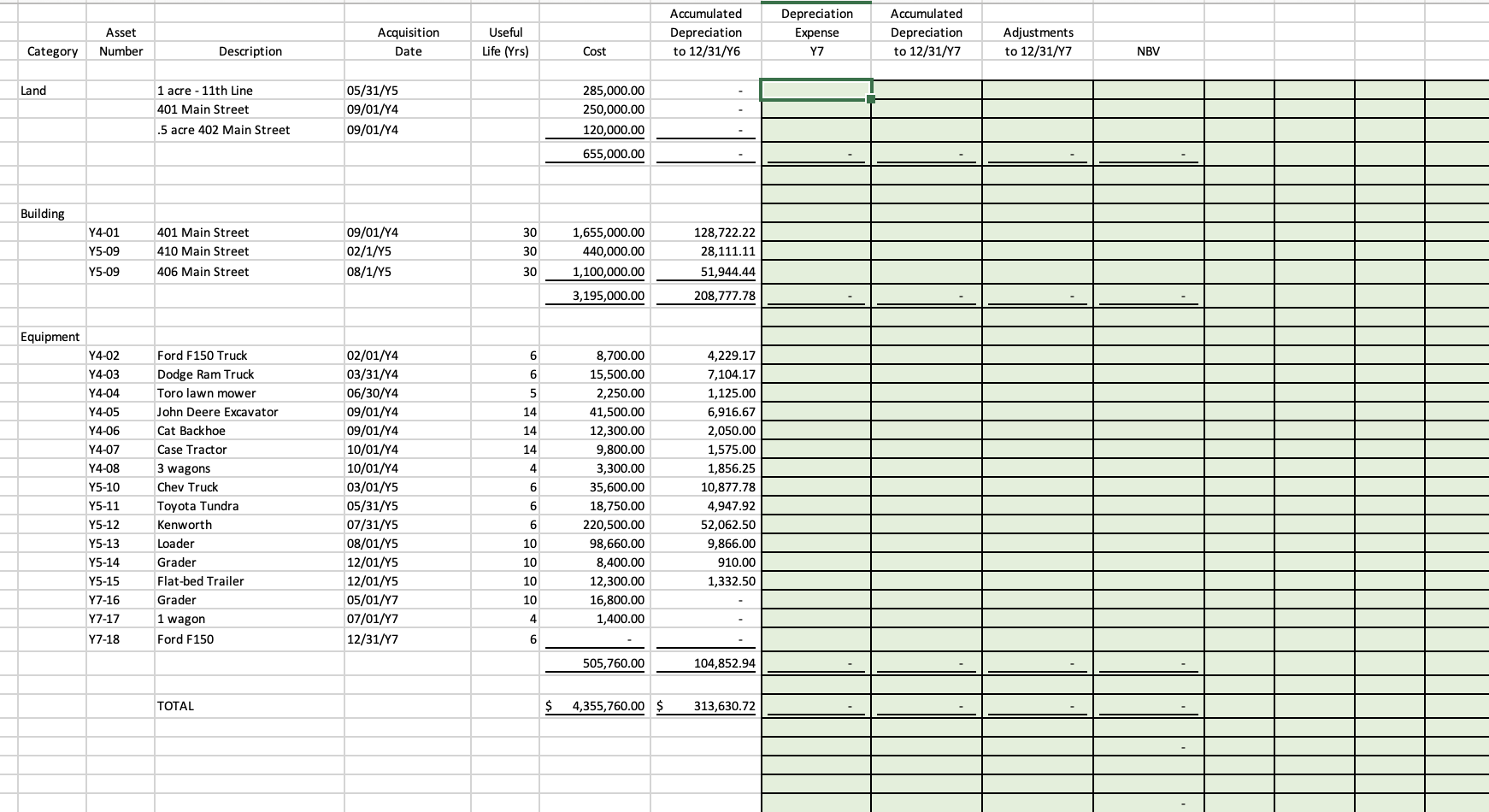

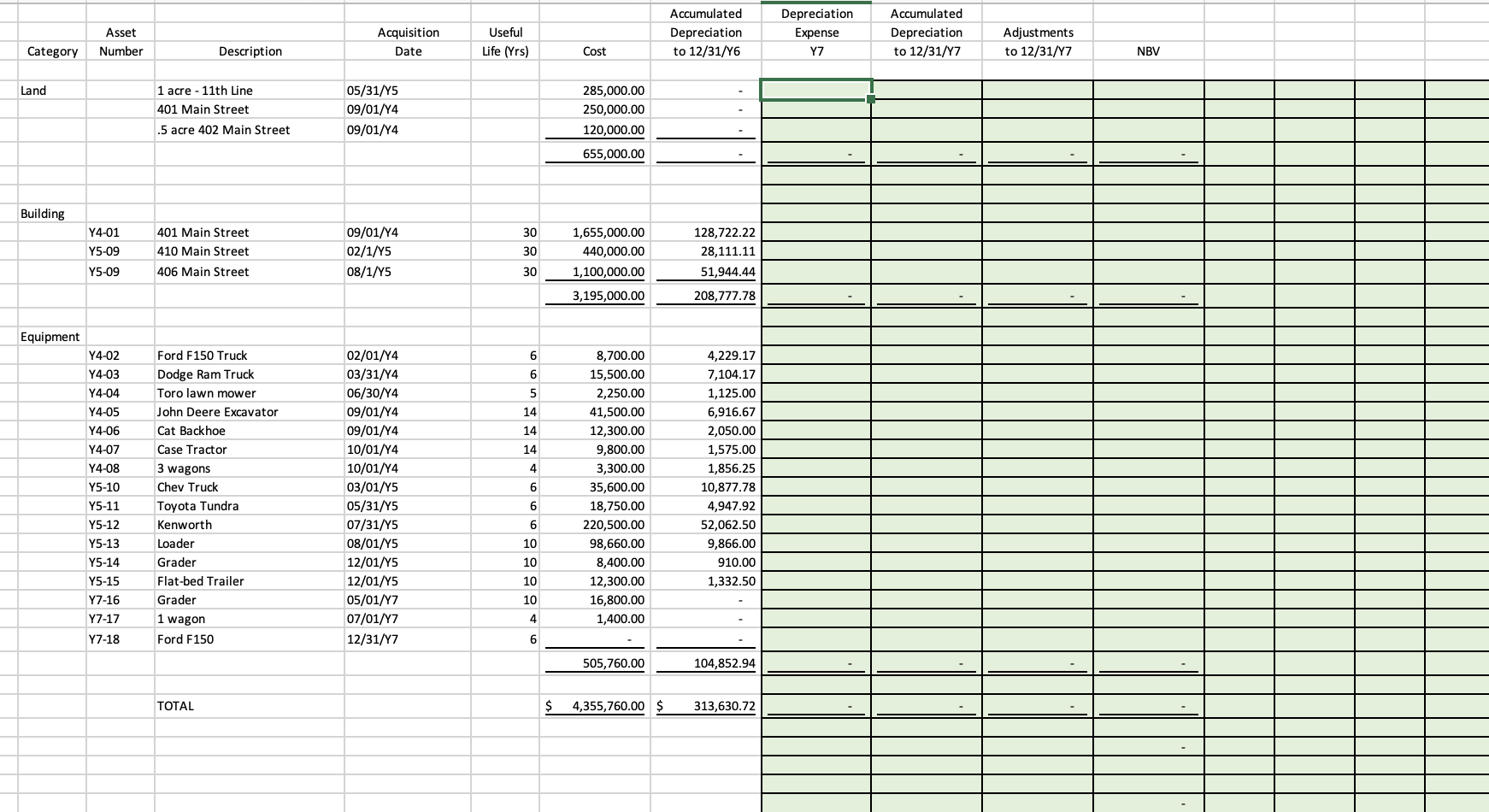

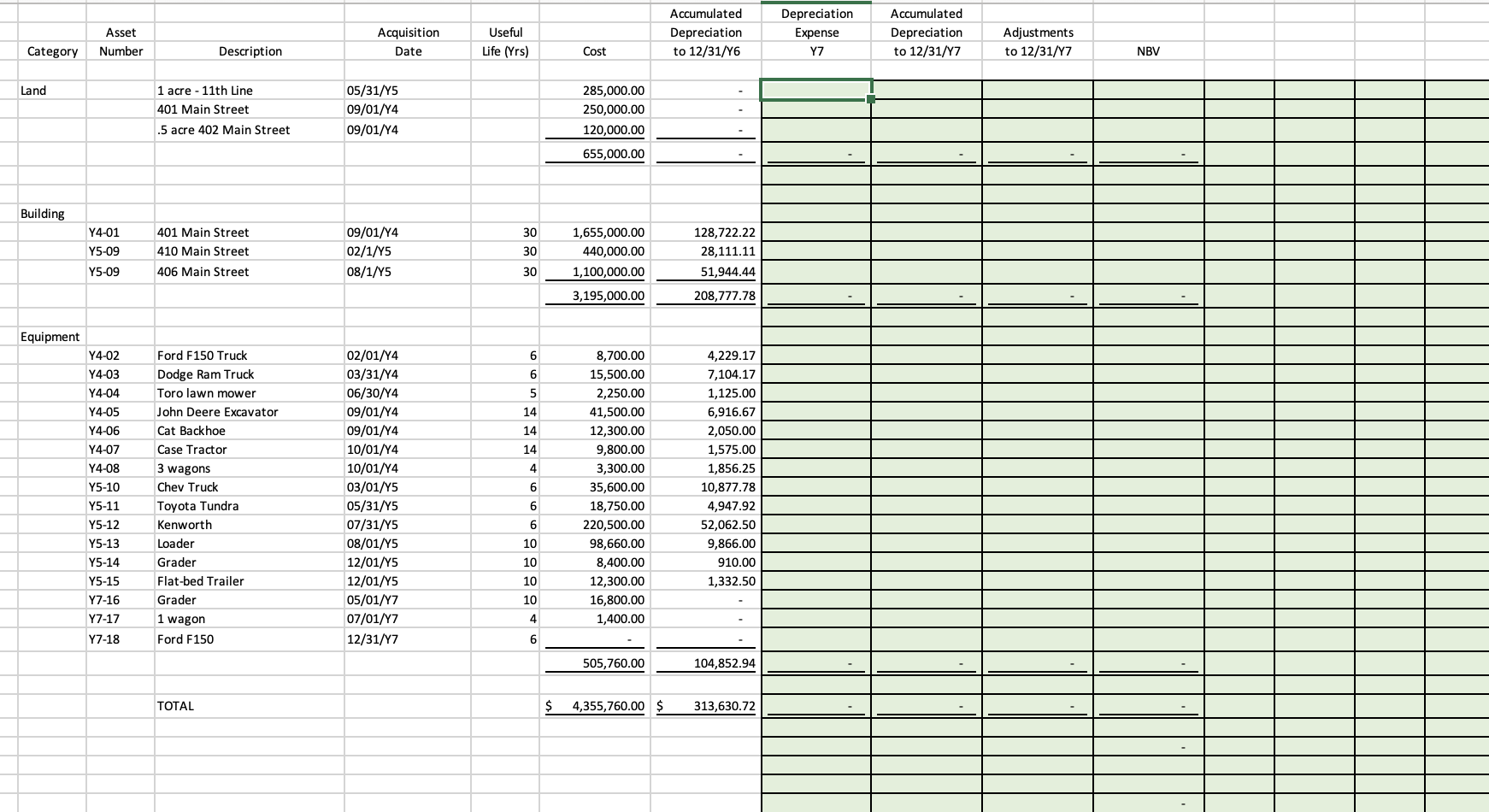

- Record Depreciation on assets

Depreciate the fixed assets according to the schedule. Depreciation is calculated on an annual basis using the straight-line method.

For assets purchased during the year, round to the nearest month when calculating depreciation.

Note two assets were purchased during the year. In the Excel spreadsheet, see the tab Fixed Asset Details to perform any necessary calculations. Details on asset Y7-18 are provided below.

- Traded a vehicle

On December 31, Y7 (after recording depreciation); the company traded asset #Y4-03 for a used Ford F150. In addition to the trade, the company paid $1,750 cash for the new truck. The fair value of asset # Y4-03 was $9,100. Assume that this transaction HAS commercial substance. Once this new asset is purchased and recorded on the fixed asset list, do not depreciate it. The above data should be used to populate financial information regarding asset number Y7-18 on the fixed asset listing.

NOTE: This transaction has not been recorded and is NOT reflected in the Unadjusted Trial Balance (on the Cash & Equivalents tab, the amount paid should flow thru the BMO Chequing account).

In the Excel spreadsheet, see the tab Fixed Asset Details to perform any necessary calculations; and update the schedule as needed.

- Revalue an Asset

On December 31, Y7 (after recording depreciation); the company reviewed assets for revaluation. The building at 410 Main Street was appraised with a new value of $430,000. The company uses the revaluation asset adjustment method to account for revaluations.

In the Excel spreadsheet, see the tab Fixed Asset Details to perform any necessary calculations; and update the schedule as needed.

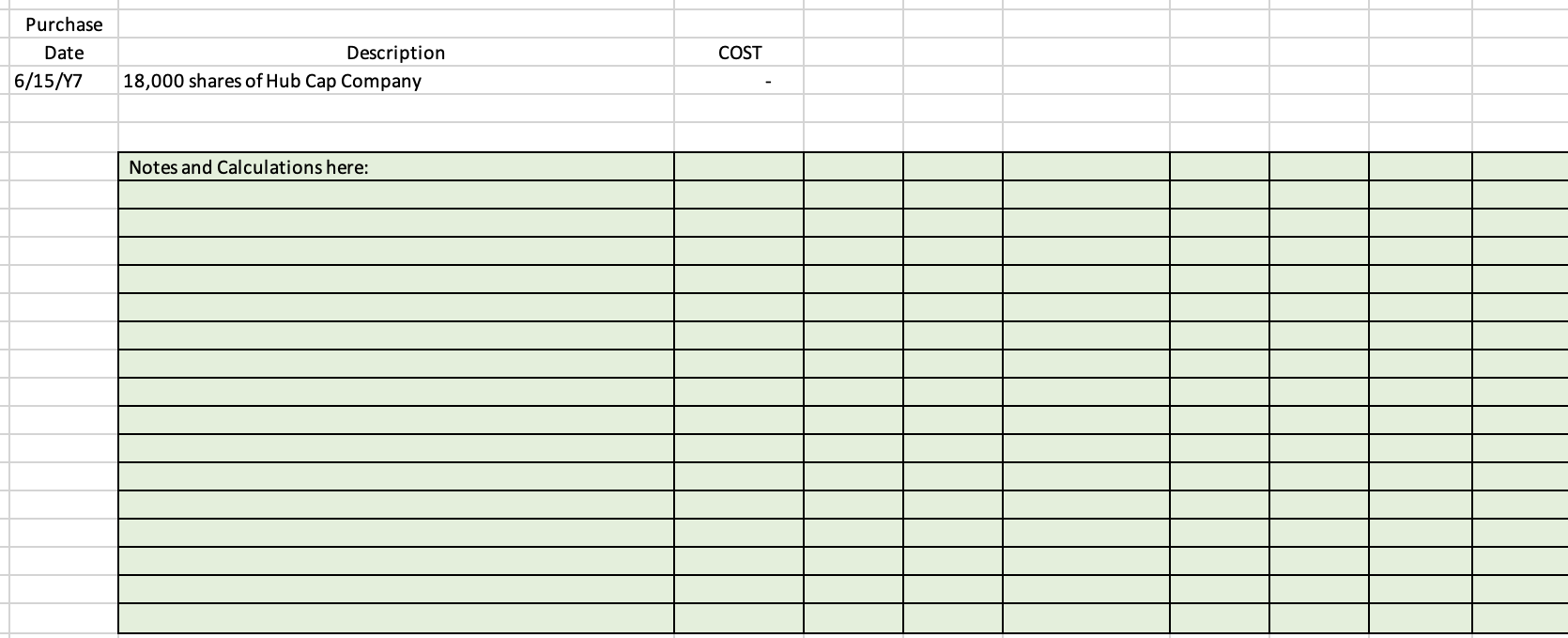

- Investments FV-OCI

On December 31, Y7, the fair value per share of Hub Cap Company was $26.25 per share. Aylmer decided to sell its shares in Hub Cap Company at that time.

NOTE: This transaction has not been recorded and is NOT reflected in the Unadjusted Trial Balance (on the Cash & Equivalents tab, the amount paid should flow thru the BMO Deposit account). In the Excel spreadsheet, see the tab FV-OCI Investments to perform any necessary calculations.

I need the solution with the steps!

Thank you

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started