Prepare journal entries for the above transactions. Aylmer Industries Inc. (Aylmer) has been in business since 2018. Aylmer has two main business segments. This first

Prepare journal entries for the above transactions.

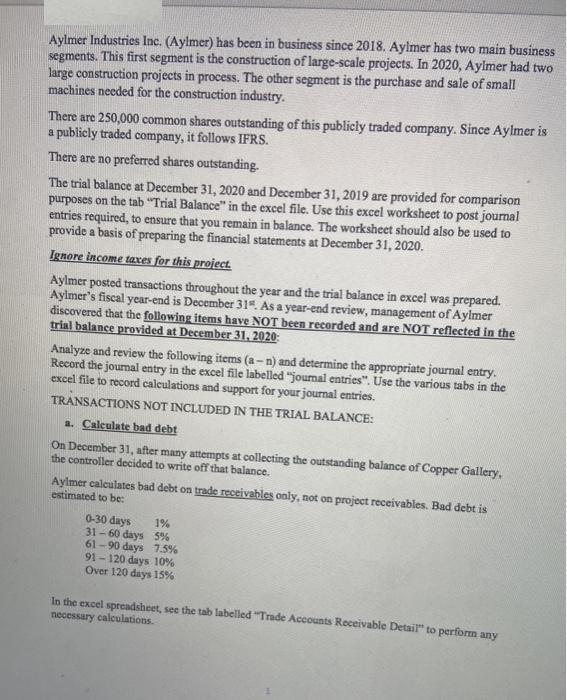

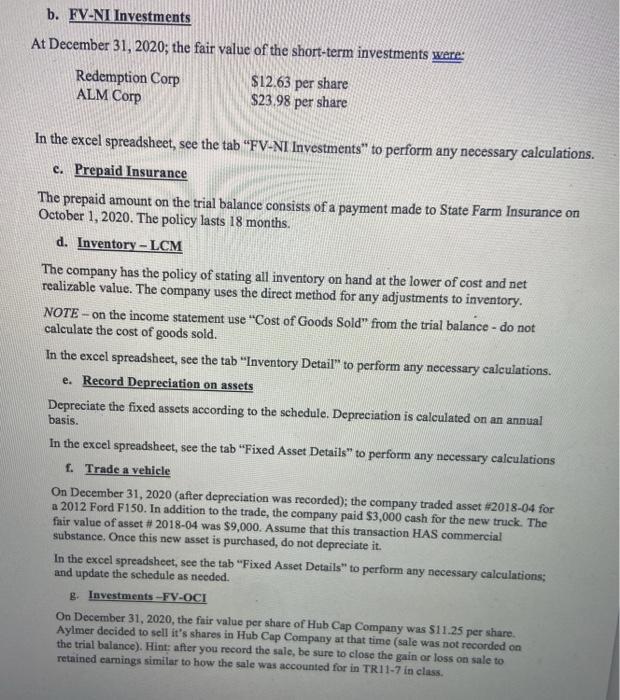

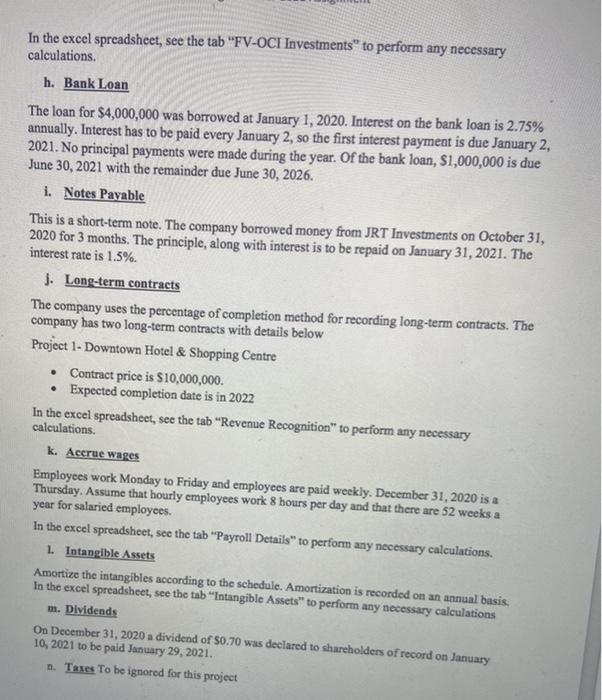

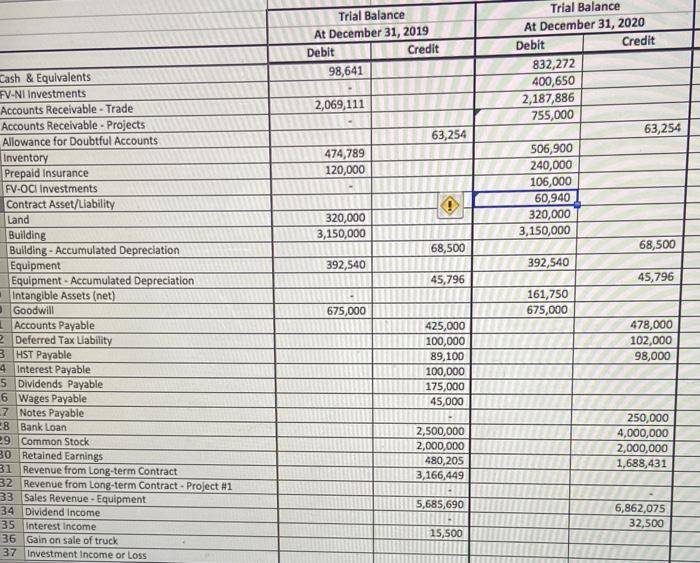

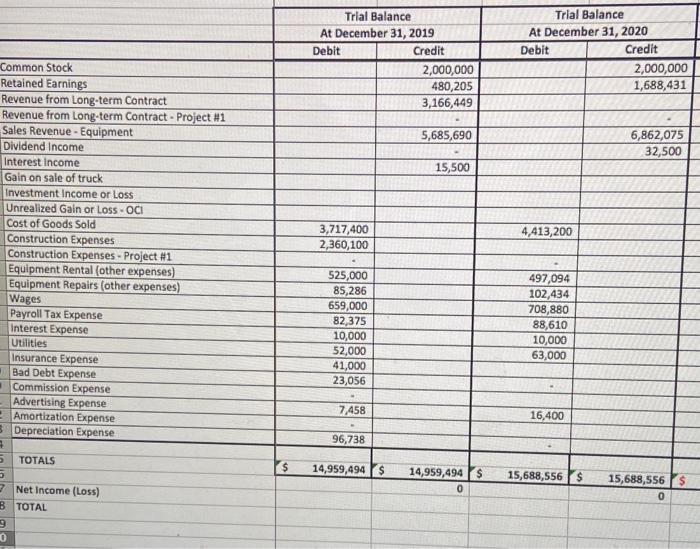

Aylmer Industries Inc. (Aylmer) has been in business since 2018. Aylmer has two main business segments. This first segment is the construction of large-scale projects. In 2020, Aylmer had two large construction projects in process. The other segment is the purchase and sale of small machines needed for the construction industry. There are 250,000 common shares outstanding of this publicly traded company. Since Aylmer is a publicly traded company, it follows IFRS. There are no preferred shares outstanding. The trial balance at December 31, 2020 and December 31, 2019 are provided for comparison purposes on the tab "Trial Balance" in the excel file. Use this excel worksheet to post journal entries required, to ensure that you remain in balance. The worksheet should also be used to provide a basis of preparing the financial statements at December 31, 2020. Ignore income taxes for this project. Aylmer posted transactions throughout the year and the trial balance in excel was prepared. Aylmer's fiscal year-end is December 31. As a year-end review, management of Aylmer discovered that the following items have NOT been recorded and are NOT reflected in the trial balance provided at December 31, 2020: Analyze and review the following items (a-n) and determine the appropriate journal entry. Record the journal entry in the excel file labelled "journal entries". Use the various tabs in the excel file to record calculations and support for your journal entries. TRANSACTIONS NOT INCLUDED IN THE TRIAL BALANCE: a. Calculate bad debt On December 31, after many attempts at collecting the outstanding balance of Copper Gallery, the controller decided to write off that balance. Aylmer calculates bad debt on trade receivables only, not on project receivables. Bad debt is estimated to be: 0-30 days 1% 31-60 days 5% 61-90 days 7.5% 91-120 days 10% Over 120 days 15% In the excel spreadsheet, see the tab labelled "Trade Accounts Receivable Detail" to perform any necessary calculations.

Step by Step Solution

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started