Question

The company decides to pay an extra $400 to each of its employee under lockdown. The total cost is estimated to be $1.2 million. In

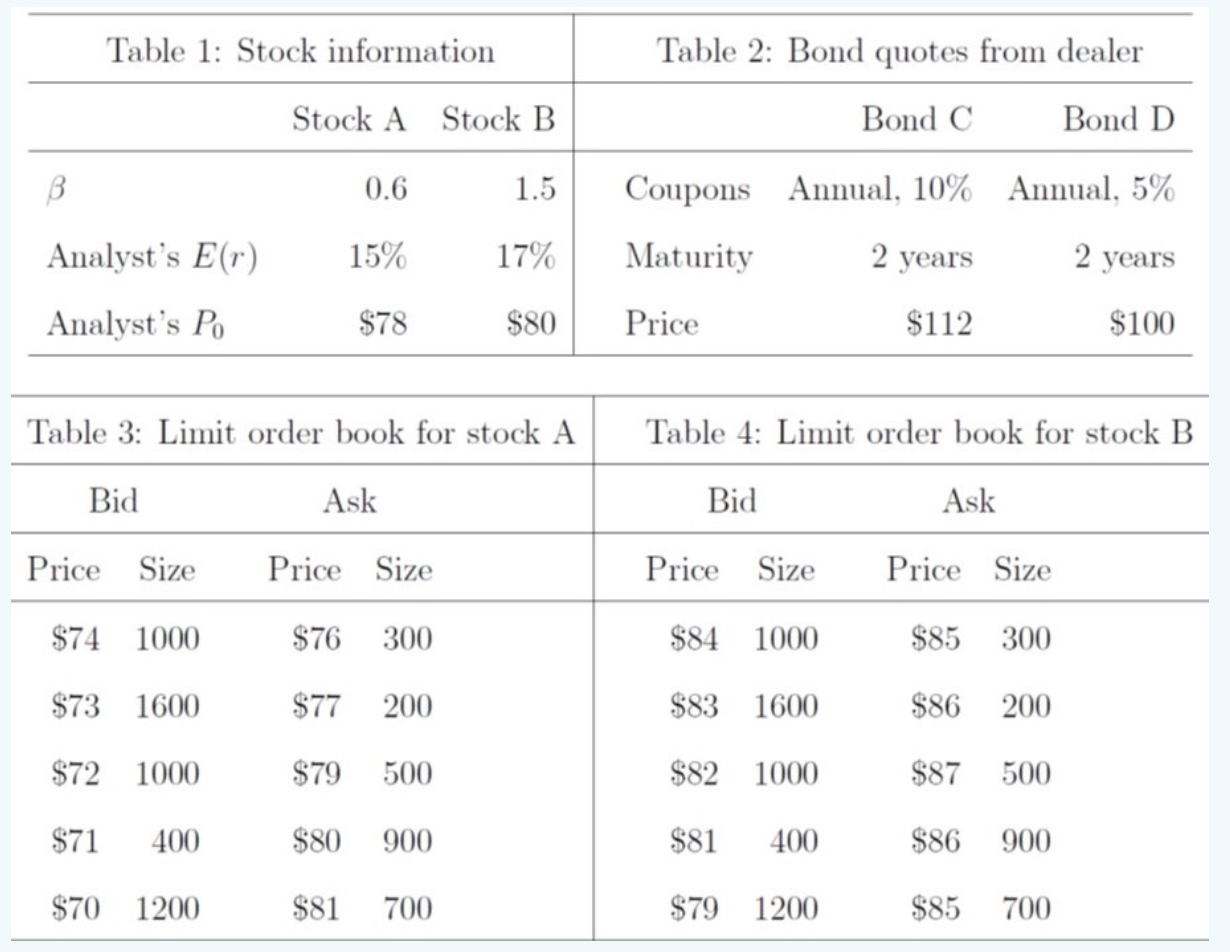

The company decides to pay an extra $400 to each of its employee under lockdown. The total cost is estimated to be $1.2 million. In order to fund this extra expenditure, you are instructed to sell some of the securities in your portfolio. Assume currently you hold four securities in your portfolio that are able to be sold, including Stock A and B, government bond C and D (newly issued, face value $100). The detailed information is listed in the following tables.

Table 1 shows the beta and the expected returns estimated by your analysts team. Assume you use CAPM model as your benchmark model and Analyst's P0 is the fair stock price today based on the analyst's report. You trade stocks in the Shanghai Stock Exchange, and Table 3 and 4 show the limit order book for stock A and B today. Meanwhile, you called your bond dealer, who quoted you the current prices of the two bonds today in Table 2. Your dealer is willing to trade with you at the quoted price for an unlimited amount. Assume the market expected return is 15%. Assume a flat yield curve of zero rates at 5%. Assume your team holds 5000 shares in each of the four securities. The total value of these securities is more than $1.2 million, so you decide to sell part of these securities in an optimal way, i.e. sell the overpriced securities first, and try not to sell the underpriced securities unless have to. Please discuss how are you going to sell your securities to fund the $1.2 million miHoYo's employee supporting plan. Please show key calculations. (Note: this is a challenging question.)

Table 1: Stock information Stock A Stock B 0.6 1.5 Analyst's E(r) 15% 17% Analyst's Po $78 $80 Table 3: Limit order book for stock A Bid Ask Price Size Price Size $74 1000 $76 300 $73 1600 $77 200 $72 1000 $79 500 $71 400 $80 900 $70 1200 $81 700 Table 2: Bond quotes from dealer Bond C Bond D Coupons Annual, 10% Annual, 5% Maturity 2 years 2 years Price $112 $100 Table 4: Limit order book for stock B Bid Ask Price Size Price Size $84 1000 $85 300 $83 1600 $86 200 $82 1000 $87 500 $81 400 $86 900 $79 1200 $85 700 Table 1: Stock information Stock A Stock B 0.6 1.5 Analyst's E(r) 15% 17% Analyst's Po $78 $80 Table 3: Limit order book for stock A Bid Ask Price Size Price Size $74 1000 $76 300 $73 1600 $77 200 $72 1000 $79 500 $71 400 $80 900 $70 1200 $81 700 Table 2: Bond quotes from dealer Bond C Bond D Coupons Annual, 10% Annual, 5% Maturity 2 years 2 years Price $112 $100 Table 4: Limit order book for stock B Bid Ask Price Size Price Size $84 1000 $85 300 $83 1600 $86 200 $82 1000 $87 500 $81 400 $86 900 $79 1200 $85 700Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started